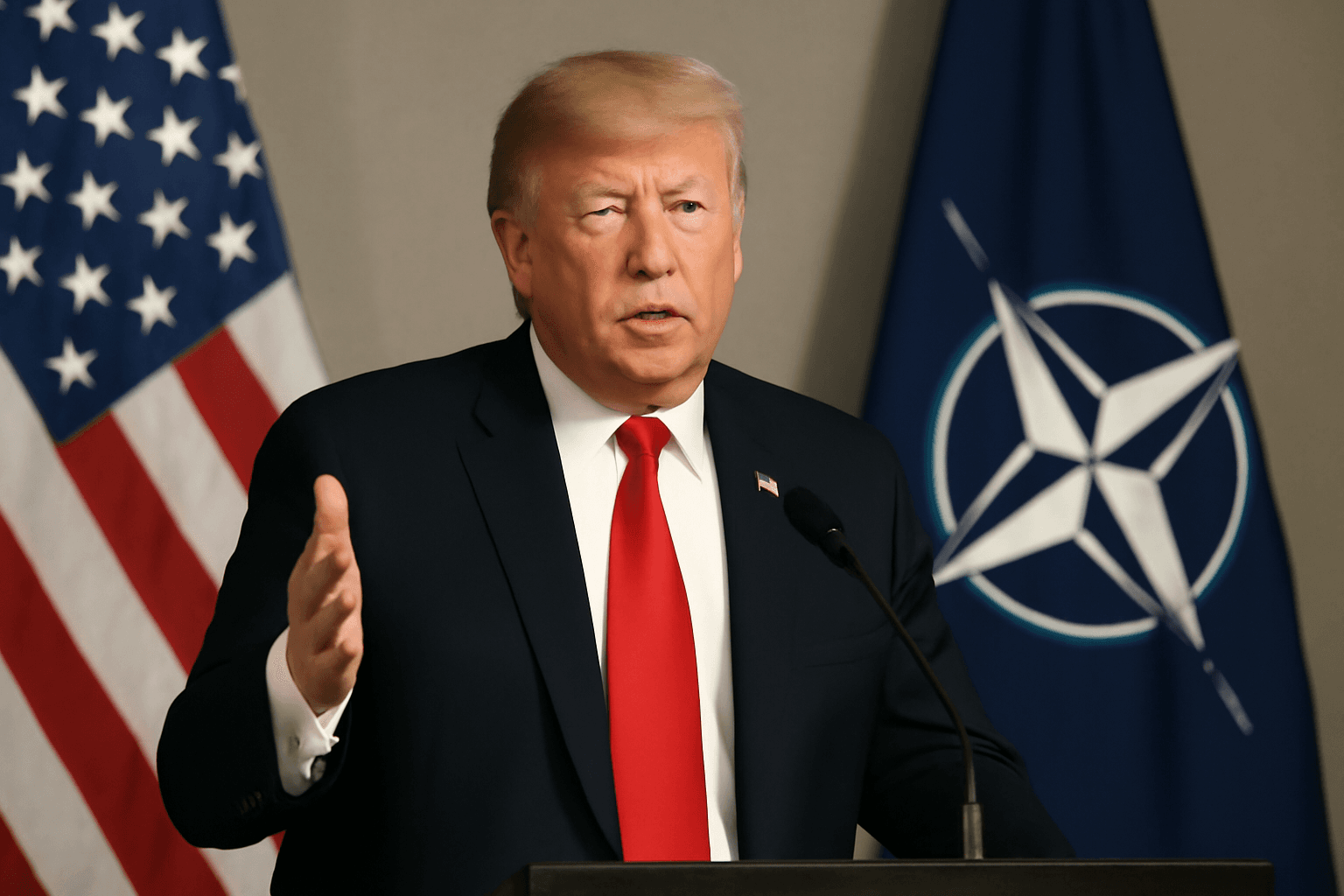

President Trump Plans Broad Tariff Increases Amid Mixed Economic Signals

In a recent announcement that has sent ripples through global markets and trade circles, President Donald Trump declared intentions to raise tariffs on most U.S. trading partners to 15% or 20%, up from the current 10%. Speaking with NBC News' Meet the Press, Trump dismissed concerns about the potential negative impact on the stock market and inflation, emphasizing that tariffs have been "well-received" as the market reached new highs.

This move arrives at a time when the U.S. economy stands at a crossroads, balancing trade tensions, fluctuating market confidence, and lingering inflation pressures following the pandemic recovery.

Trade Policy: A Blanket Tariff and Its Implications

President Trump’s strategy to impose blanket tariffs represents a sweeping escalation in U.S. trade policy. Currently, tariffs rest at 10%, affecting various imports. Increasing these to as high as 20% could significantly alter supply chains and pricing, especially considering that the United States imports over $600 billion worth of goods annually from the European Union—the country’s largest trading bloc—and more than $400 billion from Canada.

Despite multinational negotiations ongoing to potentially soften or avert new tariff measures, Trump indicated letters notifying the European Union and Canada about these elevated tariffs would be issued imminently. The European Union, in response, maintains over $100 billion in retaliatory tariffs ready to be deployed, including on products like soybeans from Louisiana and Kentucky bourbon, underscoring the potential for escalated trade retaliation that could deepen economic strain in key U.S. regions.

