Trump Affirms No Extension on Aug 1 Tariff Deadline Amid Heightened Trade Tensions

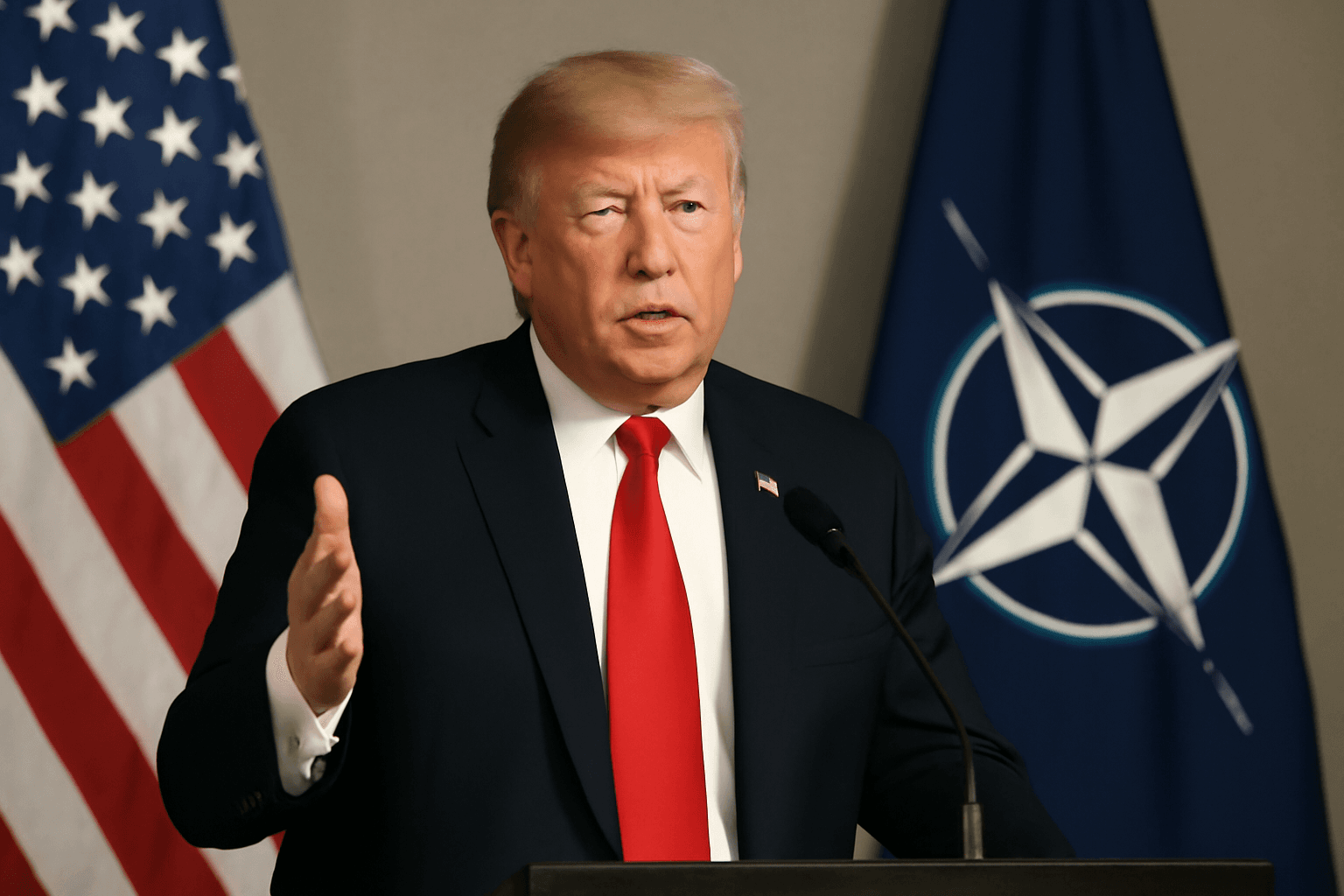

On July 9, 2025, former US President Donald Trump sent a clear and uncompromising message to his country's trading partners: the deadline to reinstate previously suspended tariffs will not budge beyond August 1. Despite ongoing negotiations and appeals from allies including Japan and South Korea, Trump announced that retaliatory duties paused in April will snap back swiftly and potentially escalate in severity.

