The Rise of Digital Coffee Culture

Walking into the newly opened Luckin Coffee near my office in Hong Kong, I faced a familiar modern dilemma: to snag a $2 drink I had to download their app; otherwise, the price jumped to $3.75. After swiftly registering, I explored their eclectic menu — from fruity Americanos and seasonal kale tea to their popular coconut milk latte, which comes with five sweetness levels. The descriptions were as vivid as the drinks themselves: the coconuts sourced from Luckin's own Indonesian grove, nourished by volcanic ash and ocean minerals, with milk cold-pressed within hours.

Though you can place orders at kiosks, the app remains central to the Luckin experience — a gamble on high-tech convenience.

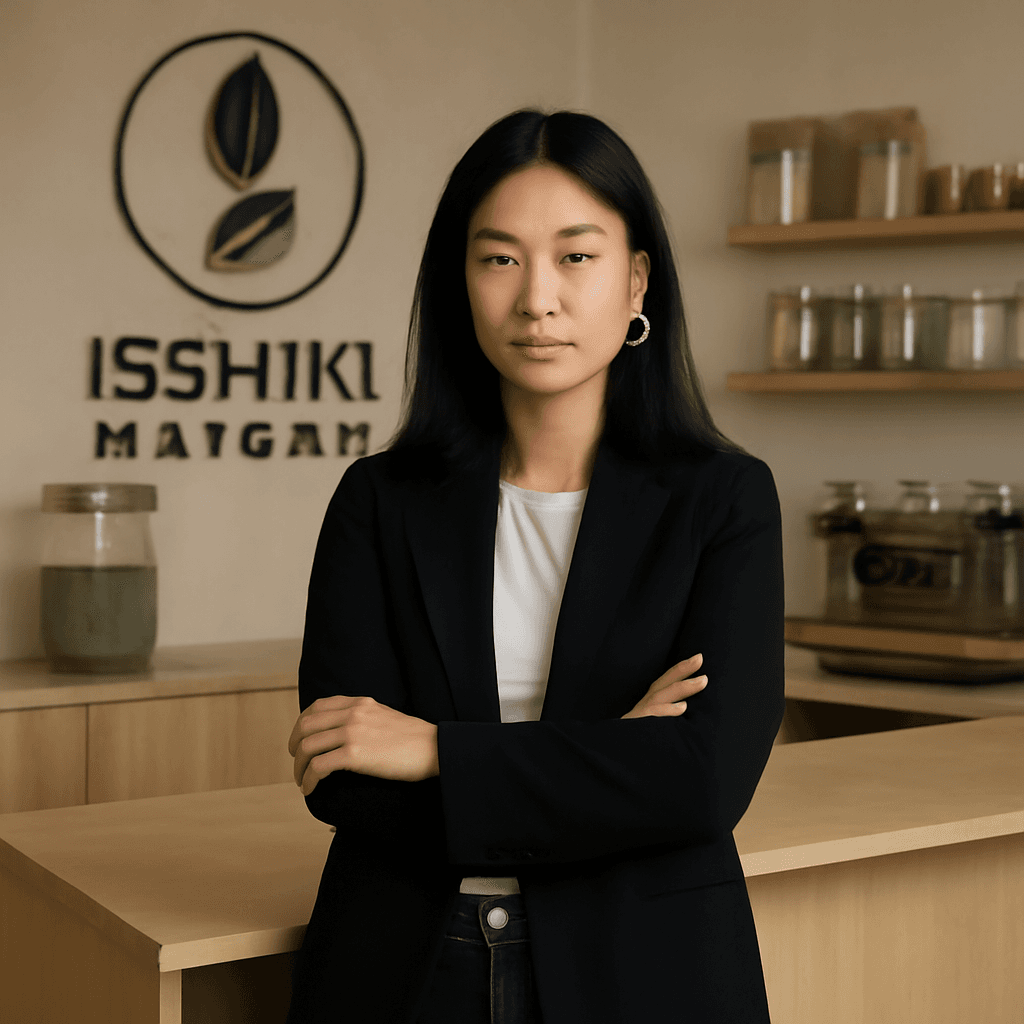

Luckin Coffee: Tech-Savvy and Trendy

As China's leading coffee chain, Luckin is eyeing international markets with its vibrant digital-first approach. Since entering Hong Kong last year, it now boasts a dozen outlets surrounded by fierce local competitors, including Cotti Coffee, founded by former Luckin executives.

When I tried to pay with an international credit card, the hoops of entering billing details pushed me back to the kiosk at a higher price — though I still had to input my phone number. Moments later, my 16-ounce iced coconut milk latte arrived, its chestnut hue inviting. The first sip was bitter and refreshing, mellowing into a silky sweetness that lingered. Admittedly, it became a bit heavy after repeated sips, but the craftsmanship was evident.

Efficient, Affordable, and Gimmicky

Luckin’s menu strikes a balance between popular classics like black coffee and oat milk lattes, usually priced around $2 in Asia, and inventive offerings. Customers often rave about the value. Andy Chan, an IT worker grabbing an Americano for his morning commute, calls it “normal” but appreciates that it's noticeably cheaper than Starbucks.

Yet, few Luckin customers seem to linger, highlighting a transactional, fast-paced vibe. This contrasts sharply with Starbucks’ inviting spaces.

Starbucks: The Classic Coffeehouse Experience

Down the street, Starbucks provides a different scene altogether. Here, patrons settle into laptops or deep conversations, enveloped in the typical coffeehouse ambiance. The menu fuses timeless favorites with regionally inspired specials like a matcha latte paired with tofu pudding. Recently, this branch went cashless — a milestone in traditionally cash-prevalent Hong Kong.

I ordered a yuzu cold brew, a tangy, almost slushy citrus-coffee hybrid steeped for 20 hours. At nearly $6 for 12 ounces, it felt pricey compared to Luckin’s offerings but delivered nuanced, refreshing flavors that gradually unfolded as the herbal ice melted. These two caffeinated treats — each uniquely shaped — left me buzzing.

The Business Behind the Beans

Starbucks has long innovated beyond coffee, effectively operating like a financial institution by accumulating $1.85 billion in stored-value cards and loyalty balances globally, some of which never gets redeemed, thus padding revenue. Though sales have dipped, this strategy provides Starbucks with low-cost, interest-free capital.

Meanwhile, Luckin embodies the startup hustle, emphasizing rapid expansion, slim margins, and digital ordering that fuels customer data insights. Viral experiments — like liquor-infused lattes — keep the brand buzzy. In 2024 alone, Luckin unveiled nearly 120 new items, likely challenging Starbucks’ R&D teams across Asia.

Two Coffee Worlds Coexisting

Coffee culture has splintered. You can find specialty pour-overs with wine-like notes, traditional espresso in historic cafes, boutique cortados, or boba-like concoctions from mass-market chains like Luckin. While Luckin fuels trends with relentless innovation and affordability, Starbucks caters to those craving a social, immersive experience.

Ultimately, there’s space for diverse coffee models. The battle between convenience-driven startups and established coffeehouse giants highlights evolving consumer preferences in a globalizing market. Incumbents face increasing pressure to redefine their value before their cherished “third place” becomes a secondary choice.