Trump Frames U.S. Trade Investments as 'Signing Bonuses' Inspired by Baseball

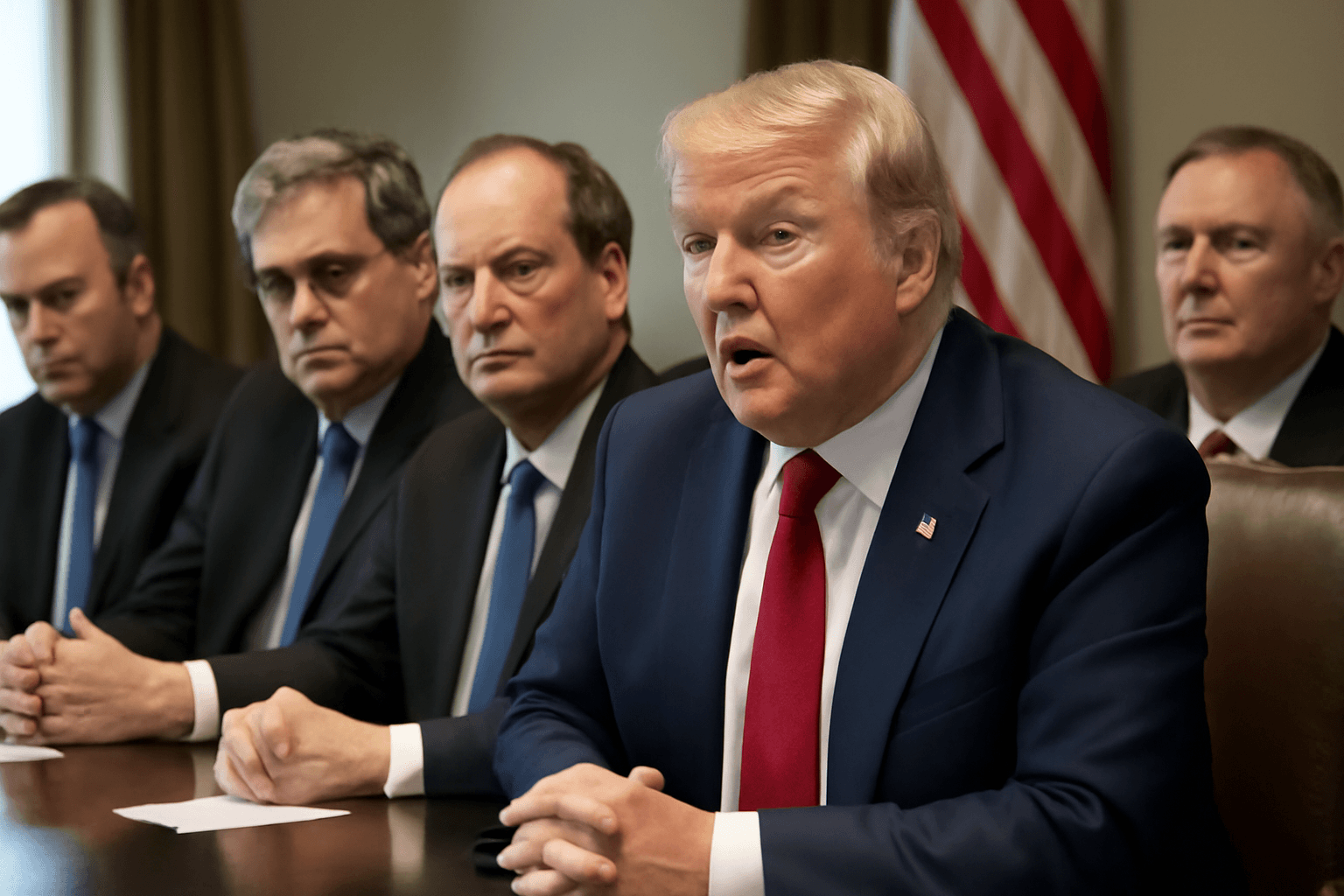

In a recent CNBC interview, President Donald Trump drew an unexpected parallel between vast international trade investments in the United States and the signing bonuses typically awarded to professional baseball players. This metaphor vividly illustrates how Trump blends his business acumen with cultural references to frame complex economic policies in relatable terms.

Trade Deals with Japan and the EU as 'Signing Bonuses'

Trump highlighted commitments from Japan and the European Union pledging over $1.3 trillion in investments and energy purchases in the U.S. as part of newly negotiated trade agreements. Specifically, he touted Japan’s pledge of $550 billion as akin to a massive signing bonus, one that far exceeds the multi-million dollar sums athletes typically receive.

He elaborated, "We’re taking in trillions of dollars. People love the tariffs, they love the trade deals, and they love that foreign countries aren’t ripping us off anymore." The president also underscored that the EU had agreed to a similar package, including buying $750 billion in American energy and investing $600 billion back into the U.S. economy by 2028.

Context and Implications of the Trade Investments

While such bold numbers capture attention, they come with important nuances. The White House indicated these funds aim to revitalize U.S. strategic industries — from semiconductor manufacturing and critical minerals mining to pharmaceutical production and defense shipbuilding. The overarching goal aligns with longstanding U.S. policy initiatives to reduce dependence on foreign supply chains and bolster domestic manufacturing.

However, questions remain about the enforceability and specifics of these commitments. When asked about consequences if investments fall short, President Trump responded that tariffs would revert to a higher 35% rate, emphasizing the leverage of tariff policy in ensuring compliance.

Trade Policy as a Game of Negotiation and Strategy

This 'signing bonus' analogy does more than provide a catchy soundbite — it reflects Trump’s broader negotiation style, steeped in deal-making and showmanship. It simplifies complex trade arrangements into narratives familiar to American audiences, potentially heightening public engagement and support.

On a deeper level, the metaphor raises important questions about the nature of such trade deals: Are these investments genuine influxes of capital directed explicitly by the U.S., or do they represent broader commitments subject to political and economic fluctuations? And how transparent and accountable will the implementation mechanisms be to ensure that these 'bonuses' translate into tangible American economic benefits?

Expert Perspective: Economic Realities Behind the Headlines

Trade experts caution that while headline figures like $600 billion or $750 billion sound impressive, the devil is in the details. Much depends on the timeframes for investment, sectors targeted, and the actual realization of purchases versus commitments. Economists also note the risk of conflating tariff revenues with incoming investment capital, two distinct financial streams with different economic impacts.

Moreover, framing tariffs as a bargaining chip to secure investment deals highlights a growing shift in U.S. trade policy, emphasizing a stronger stance against perceived unfair practices but raising concerns about potential retaliation and higher consumer prices.

Looking Ahead: What This Means for U.S. Trade and Economy

As the U.S. pushes for reshaped trade relationships post-pandemic and against a backdrop of geopolitical uncertainty, the interplay between tariffs and investment pledges will be a pivotal factor in economic recovery and growth. Trump's use of vivid analogies and high-stakes rhetoric underscores both the opportunities and complexities faced by policymakers navigating this evolving landscape.

Ultimately, whether these multi-billion dollar 'signing bonuses' yield sustainable economic dividends remains to be seen, with transparency and accountability key to transforming political bravado into real-world prosperity.

Editor's Note

The president’s likening of international trade investments to baseball signing bonuses offers a memorable yet simplified perspective on intricate trade deals. It beckons us to critically examine how such economic commitments are structured, monitored, and realized. Moving forward, it will be essential for stakeholders to demand clarity and measurable outcomes that balance national interests with the realities of a globalized economy.