President Trump Unveils Aggressive Tariffs on Copper Imports

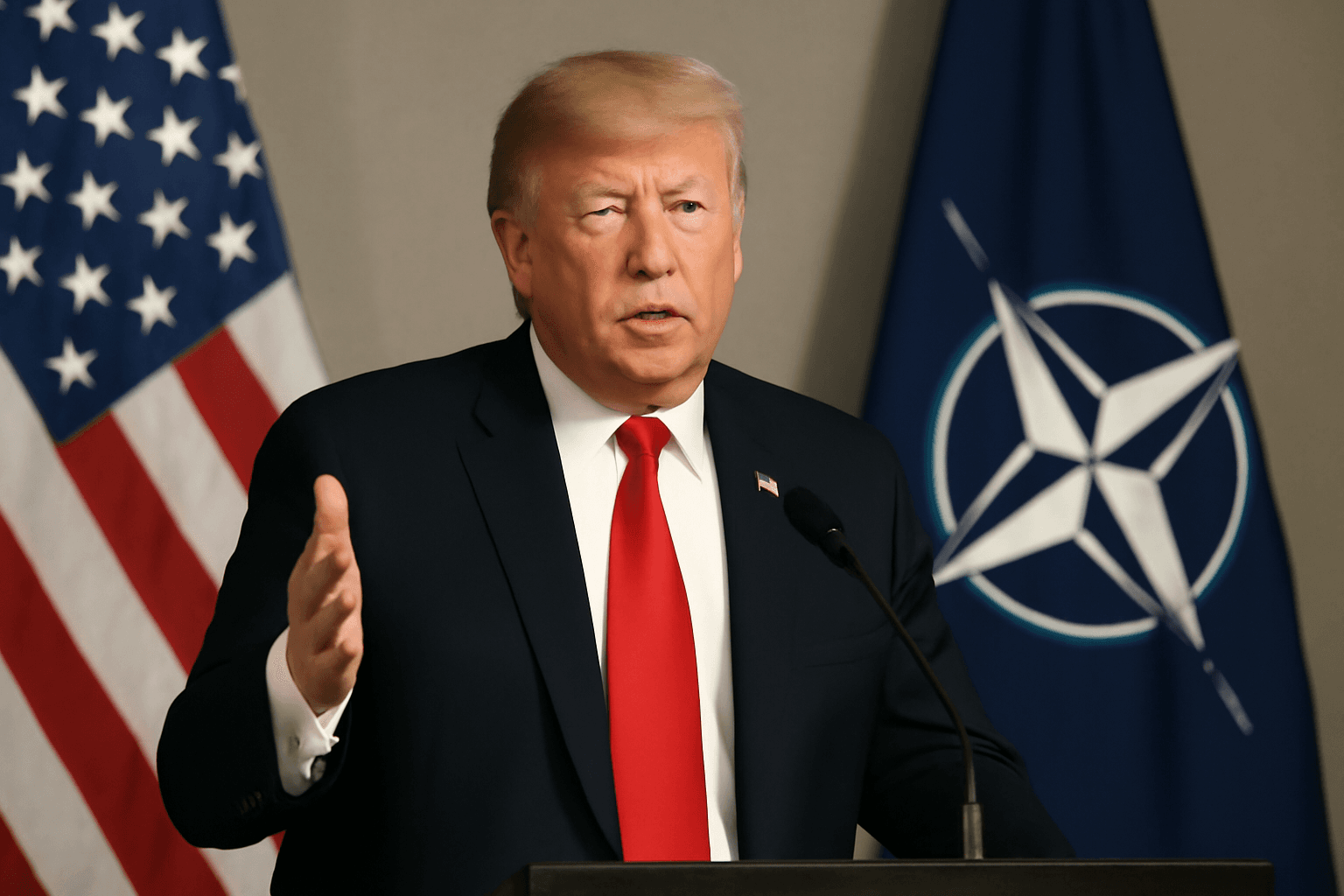

In a bold turn in U.S. trade policy, President Donald Trump announced on Tuesday that his administration will impose a striking 50% tariff on copper imports. Speaking during a White House Cabinet meeting, the president emphasized this decisive step as part of a wider agenda targeting specific sectors with steep tariffs.

Details and Implications of the Copper Tariff

"Today, we're doing copper," Trump declared, underscoring the tariff's significance without specifying exactly when it will be implemented. Copper, a critical metal for industries ranging from construction to electronics, is the country’s third-most-consumed metal after iron and aluminum. The U.S. imports nearly half of the copper it uses — primarily from Chile.

Following the announcement, copper futures soared to record highs, with the September contract surging over 10% to nearly $5.90 per pound. Shares in domestic copper mining companies also climbed over 5%, as investors anticipate elevated demand for locally sourced material.

Broader Trade Strategy: Pharmaceutical Tariffs on the Horizon

Trump also hinted at forthcoming tariffs on pharmaceutical imports, potentially reaching as high as 200%. Unlike the immediate copper tariff, pharmaceutical companies may be granted up to 18 months to shift their production back to U.S. soil before these punitive tariffs are imposed. This move signals a stronger push to revitalize domestic manufacturing within strategic industries.

Contextualizing the Tariff within Ongoing Trade Policies

This announcement builds on earlier trade actions this year. In April, the administration introduced a 10% baseline tariff on most imports, supplemented by higher rates targeting specific countries. New individualized tariffs, ranging from 25% to 40%, are scheduled to take effect starting August 1 against nations including Japan, South Korea, and Thailand.

Additionally, the Commerce Department recently concluded an investigation into copper imports on national security grounds, paving the way for these sector-specific tariffs. Commerce Secretary Howard Lutnick explained the policy aims to "bring copper production home," aligning copper tariffs with existing duties on steel and aluminum imports.

Economic and Policy Analysis: Potential Ripple Effects

Experts caution that while these tariffs may spur domestic production, they risk driving up input costs for U.S. manufacturers and consumers alike. Copper is essential for infrastructure, renewable energy technologies, and electronics. A sudden 50% tariff could exacerbate inflationary pressures amid ongoing economic uncertainties.

Legal scholars also raise questions about the invocation of national security to justify these measures, a precedent that could lead to increased trade tensions and retaliatory actions.

Looking Ahead: What to Watch

- Implementation timeline: Precise dates for the copper tariff enforcement remain pending, though administration officials signal an announcement by month-end.

- Sector responses: Industries reliant on copper will be closely monitoring cost implications, while pharmaceutical firms weigh the feasibility of reshoring production within the given timeframe.

- International relations: Trade partners may respond with countermeasures, potentially affecting global supply chains and diplomatic ties.

Editor's Note

President Trump's declaration of a 50% tariff on copper imports, alongside looming pharmaceutical tariffs, represents a significant escalation in the ongoing reshaping of U.S. trade policy. While framed as a move to protect national security and revive American industry, these tariffs carry complex economic repercussions. Will these measures ultimately strengthen domestic production, or could they trigger unintended inflation and geopolitical friction? As the administration finalizes timelines and specifics, stakeholders must grapple with balancing protectionism and global trade realities.