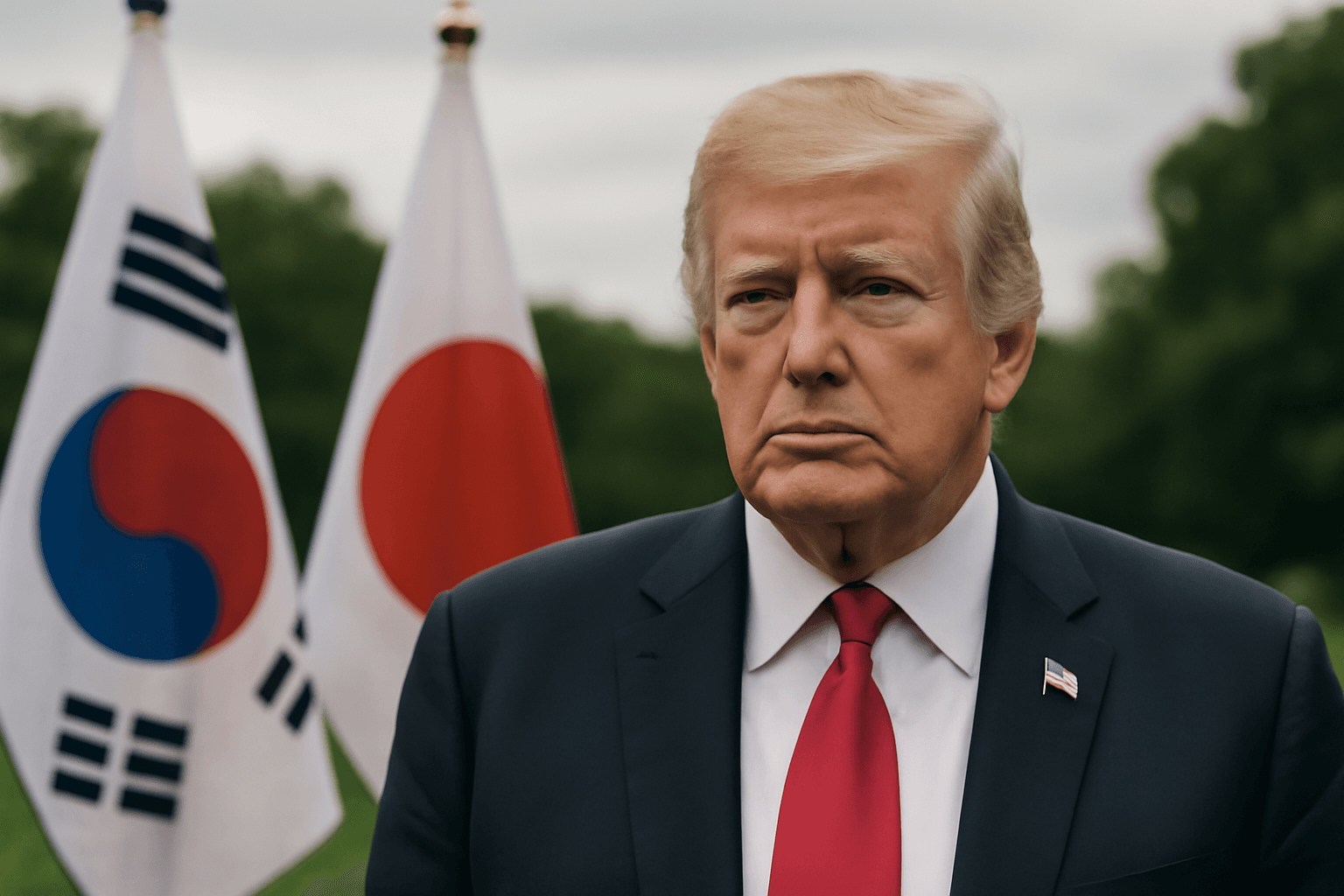

Trump’s Weekend Tariff Announcement Sends Ripple Through Global Markets

In an unexpected move over the weekend, U.S. President Donald Trump imposed hefty 30% tariffs on imports from the European Union and Mexico, stirring fresh waves of uncertainty in international trade and financial markets. Announced via social media on Saturday, these tariffs took effect Monday, sharply escalating trade tensions just as global economies grapple with inflation and supply chain disruptions.

A Strategic Timing or Tactical Jolt?

The timing of Trump’s announcement raised eyebrows. Typically, major trade policy shifts are disclosed during market hours, facilitating immediate market reactions. Instead, by posting tariff letters on a Saturday, Trump avoided instantaneous trading turmoil. Speculation suggests this choice could be a calculated move to blunt immediate market backlash or a deliberate provocation toward European leaders, for whom weekend work culture is often sacrosanct.

Such disruption not only rattles traders but also European policymakers, including European Commission President Ursula von der Leyen, who has long advocated for firm responses against U.S. protectionism.

Market Reactions and Economic Implications

- U.S. stock futures declined Sunday evening, reflecting investor caution ahead of Monday's opening. The S&P 500 had ended Friday down for the week, showing signs of vulnerability to ongoing trade tensions.

- European firms brace for impact as the tariffs are projected to depress earnings per share in the second quarter, according to research by LSEG. Industries with deep supply chain ties to the U.S. are expected to experience pronounced cost pressures.

- China’s exports defy expectations with a robust 6.5% growth in June measured in U.S. dollar terms, outperforming estimates and signaling China's resilience amid global trade headwinds.

Insights from Industry Leaders

Adding nuance to the trade conversation, Nvidia CEO Jensen Huang reassured markets that Chinese military entities will not access Nvidia’s cutting-edge chips, addressing concerns over technology transfer amid U.S.-China geopolitical friction. This underscores the complexities of balancing national security with global commercial interests.

Underreported Angle: Norway’s Unique Electric Vehicle Market Strategy

Beyond tariffs and trade disputes, a quieter narrative unfolds in Norway, where Chinese electric vehicle (EV) brands have steadily captured nearly 10% of market share without facing import tariffs. This contrasts starkly with the U.S. and EU, which impose duties to shield domestic automakers. Norway’s open-door stance on Chinese EVs exemplifies how tariff policy shapes consumer choices and international business strategies in the green economy.

What This Means for the Future

Trump’s tariffs amplify the ongoing debate about the role of protectionism in a deeply interconnected global economy. While intended to shield domestic industries, such tariffs risk retaliatory measures, supply chain fragmentation, and higher prices for consumers.

Financial markets, always sensitive to policy uncertainty, are watching closely. The juxtaposition of rising Chinese export performance and tightening U.S. trade restrictions highlights a pivotal moment where economic diplomacy and strategic interests intersect.

Editor’s Note

As the global economy stands at the crossroads of escalating trade barriers and technological rivalry, the implications of these tariffs extend beyond immediate market moves. Readers should consider how protectionist policies may reshape supply chains, corporate strategies, and international relations in lasting ways. Will such measures foster domestic growth, or could they inadvertently stifle innovation and economic collaboration? Staying informed and critical about these developments remains crucial.