Unwavering Deadline: August 1 Goes Ahead

Writing on his favored social media platform Truth Social, Trump stated, "TARIFFS WILL START BEING PAID ON AUGUST 1, 2025. There has been no change to this date, and there will be no change." This announcement follows an earlier decision to extend the original July 9 deadline by nearly a month, signaling an attempt to provide trading partners additional negotiation room. However, as the clock ticks down, Trump's stance has hardened, underscoring a broader presidential strategy to leverage tariffs as a tool of economic diplomacy.

The letters dispatched to key US trade allies clarify that duties paused amid earlier tensions will not only be reinstated but come back with increased rigor. Observers note that this could complicate ongoing trade discussions, particularly with Japan and South Korea, who remain central to US economic and geopolitical interests in the Indo-Pacific.

New 10% Tariff Targeting BRICS Nations, Including India

Expanding his tariff war playbook, Trump revealed plans to impose a 10% tariff on goods from BRICS countries—the economic bloc consisting of Brazil, Russia, India, China, and South Africa. This move takes aim at New Delhi, a critical emerging market partner for the United States, reflecting underlying tensions over global currency standards and geopolitical influence.

“BRICS was set up to hurt us, to degenerate our dollar, to take it off as a standard. That is okay if they want to play their game, I can play their game too,” Trump said. “We are not gonna lose the standard.”

Trump’s critique of BRICS suggests a strategic concern about the potential weakening of the US dollar's dominance as the global reserve currency. For American economic policymakers, maintaining the dollar’s primacy is vital for domestic financial stability and international leverage. This tariff move, while provocative, represents a broader contest over economic leadership in the 21st century.

Soaring Stakes: 50% Tariffs on Copper to Reshape Supply Chains

In a sector-specific escalation, Trump announced a proposed 50% tariff on copper imports, signaling a more aggressive stance to protect domestic industries and assert US bargaining power. Copper prices surged immediately after the announcement, reflecting worries about supply disruptions and increased input costs for manufacturers reliant on this essential industrial metal.

Addressing a Cabinet meeting, Trump said, “Today we’re doing copper. I believe the tariff on copper, we’re going to make it 50%.” Commerce Secretary Howard Lutnick later clarified to CNBC that the tariff would likely take effect between late July and August 1, aligning with the broader tariff reinstatement timeline.

This move aligns with Trump's recent strategy of targeted tariffs on key materials and sectors, potentially incentivizing American companies to relocate manufacturing operations back to the United States — a policy goal touted as part of revitalizing American industry and securing supply chains.

Future Steps: Pharmaceuticals and Domestic Manufacturing

Trump also hinted at forthcoming tariffs affecting the pharmaceutical sector but suggested that manufacturers would receive adequate time to move production domestically. This reflects an ongoing balancing act between protecting US industry and avoiding shortages or cost spikes in critical sectors such as healthcare.

Contextual Analysis: Implications for US and Global Trade

Trump’s hardline tariff approach reflects a continuation of his distinctive tenure’s trade policies, which often favored protectionism and used tariffs as diplomatic weapons. While such moves may resonate with segments of the US industrial base and voters concerned about manufacturing jobs, they also risk escalating retaliatory actions, disrupting global supply chains, and raising prices for American consumers.

Economists warn that stepping up tariffs amid a fragile global economic recovery could dampen growth and heighten inflationary pressures. The targeted 10% tariff on BRICS members adds a geopolitical dimension, potentially complicating US relations not only with those nations but also with allies wary of broader destabilization. Copper tariffs underscore concerns about securing critical resources, yet could also spur inflation in construction and electronics.

Ultimately, this unfolding trade drama invites critical questions: How will allied countries respond? Will tariff pressures push them towards concessions or entrenchment? Can the US balance assertive economic nationalism with maintaining cooperative global partnerships necessary in an interconnected world?

Editor’s Note

As the August 1 tariff deadline nears, the United States finds itself at a crossroads between pursuing assertive trade policies and navigating complex global interdependencies. Trump's uncompromising position underscores a persistent skepticism towards multilateral trade dynamics and a readiness to leverage tariffs aggressively. For readers, this developing story raises vital considerations about the future of international trade, the resilience of global supply chains, and the economic costs and benefits of protectionist strategies in an era of geopolitical uncertainty.