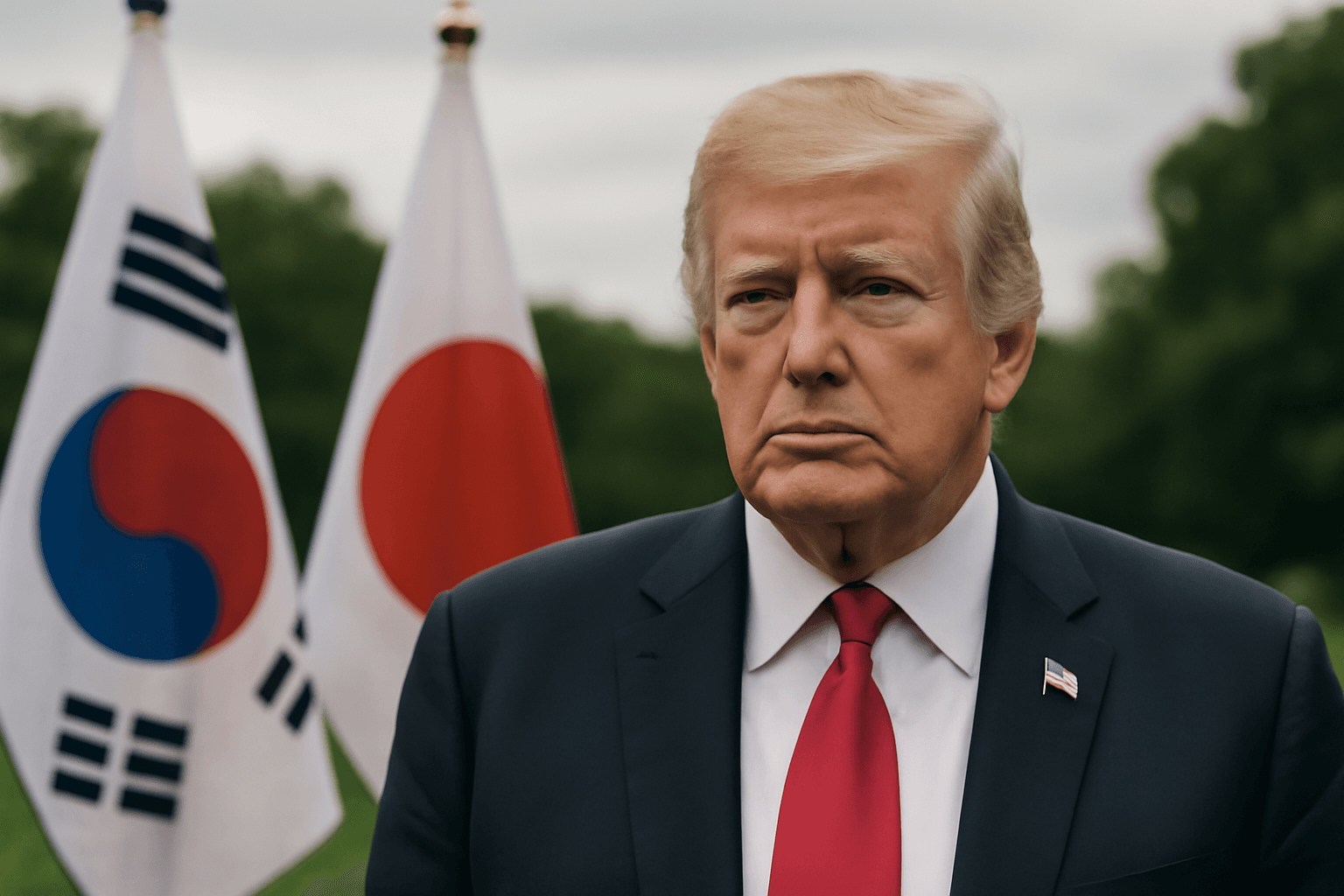

Trump Escalates Tariff Pressure on Key U.S. Asian Allies

In a move that has sent ripples through global markets, U.S. President Donald Trump has announced intensified tariffs targeting South Korea and Japan—two of America's closest economic allies in Asia. While South Korea faces the previously promised 25% tariff on imports, Japan’s tariff rate has notably increased by one percentage point to 25%, signaling a firm stance on U.S. trade policy as new tariffs are set to take effect starting August 1, 2025.

