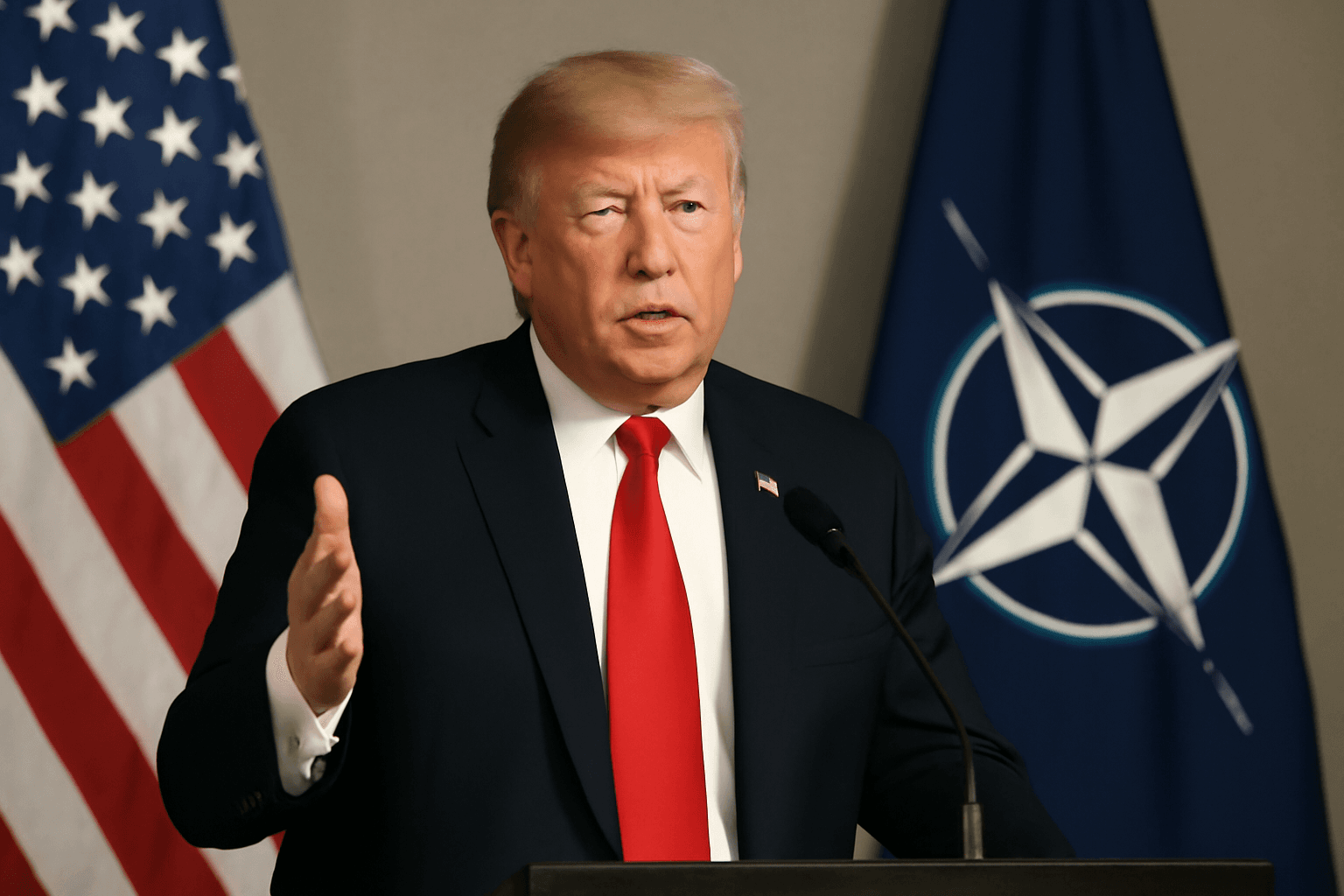

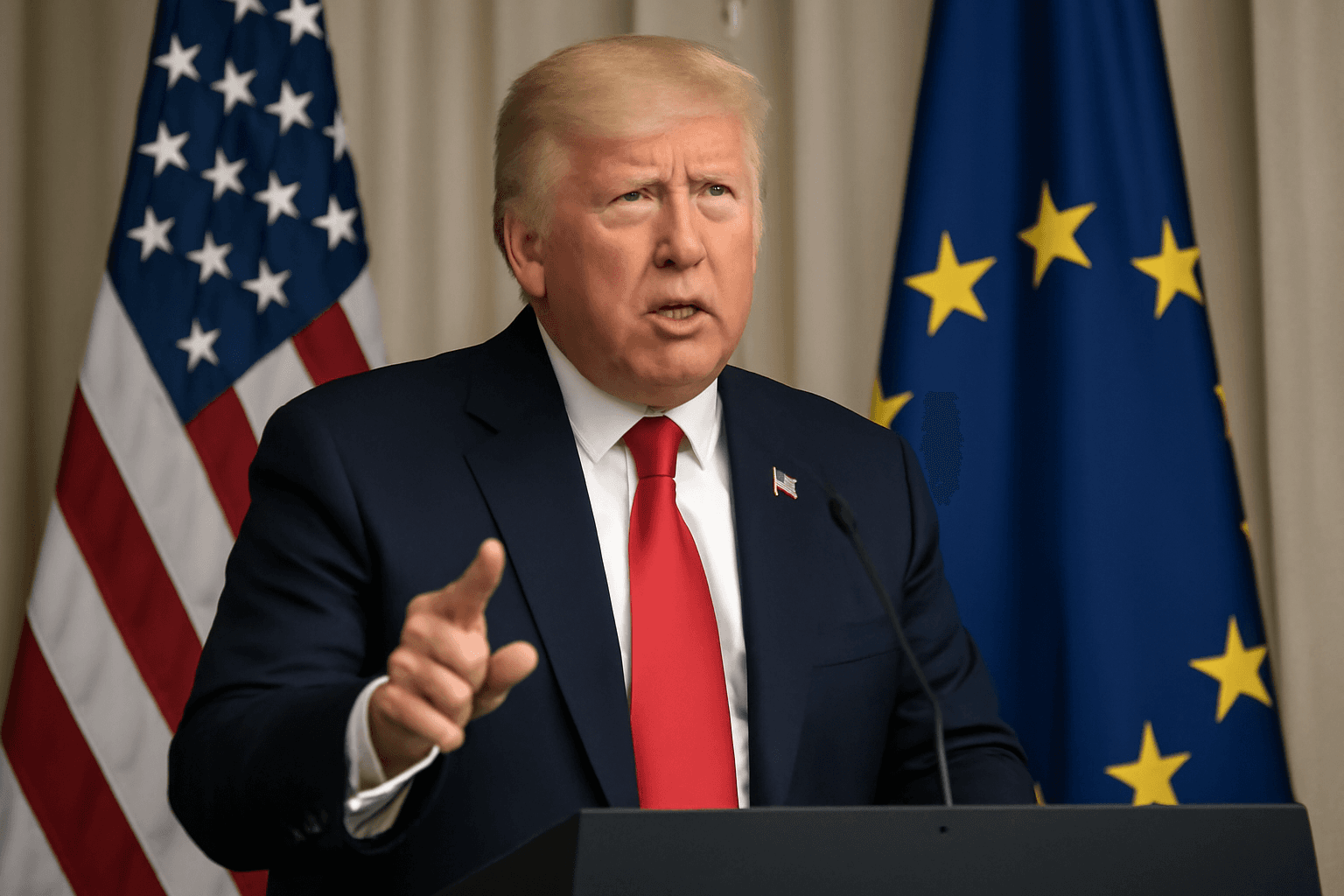

Trump Threatens Steep 30% Tariffs on EU and Mexico Amid Trade Disputes

In a dramatic escalation of ongoing trade tensions, US President Donald Trump has announced plans to impose a 30% tariff on imports from the European Union and Mexico, with a proposed starting date of August 1, 2025. This move follows weeks of stalled negotiations and represents a sharp challenge to two of America's largest trading partners.

Details of the Tariff Threat and Its Global Implications

Trump’s announcement was made public through letters sent individually to European Commission President Ursula von der Leyen and Mexican President Claudia Sheinbaum, which he then posted on his Truth Social platform. The president indicated that this 30% tariff is in addition to existing levies, including a 50% tariff on steel and aluminum imports and a 25% tariff on automobile imports from these regions.

