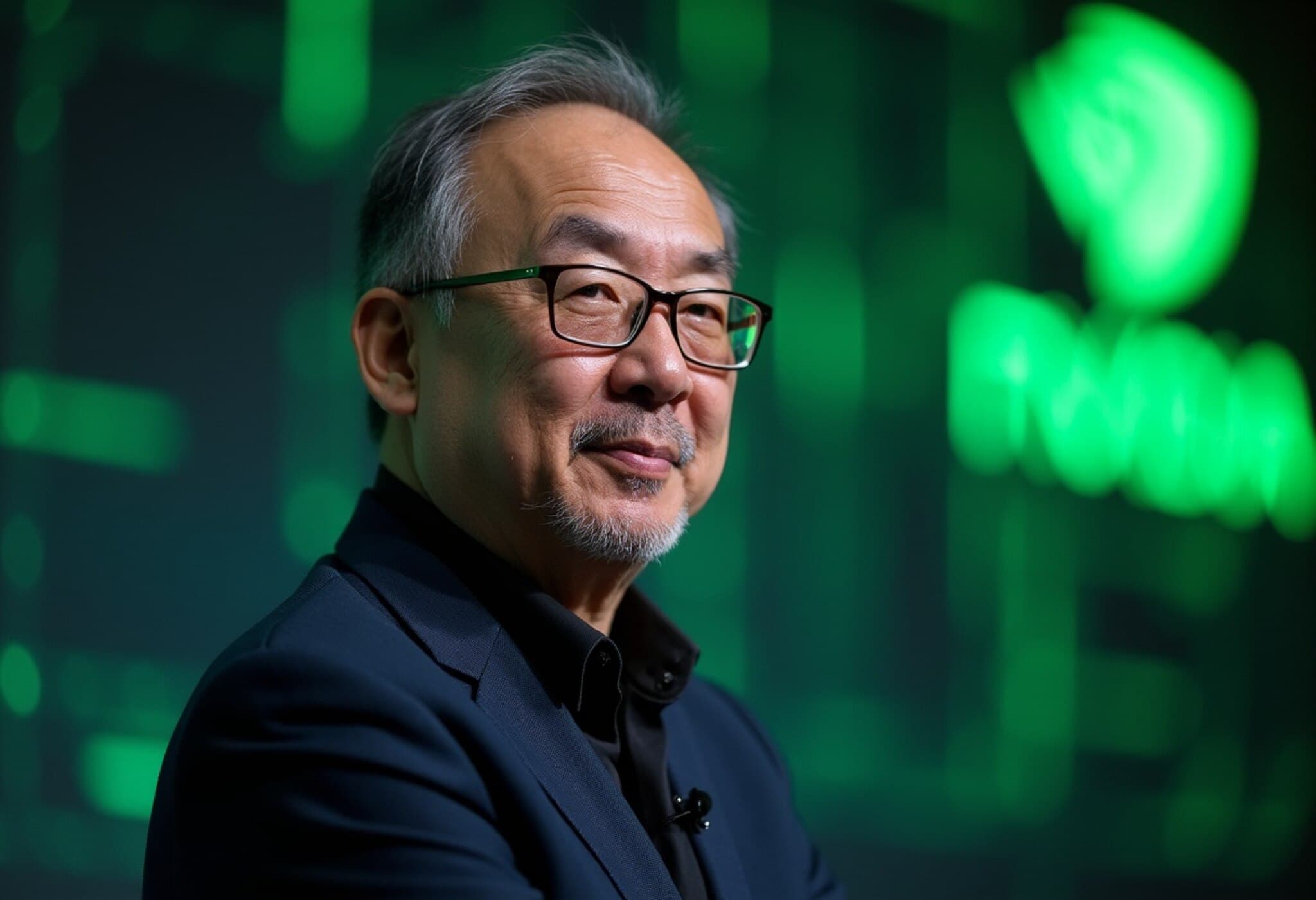

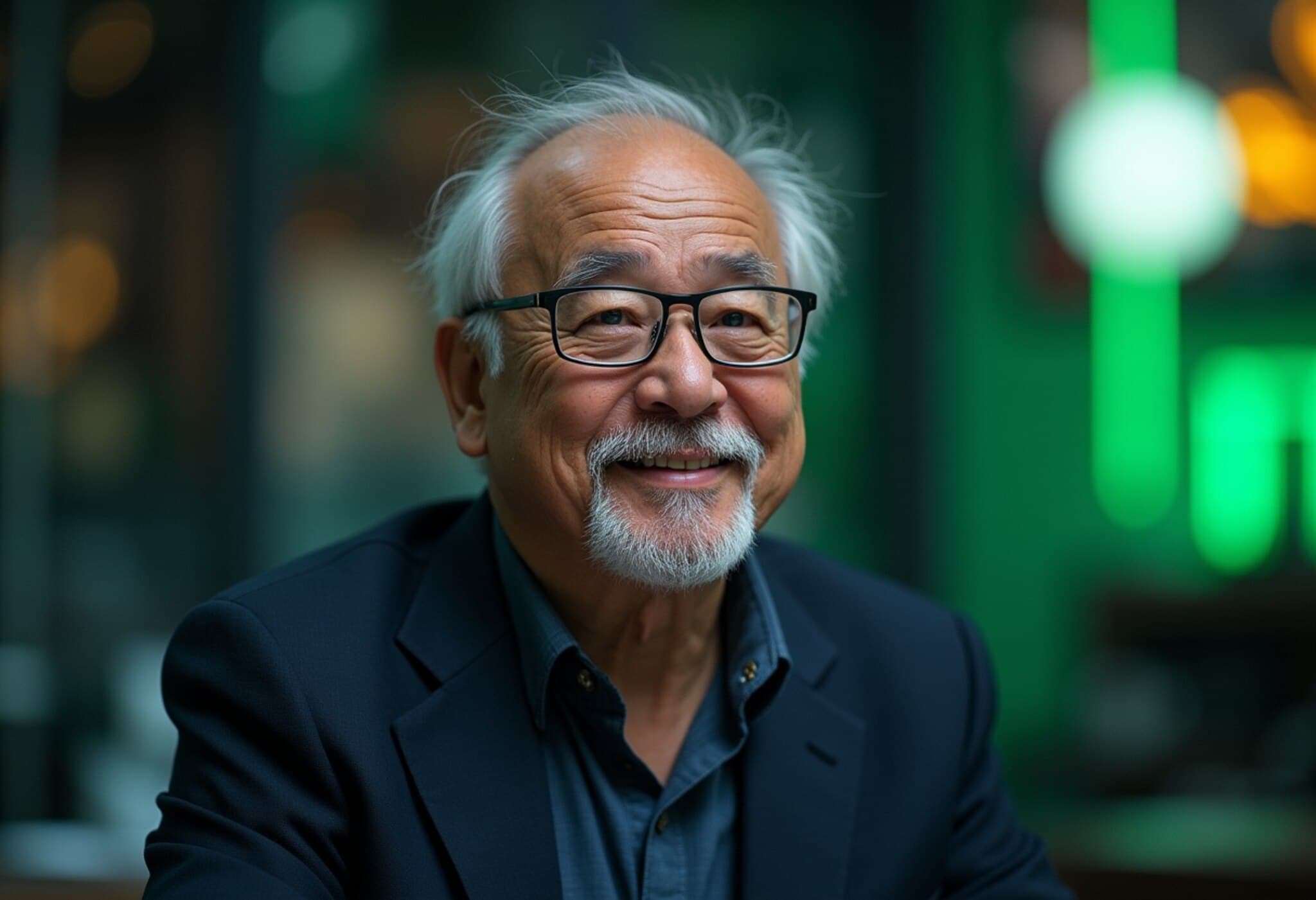

Nvidia CEO Jensen Huang Offloads $12.94 Million in Shares

On Friday, Nvidia’s co-founder and CEO Jensen Huang sold 75,000 shares in the artificial intelligence and semiconductor giant, steadily cashing out holdings valued at approximately $12.94 million, according to U.S. Securities and Exchange Commission filings. This move is part of a pre-approved March plan allowing Huang to divest up to 6 million shares over time.

Context Behind the Sale

Earlier in the week, Huang executed another sizable sale of 225,000 shares, netting nearly $37 million. These transactions come amid soaring global demand for Nvidia’s cutting-edge graphics processing units (GPUs), which have become critical for powering AI technologies such as large language models and machine learning platforms. Nvidia’s market capitalization has skyrocketed past $1 trillion, ranking it as one of the most valuable companies worldwide.

Expert Insight:

Stock sales by executive leadership can raise eyebrows, but they are often part of long-term, pre-planned diversification strategies. Given Huang’s substantial stake, these measured sales do not necessarily signal concerns about Nvidia’s valuation but rather prudent portfolio management. However, investors and analysts will keenly watch how the company navigates evolving geopolitical pressures, particularly regarding China—a critical market for Nvidia’s growth.

Renewed Chip Sales to China Signal Thaw in Export Restrictions

This week, Nvidia announced it plans to resume sales of its H20 AI chips to China, following encouraging signals from the U.S. government regarding export licenses. Earlier in 2025, trade restrictions imposed during the previous administration had clamped down on shipments of advanced AI semiconductors to China, requiring special permissions.

"The U.S. government has assured NVIDIA that licenses will be granted, and NVIDIA hopes to start deliveries soon," the company stated in an official release.

