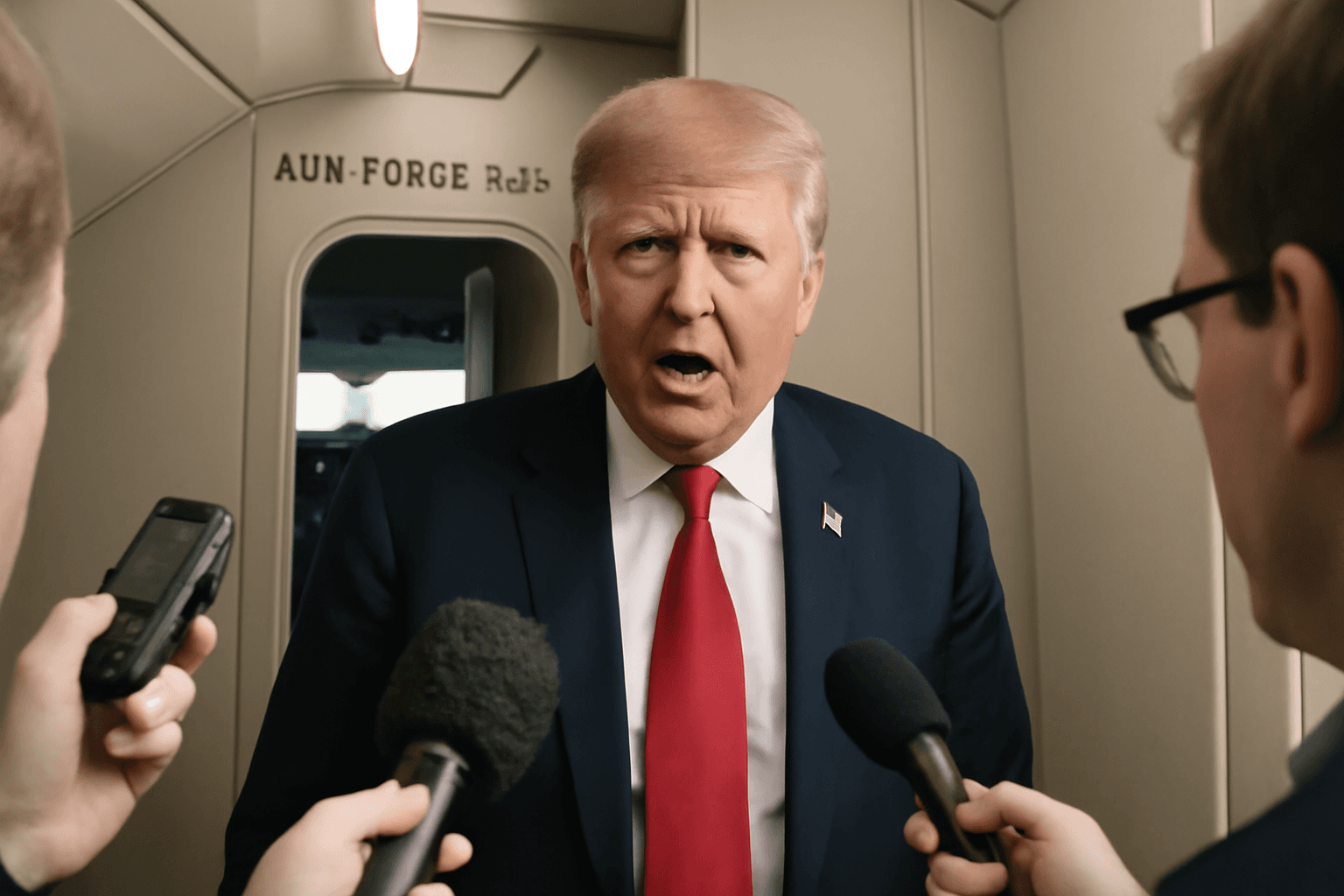

Trump's 50% Tariffs on India Spark US Policy Confusion

In an unexpected policy move, former President Donald Trump slapped a hefty 50% tariff on India, targeting its purchase and refining of Russian oil. Curiously, China—who buys significantly more Russian oil—has been spared such trade penalties. This contradictory stance has left observers in the United States and abroad puzzling over the rationale behind this selective economic sanctioning.

