US-Russia Trade Grows Despite Sanctions and Political Frictions

In a surprising development that exposes the complexities and contradictions of global trade policies, US imports from Russia surged by 23% in the first five months of 2025. This rise stands in stark contrast to the recent harsh rhetoric from Washington, particularly from former President Donald Trump, who has threatened India with tariffs over its oil purchases from Russia.

Key Commodities Driving the Increase

Data from the US International Trade Commission reveals that the United States imported about $2.1 billion worth of goods from Russia between January and May 2025. This boom is largely fueled by critical commodities including:

- Uranium: Imports jumped 28% year-over-year to $596 million, an increase of nearly 150% compared to the same period in 2021.

- Fertilizers: These saw a 21% increase to $806 million, up 60% from 2021.

- Palladium: Essential for vehicle emissions controls, imports remain robust with $878 million imported in 2024.

Although the US officially banned enriched uranium imports from Russia in 2024, companies are allowed to request waivers through 2028, helping to sustain this trade flow.

Context: The Post-Ukraine War Trade Landscape

Following Russia’s invasion of Ukraine in early 2022, US imports from Russia plummeted dramatically — from $30 billion in 2021 to just $3 billion by 2024. This collapse was largely due to sanctions focusing on Russian crude oil, which once accounted for over $17 billion in US imports and has now virtually disappeared from the US market.

Despite this, imports of vital raw materials like uranium and palladium have continued, reflecting the intertwined nature of global supply chains that are difficult to sever without economic repercussions.

