Introduction: US Tariff Policy Faces a Critical Aug. 1 Threshold

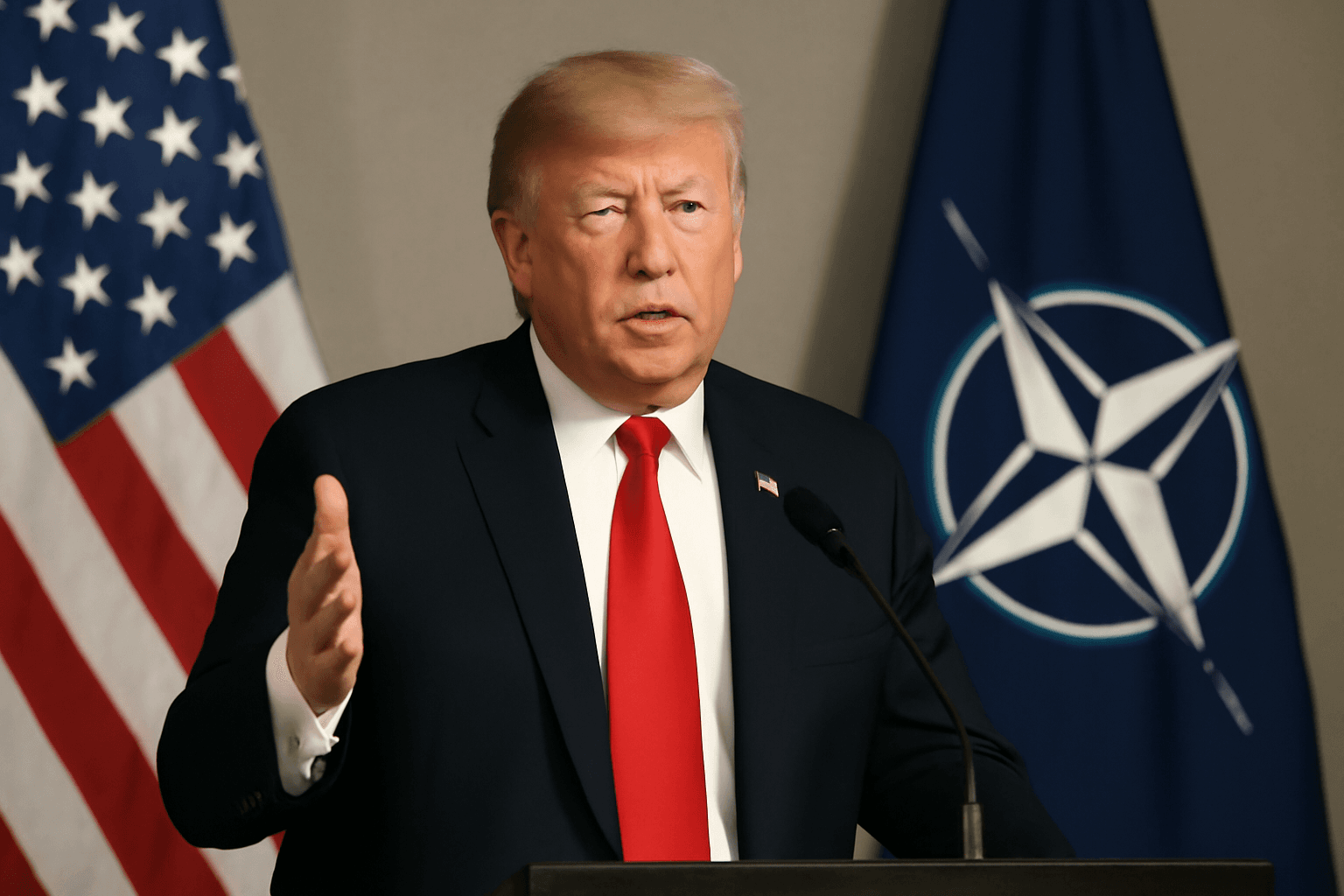

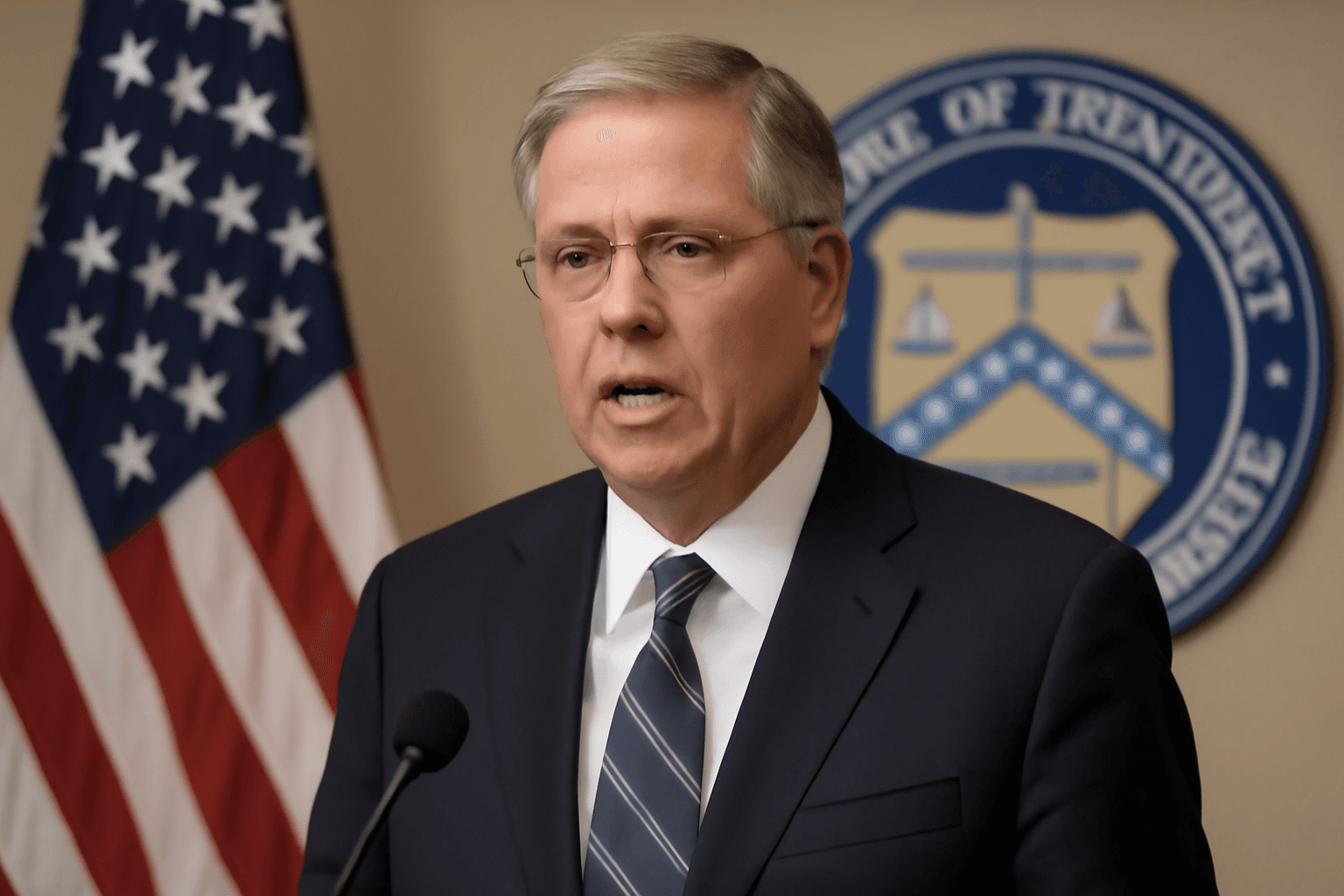

In a key update on the evolving US trade landscape, Treasury Secretary Scott Bessent announced a pivotal deadline approaching on August 1, 2025. This date marks when tariffs imposed earlier in the year by President Donald Trump’s administration could return to their previous levels for countries that have yet to finalize new trade agreements. Bessent's remarks on CNN's State of the Union clarify the administration’s stance amid mounting uncertainty for global trading partners.

August 1 Tariff Reversion: What It Means for Trade Partners

Bessent emphasized that President Trump plans to send official letters to certain trading nations, warning that if no progress is made in talks, tariffs will "boomerang back" to the April 2 rates come August 1. This approach places pressure on countries to negotiate swiftly or face reinstated higher duties on US imports.

Importantly, Bessent rejected characterizing August 1 as a fresh deadline, instead framing it as an automatic trigger for reverting tariffs if deals remain elusive. "If you want to speed things up, have at it; if you want to go back to the old rate, that's your choice," he told reporters, signaling flexibility but underscoring urgency.

Background: The 90-Day Tariff Pause

To understand the implications, it’s crucial to recall that in April 2025, President Trump paused steep tariffs for 90 days across most major trading partners. This moratorium was designed to provide a window for renegotiations to avoid escalating trade tensions further. With that window closing Wednesday, markets and policymakers alike are bracing for potential fallout depending on the outcomes.

Anticipated Trade Announcements Could Shape Market Sentiment

Adding a layer of cautious optimism, Bessent hinted at upcoming positive news. He stated he expects "several big announcements over the next couple of days" regarding new trade deals, suggesting that significant progress is underway even as the tariff clock ticks down.

