Trump’s Latest Tariffs Spark Significant Trade Shake-Up

On August 7, 2025, a new chapter in the ever-evolving US trade landscape unfolded as President Donald Trump’s sweeping tariffs officially went into effect, intensifying a trade war that is poised to reshape global economic dynamics. At the stroke of midnight (local time), the United States imposed fresh levies on dozens of countries, signaling a bold push to reclaim economic leverage amid years of complex international trade relations.

Billions Flowing Into US Coffers, Says President Trump

Targeted Tariffs Reflect Strategic Pressure Points

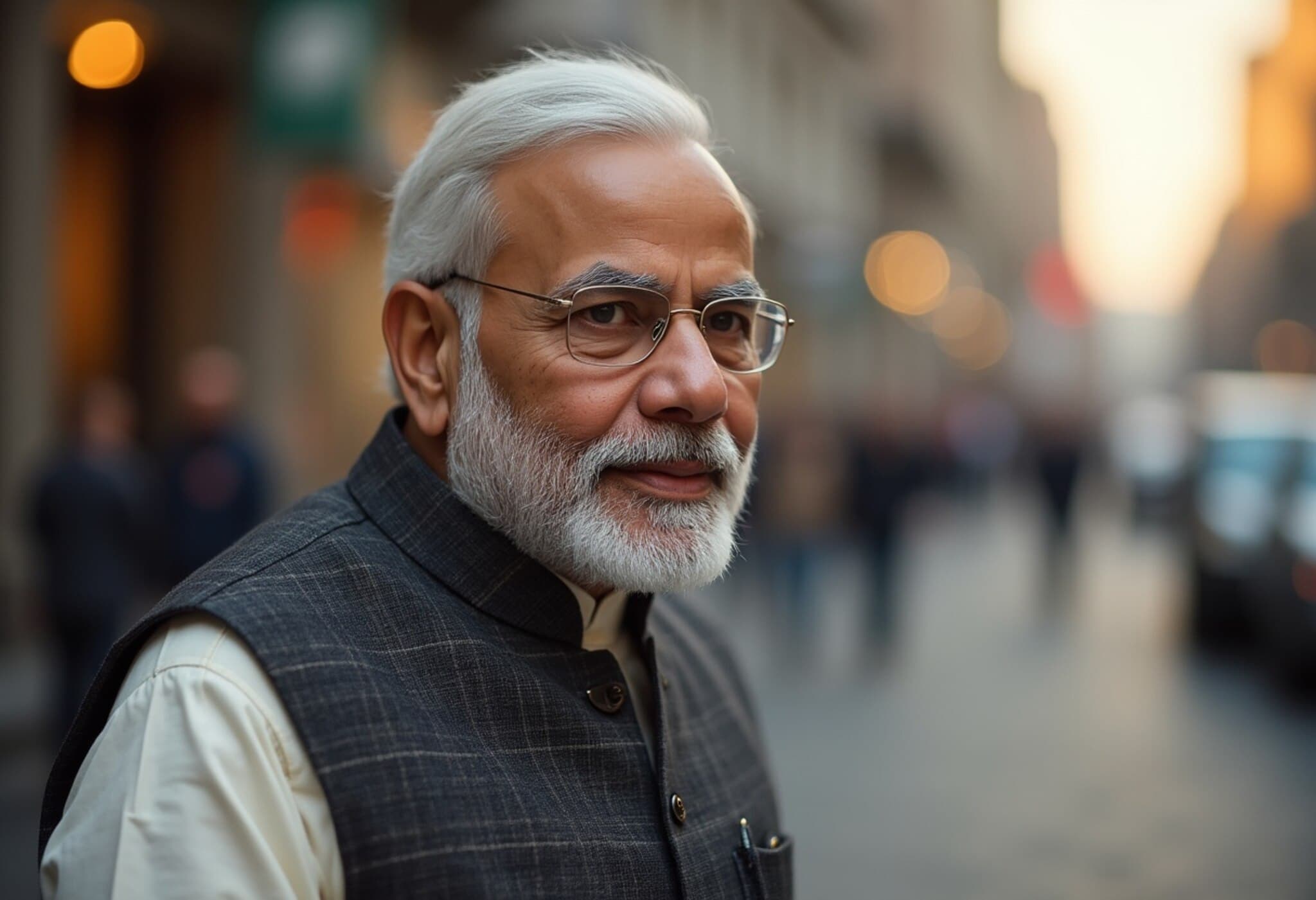

The tariffs cover a sprawling list of nearly 70 countries, with different rates depending on perceived trade imbalances or geopolitical concerns. Notably, certain nations like Laos, Myanmar, and Syria are facing steeper duties. A highly scrutinized move is the announced 50% tariff on India, contingent upon India halting its import of Russian oil by August 27 — a direct indicator of the administration’s effort to influence geopolitical energy flows.

High Stakes for Technology and Manufacturing Sectors

Perhaps the most dramatic signal lies in the tech sector: Trump warned of a possible 100% tariff on imported computer chips to encourage domestic production. This pressure is already bearing fruit, with Apple announcing a landmark $100 billion investment to expand its manufacturing footprint across the US — a clear nod to the administration’s push for reshoring critical industries.

Expert Insight: Economic and Political Implications

Trade analysts view these tariffs through a multidimensional lens. While the immediate influx of tariff revenue may buoy US coffers, concerns linger about retaliatory measures and increased costs for American consumers and manufacturers reliant on global supply chains.

Economist Dr. Anne Kim remarks, “Tariffs are a double-edged sword — they may shore up certain industries short-term but risk escalating tensions that could disrupt broader economic stability.” Moreover, the intertwining of trade with geopolitical issues — particularly the energy sanctions implied by the India tariff — introduces complex diplomatic ripples that extend beyond economics.

Legal and Political Landscape

President Trump framed the tariffs as necessary actions to prevent countries from continuing to “take advantage” of the US. However, he also cautioned that judicial opposition could hinder these policies, referencing what he called “a radical left court” against America’s economic aspirations. This highlights the ongoing tug-of-war between the executive branch’s trade agenda and potential legal challenges that may arise.

Looking Ahead: Key Dates and Uncertainties

- August 27: Deadline for India to respond to the Russian oil import ultimatum before the 50% tariff takes effect.

- Tech Industry Watch: Potential activation of the chip tariff depending on industry compliance and political negotiations.

- Global Trade Relations: Monitoring for retaliatory tariffs or diplomatic responses from affected countries.

What This Means for the American Consumer and Economy

For American consumers and businesses, these tariffs could translate into higher prices on imported goods, potentially fueling inflationary pressures already a concern in recent years. At the same time, the administration aims to stimulate American manufacturing, which advocates argue could generate jobs and technological innovation.

Yet, the balance remains delicate: economic experts urge vigilance about unintended consequences impacting supply chains, corporate investment decisions, and international diplomatic relations.

Editor's Note

President Trump’s tariff implementation marks a pivotal moment in US trade policy — one characterized by assertive protectionism and strategic economic maneuvering. While these measures promise immediate revenue boosts and a platform for “Made in America” advocacy, the broader impacts on global trade dynamics, consumer costs, and diplomatic relations remain deeply uncertain.

As the August 27 deadline approaches, the world watches closely to see whether India alters its energy purchases and how the technology sector adapts under mounting pressure. This evolving situation invites critical questions about the future of globalization and America’s place within it.