NITI Aayog Proposes Relaxing Investment Rules for Chinese Firms in India

In a significant development signaling potential shifts in India-China economic relations, the Indian government's premier policy think tank, NITI Aayog, has suggested easing restrictions on Chinese investment by allowing Chinese companies to hold up to a 24% stake in Indian firms without prior approval. This proposal aims to streamline foreign direct investment (FDI) processes and potentially rejuvenate delayed deals that have been held up since the border tensions in 2020.

Background: Investment Curbs and Border Clashes

Following the violent border skirmishes in 2020, which included intense hand-to-hand combat between soldiers of India and China, the Indian government imposed stringent rules requiring all Chinese investments in India to receive security clearances from both the Ministry of Home Affairs and the Ministry of External Affairs. These additional layers of scrutiny, while intended as national security measures, have inadvertently slowed Chinese investment and contributed to a notable decline in India's overall foreign direct investment inflows.

Implications of the Proposed 24% Stake Limit

The proposal by NITI Aayog—still under consideration by the Ministries of Finance, External Affairs, the Department of Promotion of Industry and Internal Trade (DPIIT), and the Prime Minister’s Office—would exempt Chinese investments below a 24% equity threshold from such approvals. This measure is viewed as an attempt to reconcile economic pragmatism with ongoing geopolitical sensitivities. Key takeaways include:

- Accelerating delayed transactions: For instance, BYD’s postponed $1 billion investment in an electric vehicle joint venture could gain new momentum.

- Boosting India’s FDI prospects: India experienced a dramatic drop in net FDI to an unprecedented $353 million in the last fiscal year, a sharp contrast to $43.9 billion two years prior—partly attributed to restrictive policies on Chinese investment.

- Sectoral sensitivities remain intact: Despite easing, sensitive domains such as defense, banking, and media will likely continue to enforce tighter controls.

