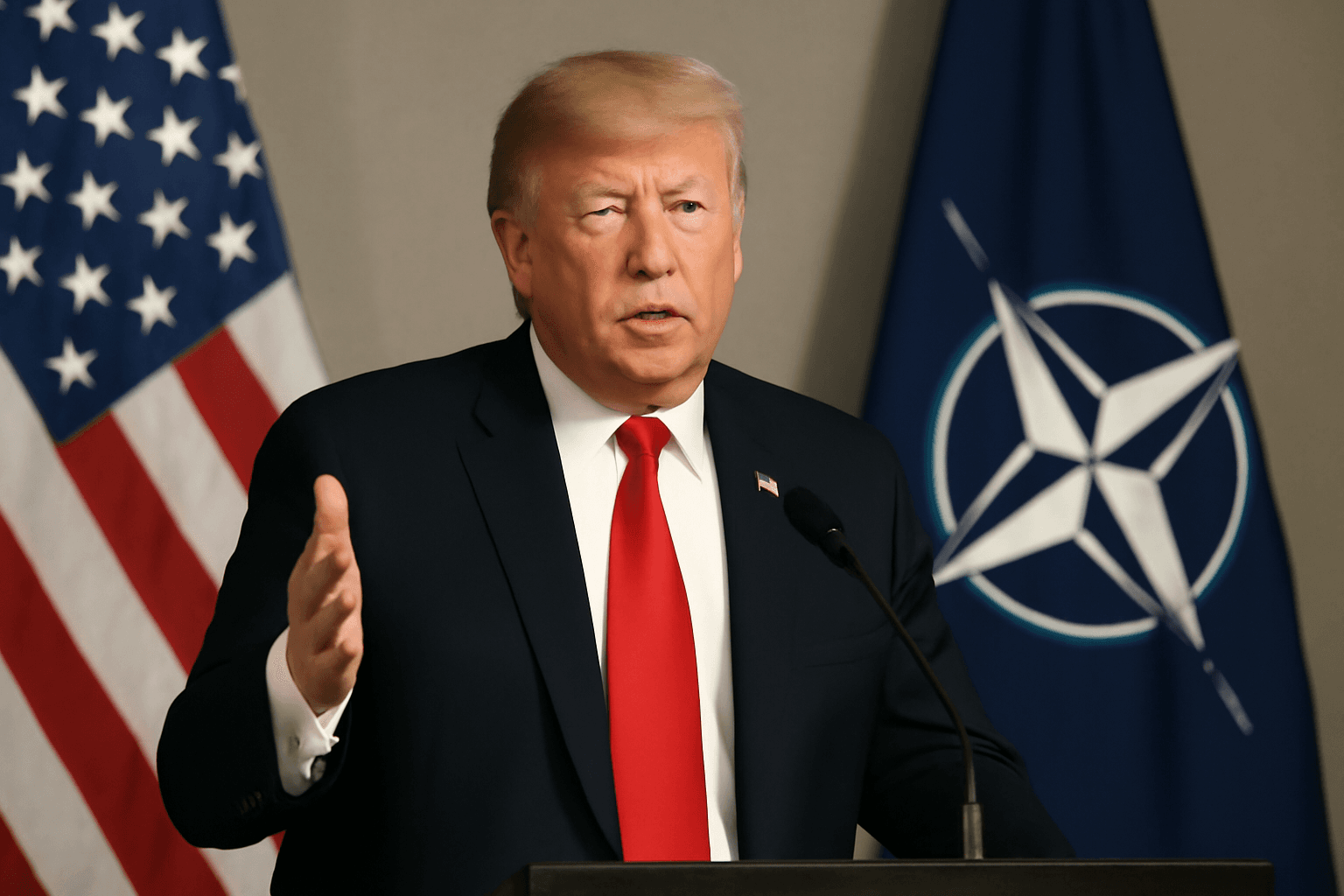

Trump’s 30% Tariff Threats Raise Stakes in US-EU and US-Mexico Trade Relations

In a startling escalation of international trade conflicts, former President Donald Trump announced plans to impose 30% tariffs on imports from Mexico and the European Union beginning August 1, 2025. This announcement, made on July 12 via Trump’s social media platform Truth Social, has intensified friction with two of America’s most crucial economic partners and stirred uncertainty across global markets.

