Trump’s Tariff on India: A Stark Lesson in Geopolitical Irony

On August 7, 2025, the announcement by then-US President Donald Trump to impose a 25% tariff on Indian exports sent shockwaves through international trade circles. The move, designed to penalize India for continuing to purchase Russian oil, ignited widespread debate—not merely about economic repercussions but for the glaring contradictions it illuminated in the US’s own trade policies.

US-Russia Trade Continues Amidst Sanctions

While India was castigated for buying Russian oil, the United States quietly maintained significant imports from Russia. Official US government statistics reveal that in 2024, American trade with Russia still hovered around $5.2 billion. Key imports include $1.3 billion in fertilizers, $878 million in precious metals such as palladium, and $624 million in uranium (USITC, 2025). These imports persist despite Washington’s vocal condemnation of Moscow’s actions in Ukraine.

This dual stance portrays a perplexing paradox: the US accuses India of indirectly funding what it calls “Putin’s war machine,” yet continues its own commercial dealings without similar punitive measures. India's Ministry of External Affairs did not hold back, calling this a “revealing double standard,” particularly as US imports of Russian uranium increased by 28% and fertilizers by 21% in early 2025 compared to the previous year (The Indian Express).

India's Energy Reality vs. US Expectations

India’s energy strategy is rooted less in choice and more in necessity. Traditional Western oil suppliers curtailed exports, redirecting supplies towards Europe amid geopolitical pressures. Faced with growing domestic energy demands, India turned to Russia as a vital alternative—not a profit-driven indulgence.

This context is crucial. As the MEA noted, India’s engagement with Russia’s oil sector emerges from “vital national compulsion,” highlighting the tightrope New Delhi walks between energy security and international diplomacy.

China’s Preferential Treatment Exposes Strategic Calculus

In contrast, China’s import of nearly half of Russia’s oil exports—about 47%—remains largely untouched by immediate tariffs. The US granted China a 90-day tariff reprieve, underscoring a strategic leniency. Beijing’s dominance in essential rare earth elements and electronics components gives it unparalleled leverage over the US economy, which Washington seems reluctant to provoke aggressively.