Contextualizing Within the India-China Diplomatic Landscape

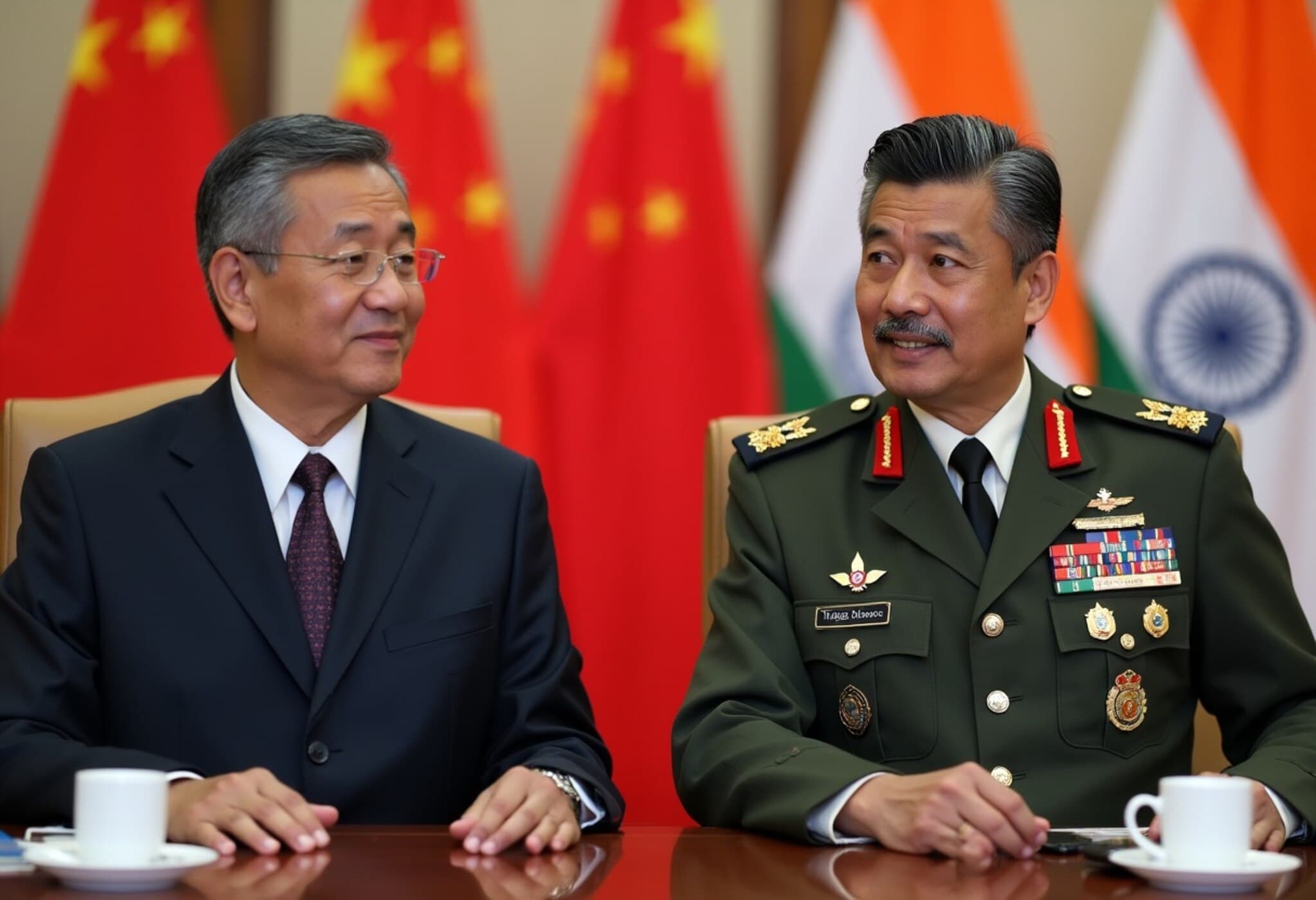

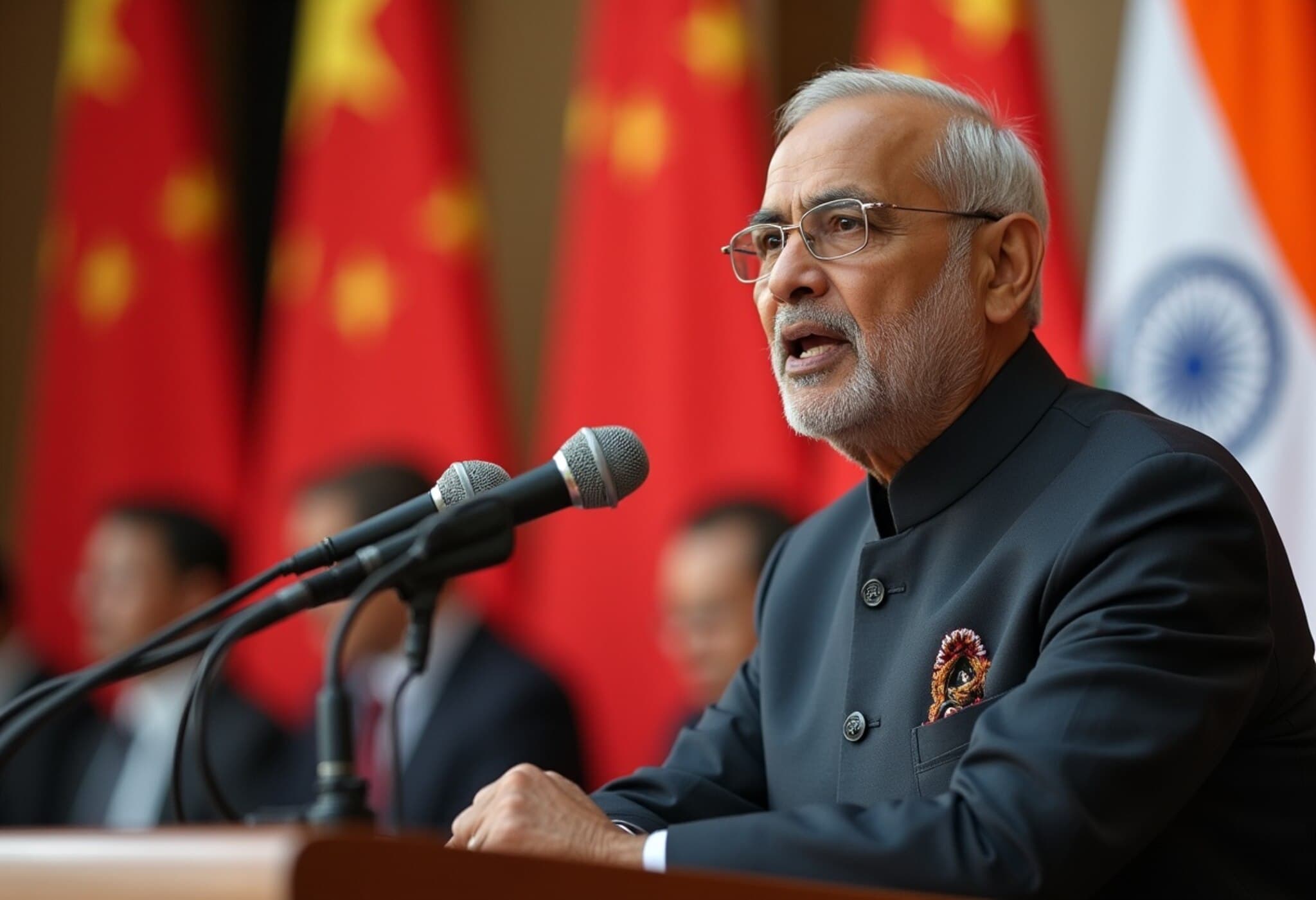

The timing of this policy suggestion dovetails with warming bilateral relations, including initiatives like the planned resumption of direct flights and diplomatic overtures to resolve the decades-old border dispute. Recently, Indian External Affairs Minister Subrahmanyam Jaishankar’s visit to China marked the first high-profile diplomatic engagement in years, emphasizing mutual interest in stabilizing ties and avoiding trade restrictions.

Experts note that while easing investment restrictions signals a positive thaw, the process must be calibrated carefully to balance economic growth with national security concerns. The idea to overhaul the Foreign Investment Promotion Board—which vets FDI proposals—is also on the table to facilitate a more transparent and efficient investment environment.

Underreported Dimensions and Forward-Looking Questions

An often overlooked aspect is how this policy might influence India’s broader supply chain calculus. Greater Chinese participation in Indian companies could foster deeper integration in sectors like manufacturing and technology, potentially impacting India's strategic autonomy. Moreover, the proposal raises critical questions:

- How will India safeguard against potential security risks associated with increased Chinese equity?

- What monitoring mechanisms will be instituted to ensure compliance without hampering business agility?

- Could this move signal a pivot in India’s Indo-Pacific strategy, or is it a pragmatic accommodation driven by economic imperatives?

Conclusion

The recommendation by NITI Aayog to allow up to 24% Chinese stakes in Indian firms without approval is a calculated gamble amid complex geopolitical dynamics. It reflects India's effort to rejuvenate investment inflows while cautiously navigating a sensitive bilateral relationship. Whether this proposal culminates in policy reform remains uncertain, with key ministries reviewing implications carefully.

Editor’s Note

The proposed investment liberalization could mark a subtle but meaningful shift in India-China economic cooperation, emphasizing the intricate balance between safeguarding national security and embracing global economic integration. Readers should watch for how this policy evolves, especially in light of India’s ambitions to strengthen its manufacturing base and assert geopolitical influence. The coming months will reveal whether this move signifies pragmatic diplomacy or remains a theoretical recommendation within India’s complex policymaking landscape.