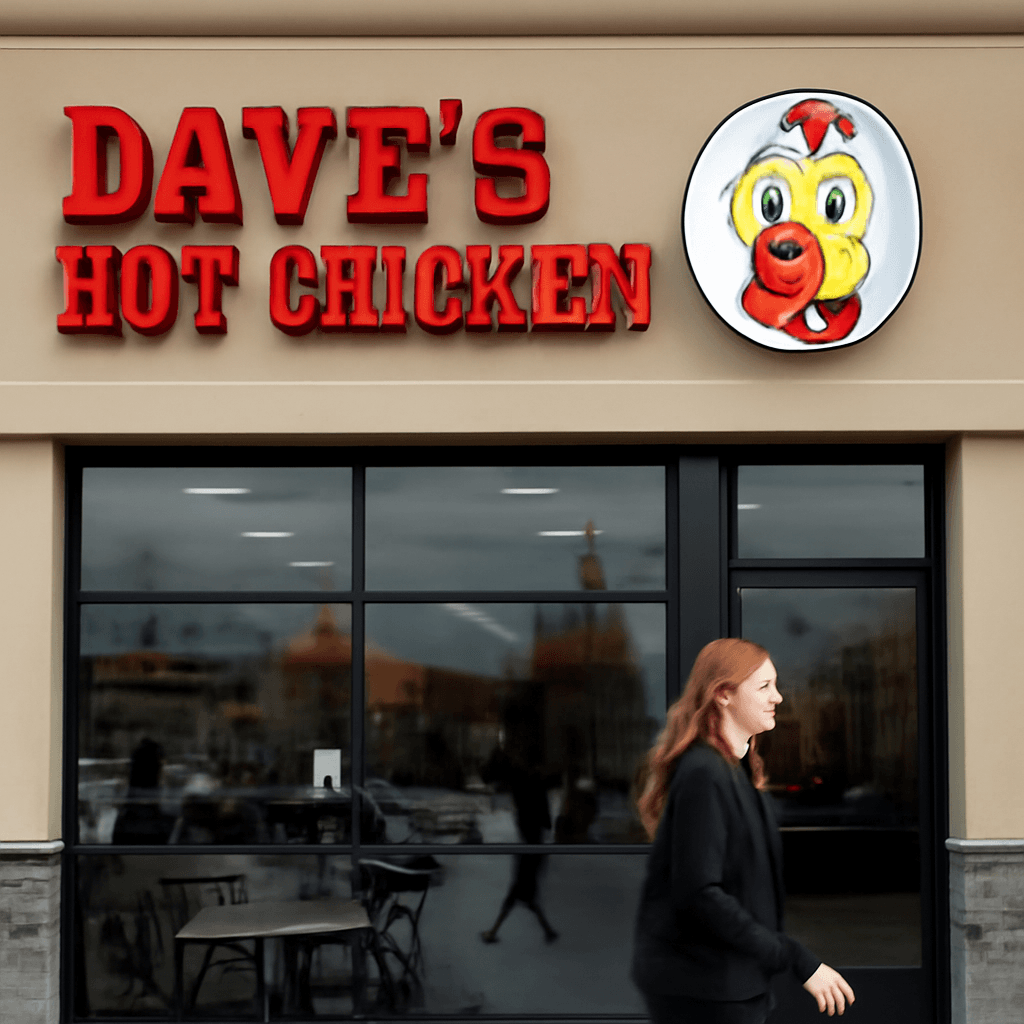

Roark Capital Invests in Rapidly Expanding Dave's Hot Chicken

Private equity firm Roark Capital has acquired a majority stake in Dave's Hot Chicken, a fast-growing restaurant chain renowned for its spicy chicken tenders. Although the financial details remain undisclosed, the company's CEO confirmed the transaction valuation is close to $1 billion.

Impressive Growth Trajectory

Founded in 2017 in a Los Angeles parking lot, Dave's Hot Chicken has rapidly expanded to over 300 locations across the United States through franchising. The chain's sales surged by 57% in the past year, surpassing $600 million. This growth reflects a broader boom in chicken-focused restaurants fueled by heightened consumer demand, especially among younger demographics with increasing tolerance for spicier flavors.

Menu Focus and Customer Appeal

Dave's Hot Chicken offers a concise menu centered on its signature oversized chicken tenders, which customers can enjoy on their own or as sliders. The chain provides varying spice levels ranging from mild to the extreme "Reaper" option, which requires customers to sign a liability waiver due to its intense heat. This fiery variety appeals to adventurous eaters, contributing to the brand's distinct identity.

Experienced Leadership and Future Outlook

CEO Bill Phelps, formerly leader at Wetzel's Pretzels, joined Dave's in 2019. The original co-founders remain actively involved and retain minority stakes post-acquisition. Phelps highlighted Roark's potential to leverage its international supply chain and franchise expertise to streamline costs and accelerate global expansion, estimating that Dave's could reach up to 4,000 locations worldwide within the next decade.

Operational Philosophy and Commitment to Quality

Despite rapid growth, Dave's Hot Chicken has consciously avoided adopting typical industry shortcuts such as expanding its menu extensively or compromising on ingredient quality. The company plans to maintain these practices under Roark's ownership, ensuring the brand’s core values and product excellence endure.

Significance of Roark Capital's Investment

This deal follows Roark's notable acquisition of Subway for an estimated $9.6 billion last year, reinforcing the firm's deep involvement in the restaurant industry. Alongside holdings like Inspire Brands and GoTo Foods, Roark manages multiple prominent restaurant businesses including Arby's, Dunkin', and Cinnabon.

Employee Benefits and Company Culture

In addition to rewarding investors, Dave's executives plan to distribute significant bonuses to employees ranging from support staff to restaurant assistant managers. This initiative has facilitated the creation of numerous employee millionaires, reflecting a commitment to inclusive growth and recognition of contribution.