This outlook dovetails with President Trump’s earlier comments that notifications to partners about tariff rates effective August 1 would soon be dispatched, and that the US would begin collecting duties immediately thereafter.

Economic and Political Context: The Stakes Are High

The rising tension over tariffs and trade negotiations comes at a delicate time for the US economy. Investors are closely watching these developments amid fears that re-imposed tariffs could disrupt supply chains and fuel inflation, potentially dampening growth. Additionally, this trade strategy reflects broader political dynamics as the administration juggles domestic interests with international diplomacy.

- For trading partners: the choice is stark — expedite trade talks or face return to higher tariffs.

- For US businesses and consumers: there could be cost implications depending on whether tariffs rise again.

- For policy observers: the situation offers a critical test of the administration’s trade negotiation efficacy.

Expert Insight: Navigating Complex Trade Waters

As a policy analyst, I observe that this tariff reversion mechanism operates as a strategic lever—using deadlines to compel action while maintaining negotiation flexibility. Historically, such tariff ‘boomerangs’ can shake markets but also serve as catalysts for breakthroughs, provided diplomatic channels remain open.

Yet, the broader question remains: can the US balance assertive tariff policies with fostering sustainable, long-term trade partnerships that support economic stability and growth?

Looking Ahead: What to Watch For

- Confirm whether announced trade deals materialize before August 1.

- Monitor US import tariffs’ status and any retaliatory responses from affected countries.

- Assess market reactions and economic indicators for signs of impact.

Editor’s Note

The upcoming August 1 tariff policy reversal is more than a bureaucratic deadline—it's a high-stakes moment for international trade relations and economic signaling. While the administration hints at progress through imminent announcements, uncertainty remains, highlighting the delicate dance between protectionism and open commerce. Observers should scrutinize not just the tariff levels but the broader negotiation dynamics shaping the future of global trade.