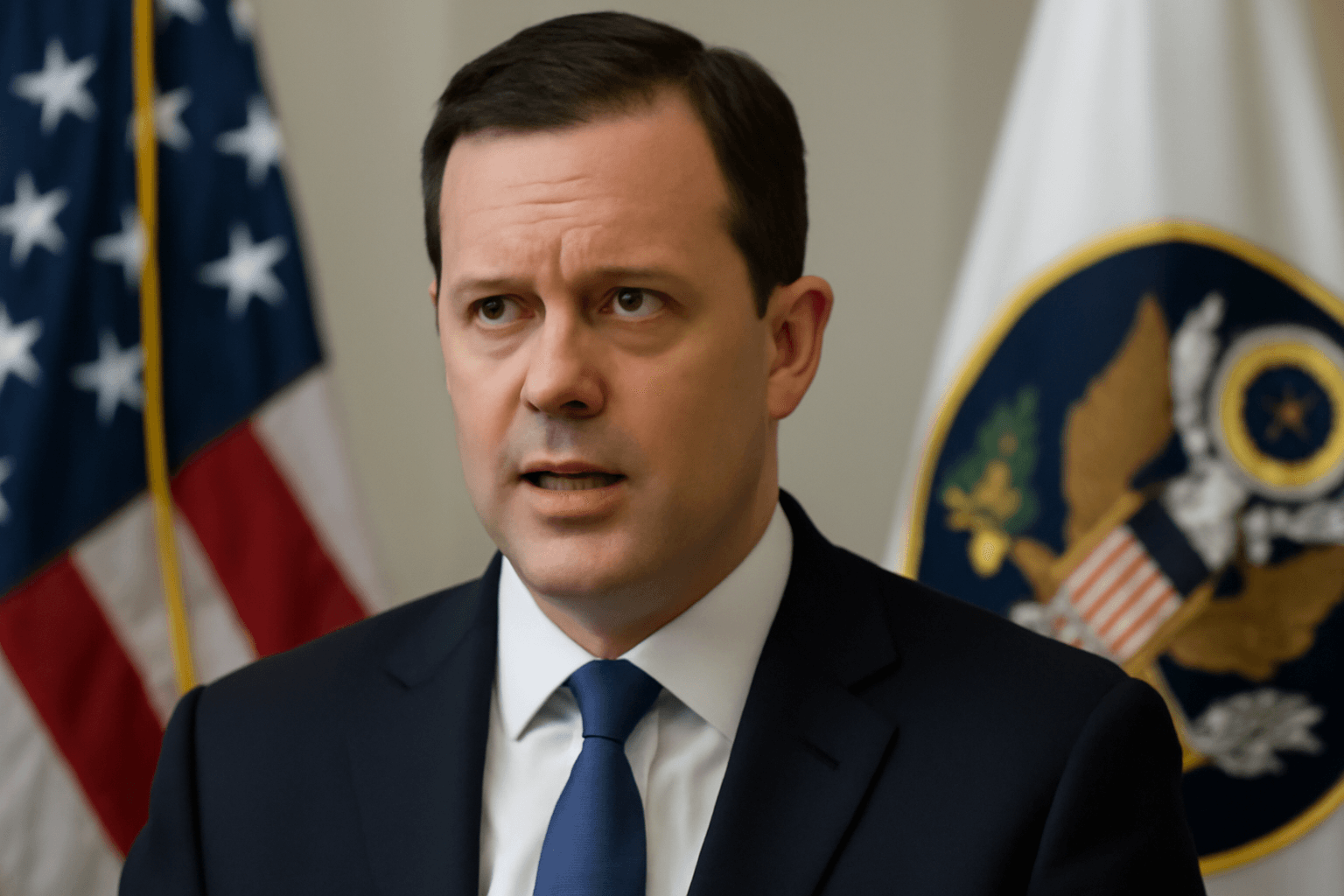

US Treasury Secretary Scott Bessent openly acknowledged this complexity, admitting that the US does not wish to infringe upon China’s sovereignty despite geopolitical tensions. Experts like Scott Kennedy from the Center for Strategic and International Studies interpret China’s strategy as one of calculated patience: “waiting out the storm” while deepening ties with Moscow.

From Targeting China to Penalizing India: The Trade War’s Evolution

Interestingly, Trump initially centered tariffs on China, addressing a colossal trade deficit exceeding $295 billion in 2024. China's goods faced tariffs around 30%, whereas India—whose trade deficit with the US is substantially smaller—is now hit with a heavy 25% tariff primarily over its oil imports.

Trump’s blunt framing accused India of profiting off Russian oil sales and disregarding the humanitarian toll in Ukraine. Yet, on closer inspection, India predominantly uses the imported Russian oil domestically, casting doubt on claims that it profits from reselling.

Examining the Logic Behind Tariff Justifications

The official rationale ties back to US national security concerns: Russia’s ongoing conflict in Ukraine is portrayed as an exceptional threat, and India’s purchases allegedly prolong this threat. However, this logic falters when considering China’s and the EU’s larger Russian oil imports, both of which have faced fewer restrictions.

Moreover, continuing US imports of Russian uranium and other goods while sanctioning India appears inconsistent. Despite Trump’s prior assertion of being able to end the conflict in 24 hours, six months into his campaign cycle saw Putin’s stance unchanged and Ukraine’s tragedy unresolved.

Global South Pushback and Strategic Realignments

Rather than bowing to US pressure, India and China stand firm. Indian Prime Minister Narendra Modi underscored themes of sovereignty and self-reliance, framing the issue within the government's Atmanirbhar Bharat (Self-Reliant India) vision. The Ministry of External Affairs explicitly rejected viewing bilateral ties through a third-party lens, signaling a clear rebuke of external interference.

Similarly, China’s leadership asserts its energy decisions as sovereign rights, positioning itself as a champion of the Global South, pushing back against US-centric policies that many see as overreaching.

BRICS and the Quiet Challenge to Western Economic Order

Both nations’ resistance aligns with the broader geopolitical narrative of BRICS, now expanded to include countries like Egypt, Iran, Ethiopia, and the UAE. The July 2025 BRICS summit in Rio de Janeiro was marked by calls against unilateral trade sanctions and for enhanced sovereign financial cooperation, signaling an emerging counterweight to Western dominance.

Trump’s characterization of BRICS as “anti-US” reflects domestic political anxieties about the group’s potential to undermine dollar hegemony and alternative payment systems like SWIFT.

Uncoordinated but Parallel Defiance

Despite underlying tensions between India and China, the US’s aggressive tariff policies are unintentionally synchronizing an economic pushback. India pursues autonomy; China follows geopolitical strategy. Both converge in resisting economic coercion hidden behind moral imperatives.

Proposals circulating within the US Senate to impose even steeper duties on countries trading with Russia further risk alienating vital partners and diminishing US global influence.

The Limits of Oil as a Leverage Point

Washington’s hope that tariffs might force India away from Russian oil faces significant practical challenges. Over 35% of India’s crude imports come from Russia, supplies that cannot be easily substituted. A rushed withdrawal could disrupt refining capabilities and destabilize supply chains at home.

Moreover, the global oil market remains volatile. Russia could retaliate by cutting pipeline supplies, pushing prices beyond $80 per barrel and hurting Western oil interests.

Conclusion: A Self-Defeating Strategy?

Ultimately, the 25% tariff on India risks being a hollow gesture rather than a strategic masterstroke. It exposes double standards in US policy, overlooks the complexity of energy geopolitics, and inadvertently nudges India and China closer economically and diplomatically.

Efforts aimed at isolating Russia could paradoxically isolate the US from crucial alliances and economic partners in the Indo-Pacific region. In this high-stakes geopolitical chess game, the first casualty may well be irony itself—ironically illustrating the need for nuanced, consistent, and globally mindful policy approaches.

Editor’s Note

This unfolding trade drama underscores critical questions: How should nations balance national security with economic realities? Can tariffs effectively serve geopolitical aims without alienating strategic partners? And what does the emerging BRICS alliance mean for the future global economic landscape?

Understanding these nuances is vital for policymakers and citizens alike as they navigate an increasingly multipolar world.