White House Economist Compares Tariff-Related Inflation Risk to Unlikely Catastrophes

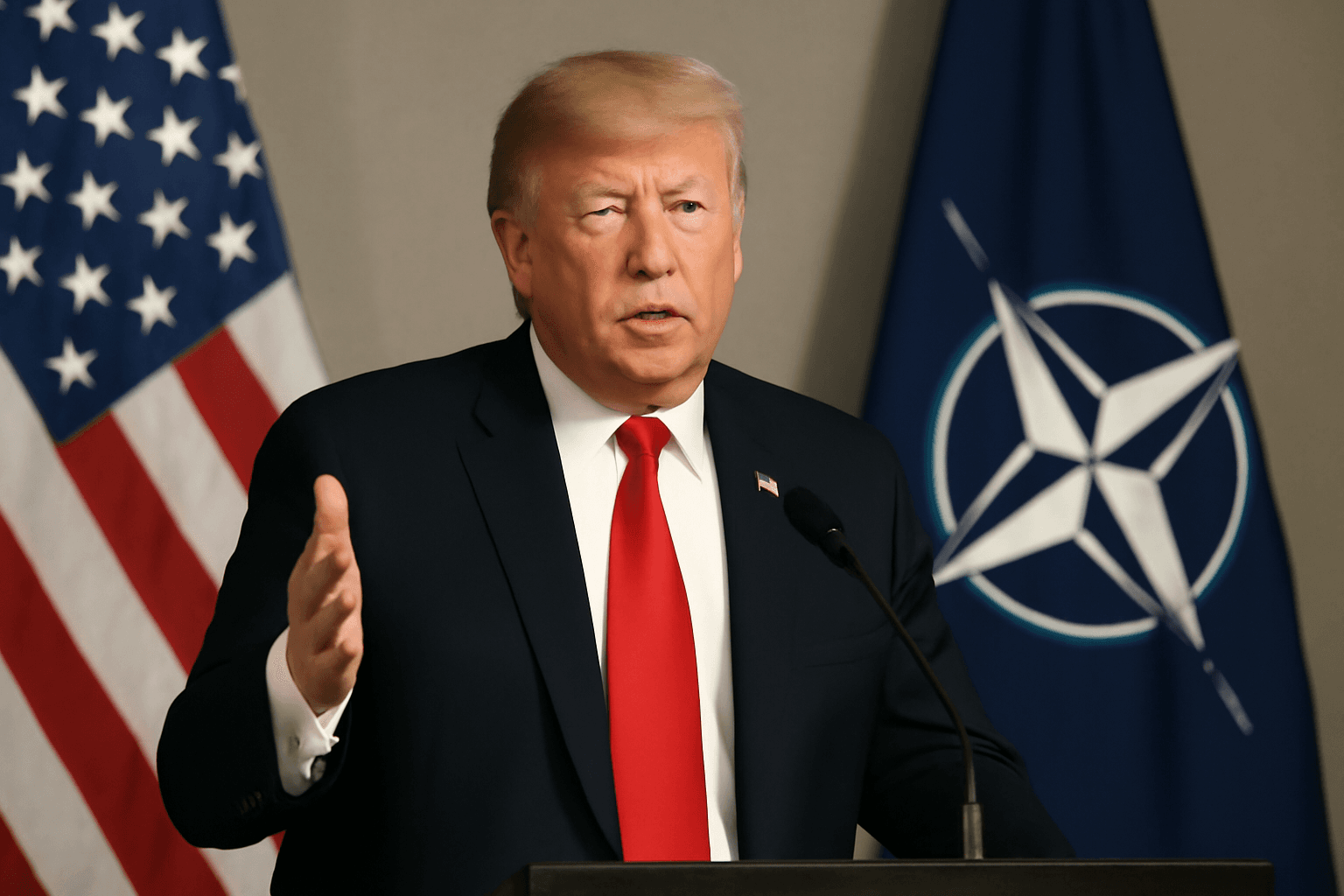

In a conversation that caught many economists' attention, Stephen Miran, chair of the White House Council of Economic Advisers, offered a striking analogy regarding the potential inflationary impact of President Donald Trump’s tariffs. Speaking on CNBC, Miran likened the chances of tariffs causing significant price hikes to that of pandemics or meteor strikes — rare, unpredictable events on the economic landscape.

Expert Commentary: “Tariff Shocks Are Possible but Not Inevitable”

Miran’s remarks come amid widespread concern in economic circles that tariffs on imports might ignite inflationary pressures detrimental to American consumers. Yet, Miran stresses the challenges inherent in economic forecasting, cautioning against alarmist interpretations of current data.

"We shouldn’t dismiss the possibility," Miran clarified, “but inflationary effects from tariffs have so far been elusive in the data. There’s no crystal ball, but evidence is our guide.”

Data Shows Contrary to Fears: Imported Goods Prices Have Fallen

The White House published a report examining two critical inflation indicators: the Personal Consumption Expenditure Price Index (PCE) and the Consumer Price Index (CPI). According to the analysis, prices for imported components overall declined between December 2024 and May 2025, despite fears stemming from Trump's announced "reciprocal" tariff policy in April 2025.

This trend has led Miran and other officials to question the narrative that tariffs have so far inflicted widespread inflationary damage. Trump's delay in enforcing the most stringent tariffs and extensions of deadlines for bilateral trade agreements have also contributed to softer price impacts than initially feared.

Why Inflation From Tariffs Has Been Slower to Materialize

- Implementation delays: Many of the harshest tariffs have been postponed, tempering immediate price impacts.

- Stockpiling by businesses: Companies bought goods in advance to hedge against tariff risks, delaying price pressures on consumers.

- Lag effects: Economic policies like tariffs often take time before filtering fully through production costs and retail prices.

Economists Remain Cautious Despite Observed Trends

Despite the White House optimism, many economists maintain a watchful stance, anticipating that sustained tariffs could eventually push consumer prices upward, especially as earlier buffers like stockpiled inventories run out.

They argue that while inflation driven by tariffs has not become pervasive yet, the risk remains real and should not be dismissed lightly. This caution is particularly relevant considering the broader inflationary environment tied to supply-chain disruptions and increased production costs globally.

Contextualizing Tariffs in the U.S. Economy

From an economic policy perspective, tariffs are a double-edged sword. Although intended to protect domestic industries from unfair foreign competition, they can inadvertently raise costs for American manufacturers and consumers. Miran’s framing invites policymakers and the public to weigh these risks carefully and recognize the complexity of inflation drivers beyond tariff measures alone.

Looking Ahead: The Inflation Outlook and Policy Implications

As the U.S. economy grapples with multiple pressures—from monetary policy shifts to global supply chain uncertainties—the trajectory of tariff-related inflation remains a critical factor to monitor. The White House's current stance, emphasizing the low probability of immediate tariff-triggered inflation, is both reassuring and a call for vigilance.

In essence, the metaphor of ‘meteors’ reminds us that while some shocks are unforeseeable, robust economic research and adaptive policies are our best defense against unexpected risks.

Editor’s Note

This evolving narrative around tariffs and inflation exemplifies the challenges of economic policymaking in uncertain times. While the White House highlights reassuring data, economists urge sustained attention to underlying risks that might yet unfold. Readers and policymakers alike should question: Are current delays and stockpiles merely postponing inevitable price pressures? Or has the economy effectively absorbed the shock? Understanding the nuanced interplay of these forces is vital for anticipating how inflation will shape economic wellbeing and monetary decisions in the months ahead.