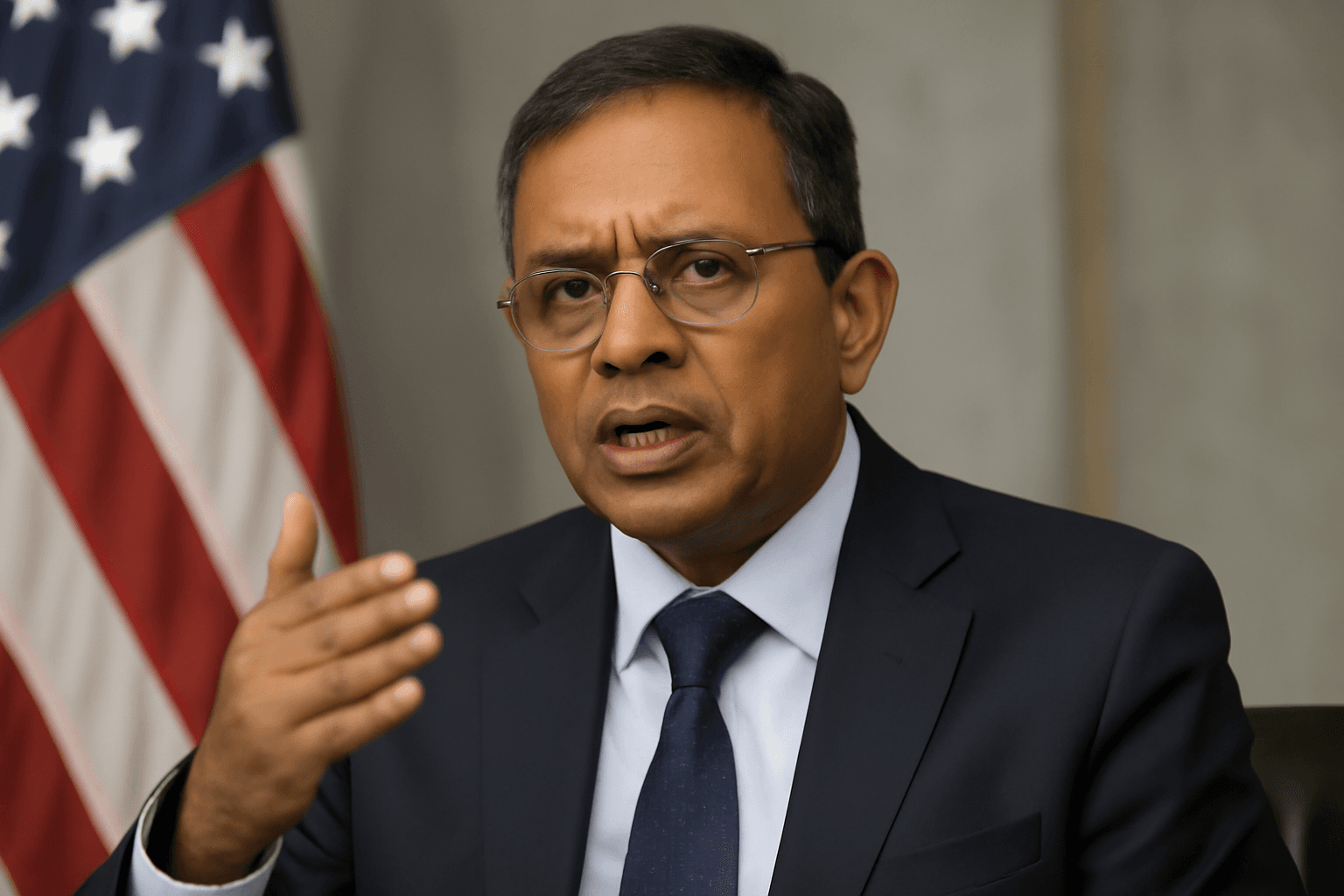

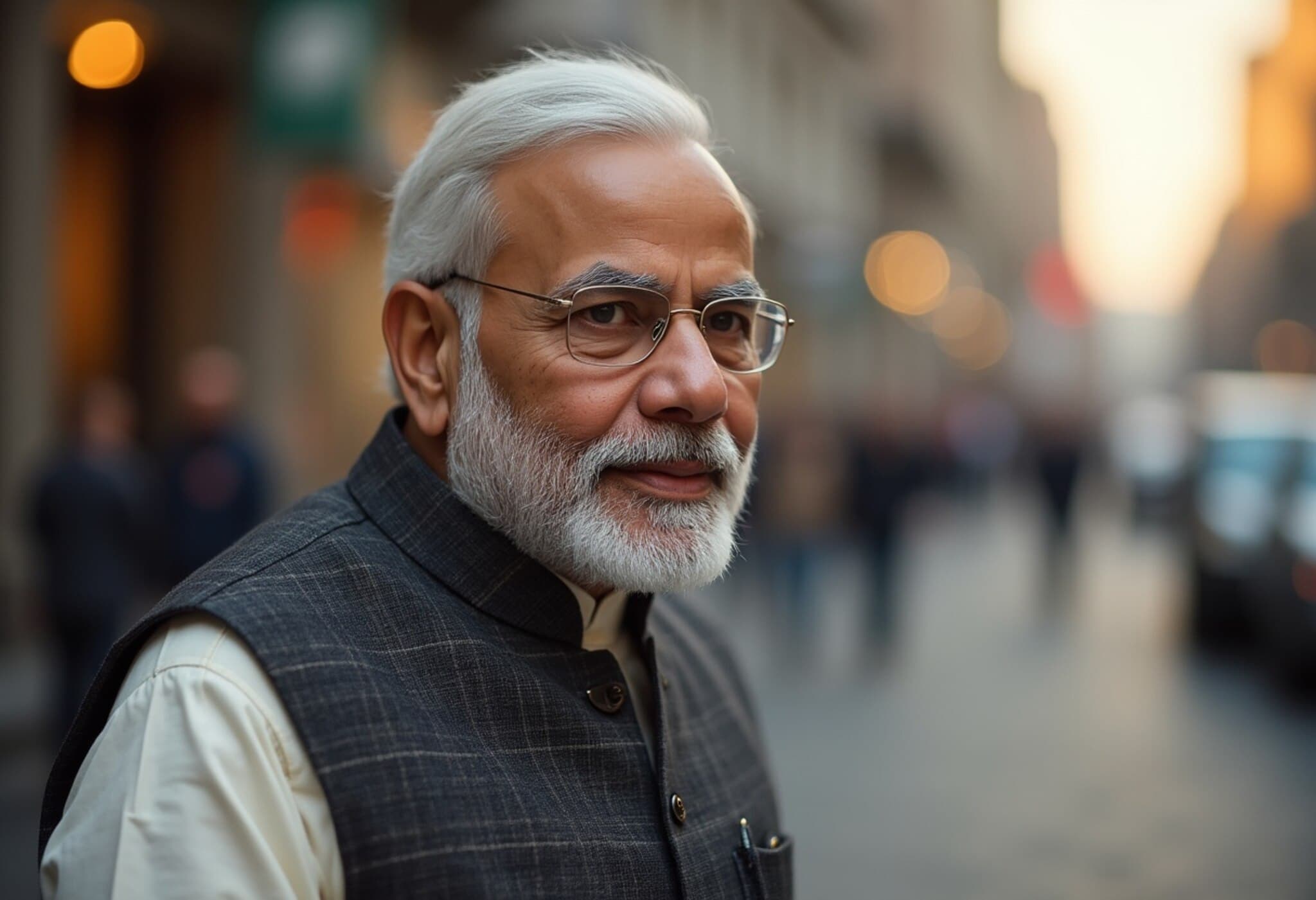

India Challenges US Hypocrisy Amid Tariff Threats

The US government, particularly under Donald Trump’s vocal approach, has repeatedly criticized India for increasing its energy and defense ties with Russia, threatening tariffs on Indian goods as a response. However, India’s Ministry of External Affairs has fired back, highlighting the perceived double standard in US policy:

“The US continues to import uranium, palladium, and fertilisers from Russia even as it criticizes us. India’s oil imports are based on economic necessity, not political preference.”

The MEA also pointed out that many Western countries, including the European Union, maintain robust trade with Russia. Notably, the EU’s trade in goods and services with Russia reached €84.7 billion in 2024, with record imports of Russian liquefied natural gas (LNG) exceeding pre-war levels.

This puts the spotlight on a persistent global dilemma: political commitments versus economic realities.

Implications and Broader Perspectives

Experts argue that this situation reveals the challenges faced by nations trying to balance geopolitical allegiances with practical economic needs. The US’s sustained imports of strategic materials from Russia underpin critical sectors such as nuclear energy and automotive manufacturing.

For policymakers, a key question emerges: How can economic dependencies on geopolitically contentious partners be managed or reduced while maintaining industry stability and national security?

Furthermore, the accusations exchanged between the US and India highlight the ongoing struggle among major powers to enforce sanctions uniformly without compromising their own commercial interests.

Looking Ahead

As the global trade environment continues to shift under political pressures and supply chain disruptions, transparency and consistency in trade policies become more vital. The US and its allies face the challenge of addressing not just the external behaviors of partners like India but also reflecting on their own trade practices.

Editor’s Note:

This evolving story is more than just a tale of rising import numbers; it is a lens into the tangled web of modern global trade where economic necessity often clashes with political posturing. Readers should consider how these dynamics affect international diplomacy and the future of trade sanctions. Are global powers prepared to reconcile these contradictions for a more coherent and equitable policy framework?