U.S. Treasury Secretary Advises Patience Amid Incoming Tariff Hikes

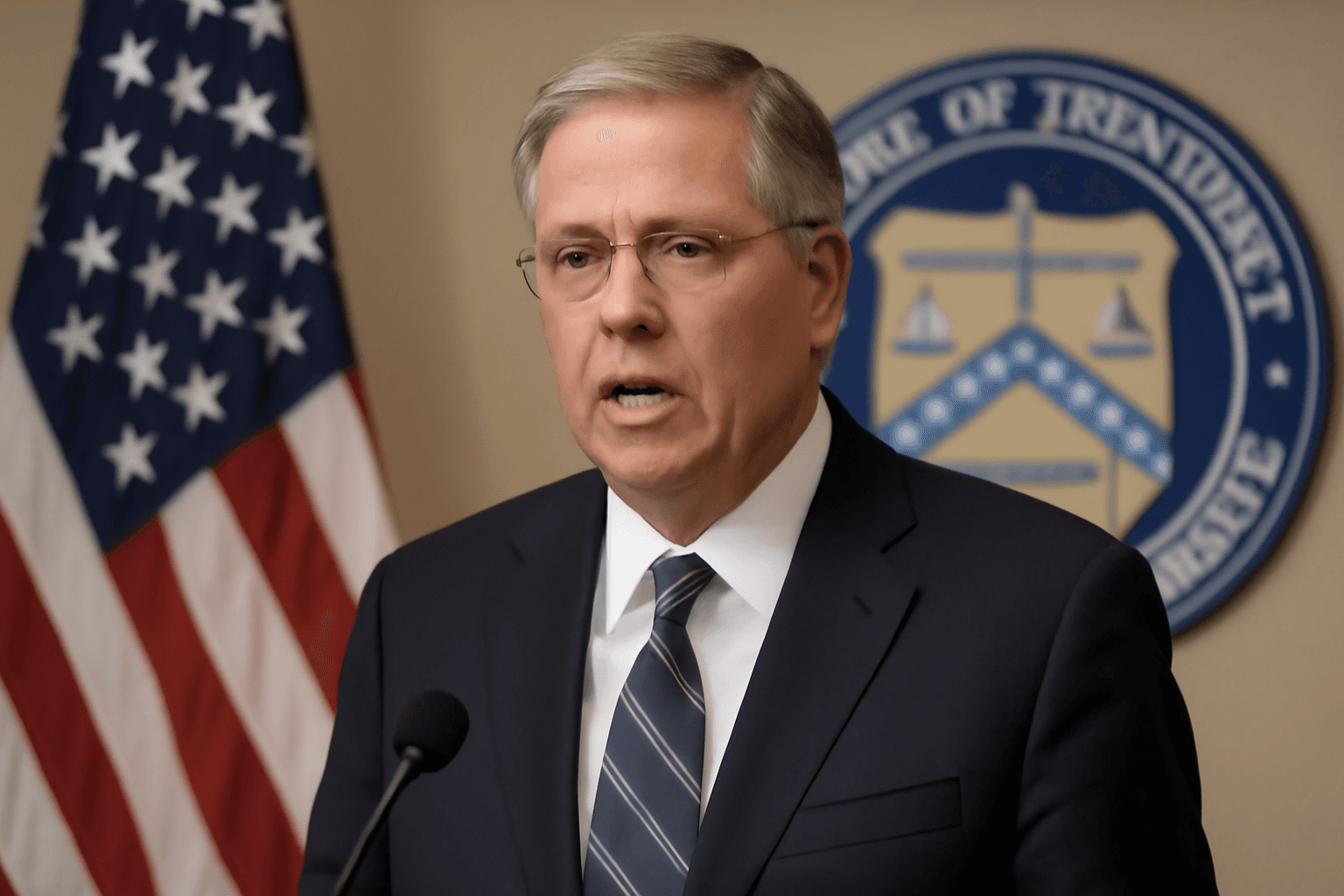

As the August 1 deadline for potential tariff rate increases looms, U.S. Treasury Secretary Scott Bessent is delivering a clear message to businesses, investors, and trade partners: there’s no need to panic. Speaking on July 30 at a policy event hosted by a conservative platform, Bessent emphasized that although some reciprocal tariffs may rise, the situation is far from irreversible and continued negotiations remain possible beyond the deadline.

Tariff Snapbacks: Temporary But High-Impact

Bessent highlighted that the impending tariff rate adjustments, many dating back to President Trump's April 2025 announcements, could last anywhere from a few days to several months, depending on ongoing trade talks.

“The tariff may be on for three days, it may be on for three weeks, it may be on for three months,” Bessent explained. “You can continue negotiating.”

He portrayed the August 1 deadline more as a strategic milestone — a negotiating lever rather than a definitive breaking point. In essence, falling back on these reciprocal tariff levels allows the U.S. government to maintain pressure for better market access while signaling flexibility to trade partners.

Implications for American Businesses and Global Trade

Though reassuring in tone, Bessent’s remarks acknowledge that August may prove to be a particularly busy month for trade discussions. Companies navigating disrupted supply chains and fluctuating tariffs will likely face challenges as these rates potentially come into effect before any new agreements are finalized.

This evolving landscape raises significant questions for sectors dependent on stable international trade, especially given some top trading partners have yet to formalize agreements ahead of the deadline.

Trump Administration’s Firm Stance

President Trump has maintained a strict posture toward the tariff deadline, stating unequivocally in a tweet that “THE AUGUST FIRST DEADLINE IS THE AUGUST FIRST DEADLINE – IT STANDS STRONG, AND WILL NOT BE EXTENDED.”

Nevertheless, Bessent’s comments suggest a dual-track strategy: enforcing tariffs as leverage while leaving the door open for talks that could alleviate or roll back those tariffs.

Expert Insight: What This Means for the Broader Trade Environment

The Trump administration’s tariff policy reflects a complex balancing act between protectionism and negotiation. From an economic standpoint, tariff volatility can create uncertainty for global supply chains, leading companies to rethink investment and sourcing strategies.

Experts warn that while “snapback” tariffs might be temporary, their ripple effects on commodity prices, manufacturing costs, and consumer prices can linger. Additionally, the indication that trade discussions will intensify post-deadline suggests that businesses and investors should prepare for a dynamic environment, where tariffs could fluctuate based on diplomatic developments.

Underreported Dimensions

- Smaller Economies’ Challenges: Less-discussed are the impacts on developing countries with less bargaining power, which may face disproportionate burdens under tariff escalations.

- Impact on American Consumers: As tariffs increase, U.S. consumers may experience higher prices on imported goods, which could affect inflation and purchasing behavior.

- Legal and Compliance Risks: Companies must remain vigilant on compliance amidst shifting tariff classifications to avoid penalties.

Looking Ahead: What to Watch in August

August promises to be a pivotal month, with increased negotiation activity and heightened market sensitivity. Stakeholders should watch for:

- Announcements of New Trade Deals: Any breakthroughs could trigger tariff rollbacks or adjustments.

- Market Reactions: Stock and commodity markets responding to tariff developments.

- Policy Signals: Guidance from administration officials post-August 1 will clarify U.S. trade strategy going forward.

Editor’s Note

Bessent’s call for calm amid looming tariff hikes underscores the complexity of contemporary U.S. trade policy — where firm deadlines serve both as pressure points and negotiation tools. While businesses and investors face uncertainty, ongoing talks highlight an underlying openness to compromise. Readers should consider not only the immediate tariff changes but also the broader economic ripple effects and geopolitical calculations shaping America’s evolving trade landscape.