Background: A Volatile Landscape of Trade Measures

This latest tariff threat adds fuel to an already volatile trade environment. Over the past week alone, the Trump administration has targeted more than 20 countries with new or increased tariffs and unveiled plans for a massive 50% tariff on copper imports. These aggressive measures reflect a bold but controversial approach to trade policy focused on protecting American industries, even at the risk of igniting retaliatory responses and supply chain disruptions.

Targeting the EU: Stalled Negotiations and Unmet Expectations

Despite weeks of intense negotiations between European diplomats and US officials aimed at softening existing trade barriers, Trump’s announcement signals a hardening stance. The EU and US had been discussing potentially lowering the 25% tariff on vehicles and related components, and even removing duties on aircraft, spirits, and industrial parts. However, Trump’s letter expressed deep frustration over slow progress and hinted at dissatisfaction with Europe's enforcement of trade rules.

The European Union’s readiness to address the €198 billion trade surplus by increasing purchases of American liquefied natural gas and defense equipment has thus far failed to dissuade the 30% tariff threat. While Brussels maintains it has avoided retaliatory tariffs to date, officials have warned they are preparing robust countermeasures should the US proceed.

Mexico: Renewed Tariff Pressures Amid Security Concerns

Mexico faces intensified scrutiny despite exemptions granted under the 2020 United States-Mexico-Canada Agreement (USMCA). Earlier this year, Mexico was initially targeted by 25% tariffs related to immigration and fentanyl trafficking concerns, but many goods entered the US tariff-free thanks to exemptions.

The proposed 30% tariffs threaten to upend this balance, jeopardizing Mexico’s export economy. Recent statements from Trump cited Mexico’s perceived failure to curb cartel activities—highlighting how intertwined issues of trade, immigration enforcement, and border security have become in US policy.

Broader Implications: National Security Investigations and Economic Fallout

Beyond these headline threats, the US administration has launched national security probes into various sectors, including semiconductors, aerospace, pharmaceuticals, and consumer electronics. These investigations open the door to additional tariffs that could further fragment global supply chains, impacting industries critical to both American economic interests and international cooperation.

This aggressive tariff posture raises urgent questions about the long-term stability of global trade partnerships. Businesses worldwide are now bracing for disrupted supply lines, increased costs, and retaliatory actions that could ripple through economies far beyond North America and Europe.

Expert Analysis: Navigating the Risks and Opportunities

Trade experts warn that unilateral tariff hikes, especially on major partners like Mexico and the EU, risk devolving into tit-for-tat escalations with damaging economic consequences. Tariffs can protect domestic industries temporarily but often lead to higher prices for consumers and strained diplomatic relations.

From a policy standpoint, this approach reflects a broader shift toward prioritizing national security and sovereignty concerns within trade frameworks. However, sustaining global alliances while deploying these measures poses a delicate balancing act for US policymakers and international stakeholders alike.

What’s Next?

- August 1 Deadline: Markets and governments will monitor closely to see if Trump’s tariff threats become reality.

- Potential EU Countermeasures: The EU has promised reciprocal tariffs if the US follows through.

- Mexico’s Economic Resilience: Mexico must navigate challenges to protect its export-driven economy amid heightened US scrutiny.

- Global Supply Chain Impact: Companies may accelerate diversification away from vulnerable trade corridors to mitigate risk.

Editor’s Note

President Trump's announced tariffs on Mexico and the European Union underscore the fractious dynamics reshaping global trade in the mid-2020s. While aimed at addressing national security and enforcement concerns, these measures open a Pandora’s box of economic uncertainty. Readers should watch closely how diplomatic negotiations evolve and consider the wider implications for industries and consumers alike. This moment invites reflection on how nations balance protectionism with cooperation in an interconnected world economy.