Conflicting Narratives from Top US Officials

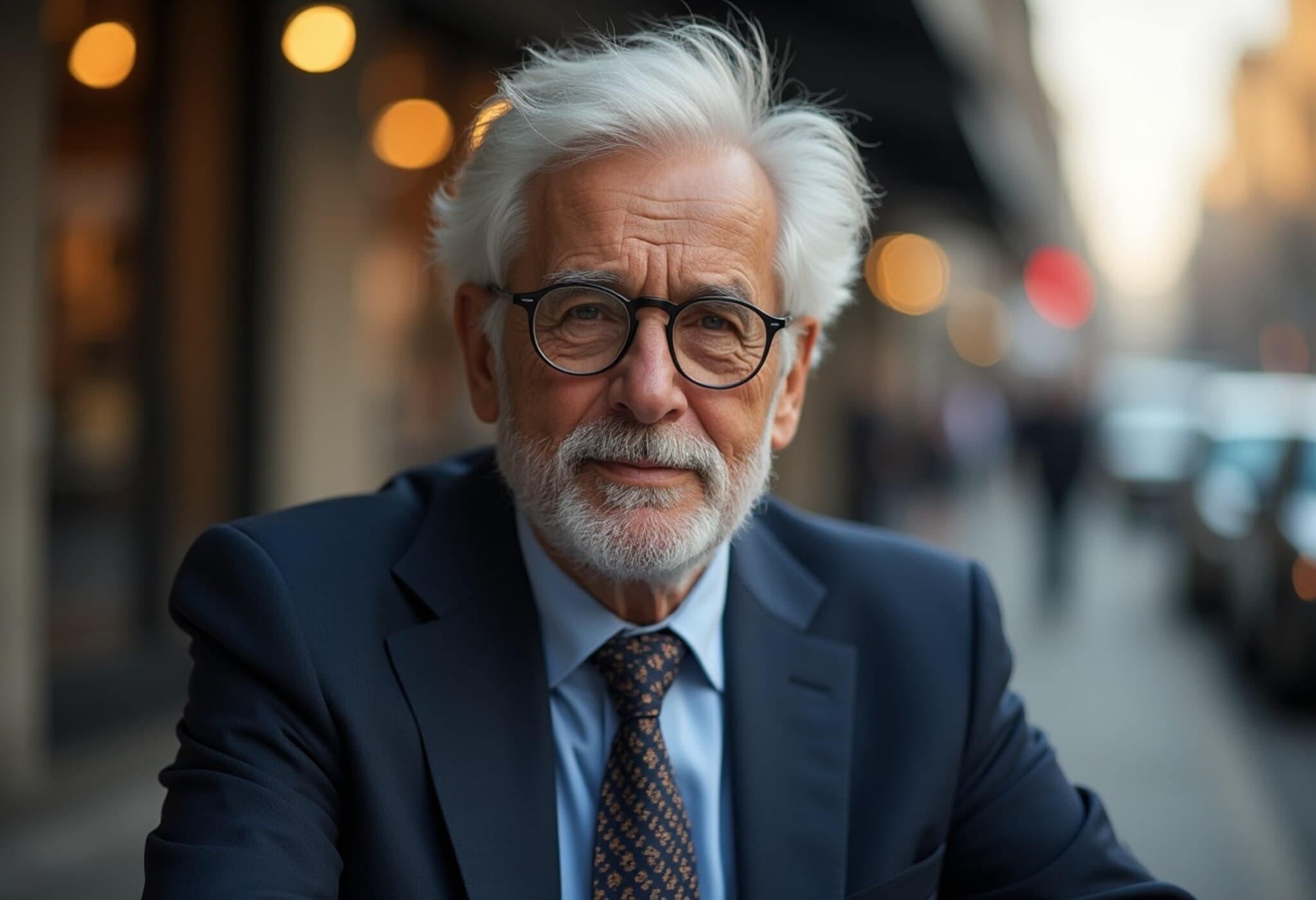

The confusion deepens with contrasting statements from senior US officials. Treasury Secretary Scott Bessent accused India of engaging in what he termed the "Indian arbitrage"—buying discounted Russian crude oil, refining it, and then selling refined products at a profit on the international market. He estimated India made $16 billion in “excess profits” from this practice, justifying the punitive tariffs.

Meanwhile, Secretary of State Marco Rubio offered an almost diametrically opposed read. He acknowledged that China performs similar refining and reselling operations but argued that China’s actions help stabilize the global oil market by keeping prices in check. Rubio stated this as the rationale for exempting China from tariffs, despite its larger volume of Russian oil imports.

Oil Market Dynamics and the Contradiction

At the core lies the complex global oil supply dynamic. Both India and China absorb significant shares of Russian oil exports, refining crude and offering competitive prices in global markets. This process arguably helps prevent sharp spikes in global energy prices. Yet, while Bessent heralds India’s refining as a reason for sanctions, Rubio cites the very same activity for China as a reason to avoid them, raising the question of consistent US policy doctrine.