Significantly, Trump also issued similar tariff threat letters to 23 other major US trading partners—including Canada, Japan, and Brazil—with rates ranging from 20% to 50%. Notably, copper imports would be subjected to a hefty 50% tariff.

Official Responses from the EU and Mexico

Both the EU and Mexico condemned the tariffs as unfair and potentially disruptive, while extending an olive branch for continued dialogue. European Commission President Ursula von der Leyen warned that the tariffs would undermine vital transatlantic supply chains, adversely affecting businesses, consumers, and even patients reliant on steady imports.

Meanwhile, Mexican President Claudia Sheinbaum emphasized sovereignty in her response, underscoring the importance of maintaining a “cool head” amidst tensions and expressing confidence that a deal remains achievable.

Mexico’s Trade Position and Tariff Rate

Interestingly, Mexico faces a slightly lower tariff rate (30%) than Canada (35%), despite the US citing concerns over fentanyl trafficking as a rationale. Trump highlighted ongoing issues with Mexican cartels impacting North America, though statistics show that the vast majority of fentanyl chemicals actually originate from China, and only a small fraction is trafficked through the US-Canada border.

Broader Context: Trump’s Trade Strategy and Economic Impact

This move signals a return to Trump’s assertive trade posture first seen earlier in his presidency, when sweeping tariffs unsettled global markets before being partially rolled back or delayed. Despite the backdrop of a robust US economy and a record-setting stock market, the president appears determined to press forward with his tariff agenda.

Experts note that while the August 1 deadline provides a window for negotiators to forge agreements mitigating these tariffs, Trump’s history suggests possible last-minute reprieves. Still, these tariffs have already generated tens of billions in US government revenue—customs duties surpassed $100 billion in the federal fiscal year through June 2025.

Potential Retaliation and Diplomatic Fallout

- European Parliament trade committee chair Bernd Lange called the tariffs a “slap in the face” and indicated the EU is poised to consider countermeasures promptly.

- Economic analysts warn the tariffs risk triggering a tit-for-tat escalation reminiscent of the US-China trade conflict, which unsettled financial markets worldwide.

- Japan’s Prime Minister Shigeru Ishiba has suggested that the tariff tensions are prompting security and trade diversification conversations among US allies.

- Canada and various European countries are reassessing their strategic dependence on US security and weaponry amid these frictions.

Complexities of the Trade Deficit and Market Access Demands

Trump’s letter to the EU called for the bloc to eliminate its own tariffs to enable “complete, open Market Access” to the US, citing the desire to reduce the large trade deficit. However, the EU remains cautious, negotiating a more balanced approach that safeguards diverse member states’ interests—from Germany’s industrial priorities to France’s insistence on equitable terms.

Looking Ahead: What This Means for Global Trade and US Policy

The unfolding situation highlights the increasingly unpredictable nature of US trade policy under Trump’s leadership. While tariffs can serve as leverage in negotiations, they risk causing long-term damage to transatlantic and North American economic integration.

For US consumers and businesses alike, these tariffs could translate into higher prices and disrupted supply chains. Moreover, the diplomatic strain on some of the nation’s closest allies could have broader geopolitical ramifications, potentially reshaping international partnerships and security alliances.

Expert Insight: Navigating the Trade War Maze

Economists like Jacob Funk Kirkegaard from Brussels-based think tank Bruegel caution that these escalating tariffs are a double-edged sword—while generating immediate revenue, they threaten to provoke retaliatory tariffs that ultimately harm all parties involved. Past US-China tariff cycles showed that while tariffs might temporarily rise and fall together, lasting resolutions require sustained negotiation and trust-building.

Editor’s Note

As President Trump enforces tougher trade measures, the key question is whether this approach will compel meaningful concessions or deepen fractures with vital allies. Observers should watch closely how the EU and Mexico respond—not only economically but diplomatically—as the August 1 deadline looms. Furthermore, this episode spotlights the challenge in balancing national interests with the realities of a closely interconnected global economy. Trade policy today is not just about tariffs; it is about trust, sovereignty, and the future shape of international cooperation.