US House Approves Trump’s Remittance Tax Impacting Indian Diaspora

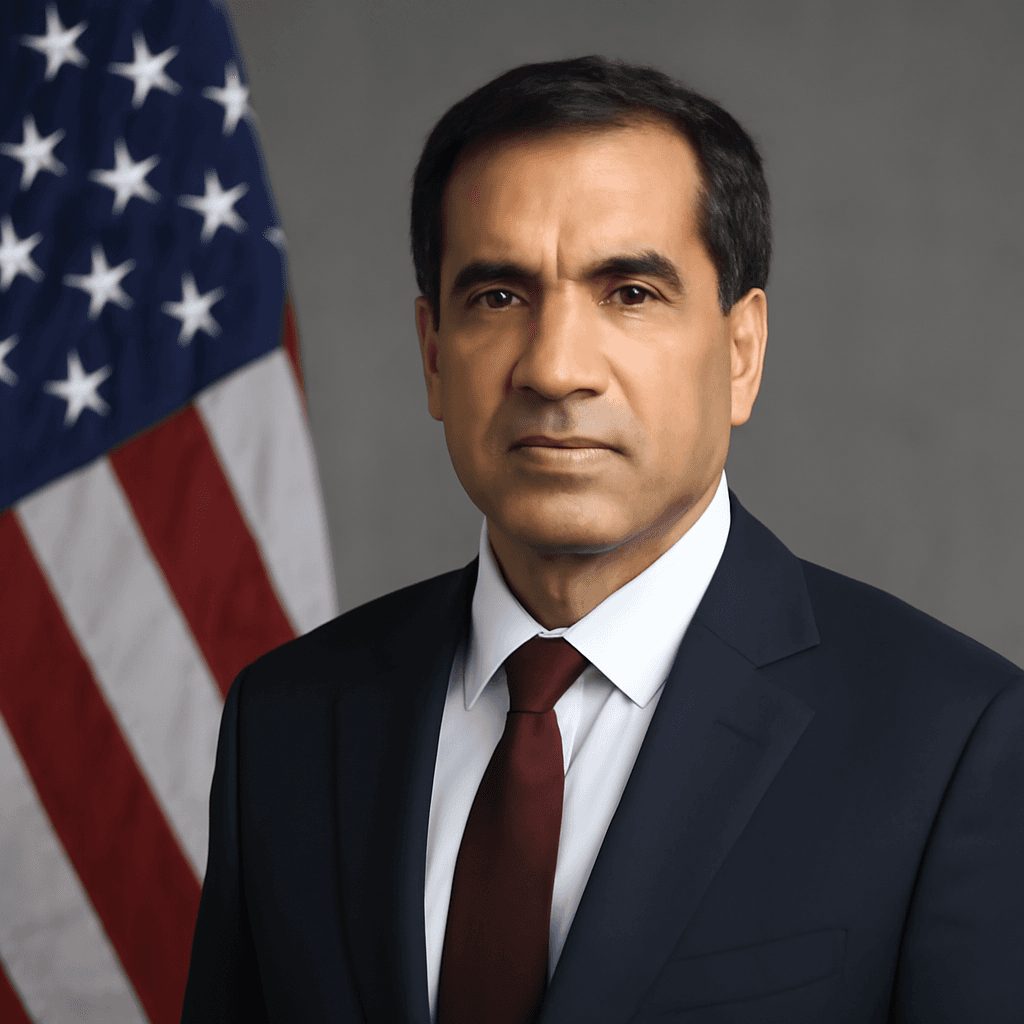

On May 22, 2025, the US House of Representatives narrowly passed the "One Big Beautiful Bill," a legislative package initiated by former President Donald Trump. A notable provision includes a 3.5% excise tax on remittances sent abroad by non-US citizens and non-nationals, set to take effect from January 1, 2026, pending Senate approval.

This tax targets individuals holding H1B, L1, and F1 visas, as well as Green Card holders, who send money overseas. For example, a $1,000 transaction to India would incur a $35 tax deducted from the amount received. Importantly, this excise tax is not creditable against existing federal or state taxes, representing an additional financial burden.

Potential Economic Impact on India

India remains the largest global recipient of remittances, receiving approximately $129 billion in 2024. According to World Bank data, 28% of these remittances originated from the US. Analysts from the Global Trade Research Initiative (GTRI) estimate the proposed tax could reduce remittance flows to India by 10-15%, resulting in an annual loss between $12 billion and $18 billion.

Broader Consequences for Indian Nationals and US-India Relations

Alongside the remittance tax, the US administration has enacted stricter immigration policies, including tighter international student admissions and more rigorous work visa requirements. These measures have led many Indian nationals to reconsider their education and employment opportunities in the United States.

The combination of these policies, coupled with contentious remarks by President Trump regarding India-Pakistan tensions, has strained diplomatic relations. Trump claimed credit for mediating a ceasefire between the two nations, a position disputed by Indian officials who assert that the agreement resulted from direct bilateral military communications.

These developments risk undermining long-term bilateral cooperation, potentially impacting trade negotiations and diplomatic trust between India and the US.

Reported with agency inputs.