Economic Context: Slowing Growth Amid Rising Trade Barriers

Both Japan and South Korea have recently grappled with contracting economic growth, with first-quarter GDP figures showing quarter-on-quarter declines. Japan, in particular, teeters on the brink of a technical recession, a condition marked by two consecutive quarters of economic contraction. Against this backdrop, the introduction of additional tariffs threatens to exacerbate an already fragile economic environment.

The Tariffs in Detail

- Automobiles and auto parts: Currently subject to a 25% tariff on imports into the U.S.

- Steel and aluminum: Face a steep 50% levy from most countries.

Automobiles represent Japan’s largest export sector to the United States and hold significant economic weight for South Korea as well—making these tariffs particularly impactful. In 2024, South Korea ranked as a top exporter of automotive products to the U.S., highlighting the potential economic fallout.

Nation Leaders and Economic Experts Weigh In

Japanese Prime Minister Shigeru Ishiba has voiced his government’s cautious approach, emphasizing Japan’s intent to secure a mutually beneficial agreement that also safeguards national interests. Ishiba underscored Japan’s firm stance against any deal that fails to eliminate these auto-related tariffs.

Adding analytical depth, Norihiro Yamaguchi, Lead Japan Economist at Oxford Economics, warns that the additional tariffs could trim Japan’s GDP by 0.1 percentage point by the end of 2026. He stresses that the combined effect of tariffs, global trade uncertainties, and weak domestic consumption “should not be underestimated.” Yamaguchi predicts negligible growth in the latter half of 2025 through mid-2026, with recession remaining a tangible risk.

Trade Volumes and Economic Stakes

- The United States remains Japan’s largest export market, accounting for significant trade volumes in 2024.

- For South Korea, the U.S. stood as the second-largest export destination the same year.

Reflecting these challenges, the Bank of Korea has sharply revised down its GDP growth projection for 2025 from 1.5% to 0.8%, attributing the downgrade to delayed domestic demand recovery and expected sluggish export growth amid tariff pressures.

Frederic Neumann, HSBC’s Chief Asia Economist, candidly describes the tariffs as presenting “considerable headwinds” to both countries’ growth, especially if negotiations fail to produce relief. Both South Korea and Japan are currently contending with weak domestic demand, compounding the difficulties posed by trade tensions.

Diplomacy and Market Reactions: A Complex Landscape

Despite the escalation, President Trump has offered a tentative olive branch, signaling openness to adjusting tariff rates if Japan and South Korea are willing to liberalize their markets and reduce barriers to U.S. exports. This strategic pressure reflects a broader U.S. agenda to recalibrate trade relationships more favorably.

Vishnu Varathan, managing director at Mizuho Securities, interprets Trump’s actions as an expression of frustration with the stalled negotiations, particularly influenced by Japan’s principled and comprehensive approach to tariff talks. While South Korea has faced less public scrutiny from the president, Varathan indicates possible similar sticking points may justify the inclusion of South Korea in the tariff letters.

Meanwhile, financial markets appear undeterred for now. According to Neumann, investors view the tariff announcements as essentially a postponement of final decisions, with room for negotiation to potentially soften or rescind the tariffs.

Looking Ahead: What Lies on the Horizon?

The introduction of these tariffs adds another layer of complexity to already strained U.S.-Asia trade relations. The critical question remains whether diplomatic negotiations can overcome these tensions without inflicting long-term damage on economic ties that have been built over decades. Both Japan and South Korea face navigating a delicate balance between protecting national industries and responding to U.S. trade policies that reflect a more protectionist approach.

Key Takeaways:

- Economic Vulnerability: South Korea and Japan’s economies are sensitive to disruptions in trade, especially in autos and steel.

- Policy Leverage: Tariffs are being used as bargaining tools, but with considerable risk to growth.

- Potential for Negotiation: President Trump’s remarks suggest flexibility if market access improves.

- Market Resilience: Investors are cautiously optimistic, awaiting clarity on final outcomes.

Editor’s Note

The latest tariff moves by the U.S. administration underscore a shifting paradigm in global trade diplomacy, where long-standing alliances are intersecting with assertive economic nationalism. For policymakers and economists, this situation raises essential questions: How can countries balance sovereign economic interests with global cooperation? And, crucially, what safeguards exist to protect economies vulnerable to the domino effect of such trade disputes? Observing how Japan and South Korea navigate these turbulent waters will offer critical insights into the future contours of international trade in an increasingly fractious geopolitical climate.