During a recent visit to Beijing, Huang highlighted ambitions to extend sales beyond the H20 chips, potentially offering even more advanced technology to China, despite ongoing geopolitical complexities. This development underscores how AI technology supply chains are enmeshed in broader U.S.-China relations, affecting corporate strategy and global market dynamics.

Economic and Policy Perspective:

- AI Industry Implications: Resuming chip shipments will likely boost Nvidia’s revenue streams and maintain China’s access to vital AI infrastructure.

- Geopolitical Factors: Export license approvals indicate a possible recalibration of U.S. trade policies balancing national security with economic interests.

- Technology Race: Nvidia’s advances and cross-border sales shape the broader technological competition between the U.S. and China.

What This Means for Investors and the Market

Jensen Huang’s share sales reflect a personal liquidity strategy against a backdrop of strong corporate performance and expanding market opportunities. Simultaneously, the easing of chip export restrictions could unlock new revenue channels but may invite scrutiny regarding technology transfer and intellectual property protections amid tense U.S.-China relations.

Industry watchers should monitor forthcoming government decisions on export licenses and how Nvidia balances growth ambitions with compliance to regulatory frameworks.

Editor’s Note

Jensen Huang’s recent stock transactions and Nvidia’s resumption of AI chip sales to China provide a revealing window into the delicate intersection of global tech innovation, corporate governance, and international policy. Investors should consider the nuanced risks and opportunities as Nvidia continues to navigate a complex geopolitical landscape while leading the AI revolution.

As the U.S. government signals openness to chip exports to China, critical questions arise: How will this affect the global AI race? What safeguards are in place to protect American technological advantages? And how will Nvidia reconcile rapid market expansion with evolving export controls? These dynamics deserve close attention from policymakers, investors, and tech enthusiasts alike.