Stock Market Rally or Illusion?

While Trump pointed to the S&P 500 hitting record highs as validation for his tariff policies, it is vital to note that this market surge follows marked volatility earlier in the year. After the initial wave of tariffs on April 2, the S&P experienced one of its fastest 20% drops ever. Such volatility reflects deeper investor unease over sustained trade tensions and uncertainty about economic growth prospects.

Inflation and Consumer Impact: The Hidden Cost

On the inflation front, President Trump downplayed warnings, including industry signals like Hasbro’s CEO comments on rising toy prices linked to tariffs. Although inflation has moderated from pandemic peaks, it remains stubbornly above the Federal Reserve's 2.3% target, impacting everyday Americans.

Trump stressed that if goods were produced domestically, companies wouldn’t need to raise prices, a stance that overlooks complex factors like manufacturing costs, labor availability, and global supply chains. This raises critical questions about the balance between protectionist policies and consumer affordability.

Geopolitical and Defense Updates: Russia, Ukraine, and NATO Dynamics

President Trump also touched on international security matters, notably the conflict in Ukraine. Expressing disappointment at Russia's continued aggression, he promised a "major statement" soon but withheld specifics. He highlighted a newly reached arrangement where weapons are shipped to NATO members who finance these arms before transferring them to Ukraine, a strategic move aligning the U.S. military support with NATO's collective defense principles and financial responsibility.

This development comes after a brief and controversial pause on U.S. weapon shipments to Ukraine orchestrated by Defense Secretary Pete Hegseth, which reportedly surprised some administration officials. Trump's apparent unawareness of the pause juxtaposes with his praise for Hegseth, reflecting potential internal fractures over the U.S.'s approach to the conflict and military aid.

Domestically, the administration's stance on sanctions against Russia received renewed attention, with bipartisan support building in the Senate for increased punitive measures—legislation Trump acknowledged as empowering him with flexible executive options.

Domestic Policy Spotlight: The "One Big Beautiful Bill" and Political Fallout

On the home front, Trump commented on the recently passed, sweeping Republican domestic policy package known colloquially as the "One Big Beautiful Bill Act." This extensive legislation extends tax cuts from 2017, introduces temporary breaks on tips and overtime pay, and allocates vast funding to border security and military expenditures, but concurrently enforces significant cuts to Medicaid, nutrition assistance, and clean energy programs.

While Trump expressed confidence in the bill's favorable reception, Democrats have launched aggressive campaigns to highlight its social safety net cuts, framing it as a betrayal of constituent needs. Democratic National Committee Chair Ken Martin criticized GOP lawmakers for prioritizing party allegiance to Trump over their voters' interests.

The political tussle surrounding this legislation exemplifies broader challenges facing the GOP as it defends the bill amid looming 2026 midterms, where control of Congress hangs in the balance.

Expert Commentary: Navigating Complexity and Contradictions

Trump's declared tariff increases symbolize a stark trade policy recalibration, revealing tensions between nationalist economic visions and global interdependence that both shape and strain international commerce. Experts warn that while tariffs aim to protect American industries, they risk raising prices for consumers and inviting retaliatory measures that harm U.S. exporters.

From an economic policy perspective, the administration’s narrative around inflation remains contested. Although inflation metrics have stabilized somewhat, tariffs can embed hidden costs into consumer goods, disproportionately impacting lower-income families. This nuanced interplay requires policymakers to weigh immediate economic gains against long-term affordability and employment considerations.

Moreover, the geopolitical undertones—particularly on Russia and Ukraine—reflect a sophisticated balancing act between military support, NATO financing responsibilities, and evolving U.S. strategic interests amid a complex, ongoing conflict.

Looking Ahead: Key Questions for Policymakers and the Public

- How will blanket tariff increases impact American consumers and domestic industries in both the short and long term?

- What measures can be implemented to mitigate inflationary pressures linked to protectionist trade policies?

- How might escalating trade tensions with key allies such as the EU and Canada reshape diplomatic and economic alliances?

- In managing military aid to Ukraine, what is the sustainable balance between U.S. financial and strategic responsibilities versus burden-sharing with NATO partners?

- Politically, how will the "One Big Beautiful Bill" influence voter sentiment amid growing debates over social program funding and economic priorities?

Editor’s Note

President Trump’s announcement of widespread tariff hikes underscores a decisive pivot toward assertive trade protectionism amid a complex landscape of inflation concerns and global geopolitical tensions. While the move aims to bolster domestic manufacturing and leverage international negotiations, it raises questions about economic costs to consumers, potential retaliation from trading partners, and broader implications for U.S. leadership on the world stage.

As markets react and political debates intensify, stakeholders—from policymakers to everyday Americans—should watch closely how these decisions unfold, weighing immediate benefits against potential ripple effects. The intersecting narratives of trade, inflation, military aid, and domestic policy encapsulate the multifaceted challenges shaping America’s path forward in a rapidly evolving global environment.