Following this logic, either both nations should face tariffs, or neither should. The current contradictory stance suggests other geopolitical factors might be driving these economic decisions.

Context: US Energy Policy and Geopolitical Calculations

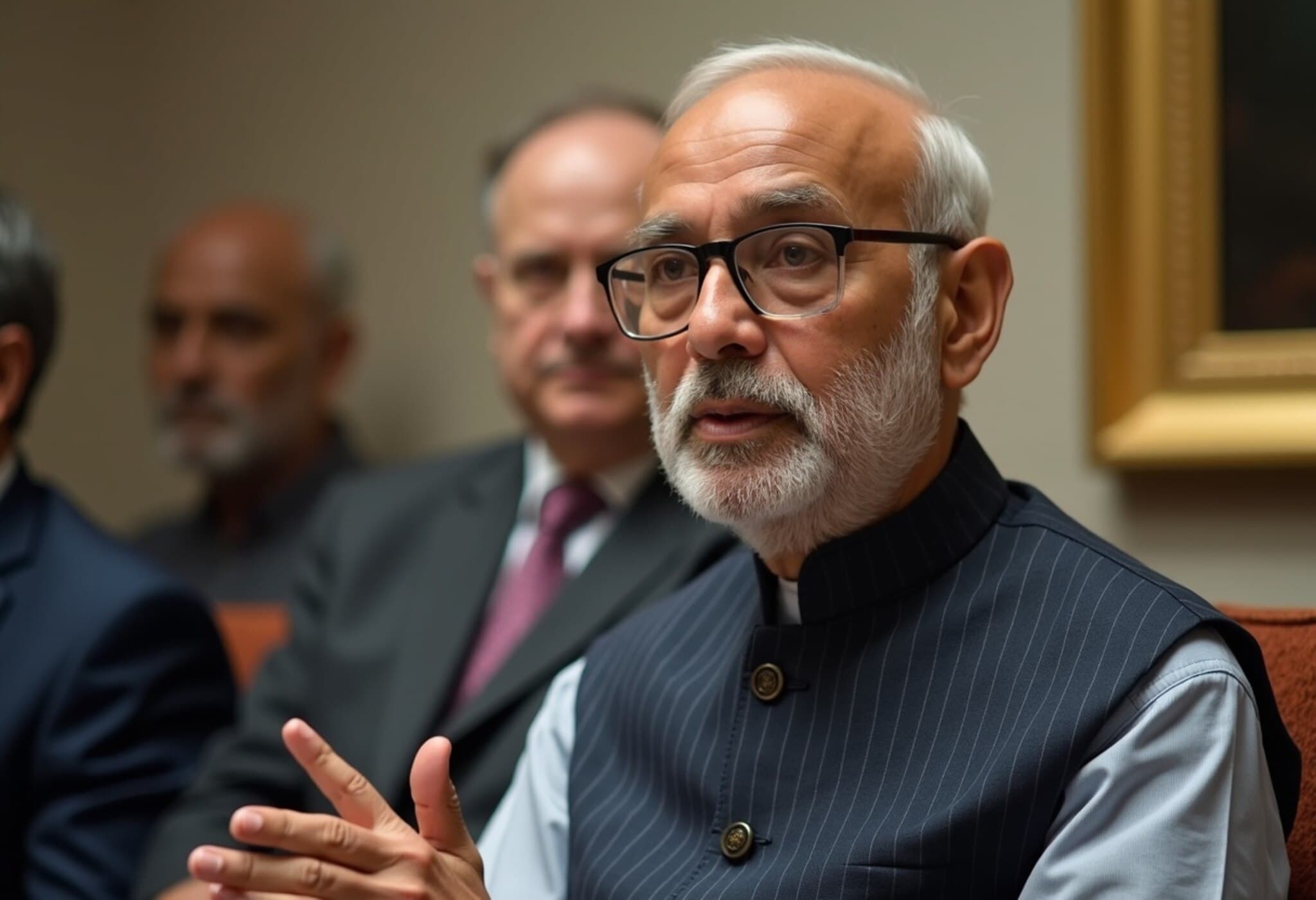

The Biden administration’s approach contrasts sharply with Trump’s recent actions. Earlier, the US government encouraged India to purchase Russian crude to mitigate global oil price surges after Russia’s invasion of Ukraine. Indian cooperation was integral to the Western price cap sanction mechanism designed to limit Russia’s oil revenue.

Bob McNally, President of Rapidan Energy, emphasized India’s role during this period, noting that Washington saw Indian oil purchases as a stabilizing influence on the global market.

However, Trump’s recent tariffs align with a broader strategy of economic confrontation with India, despite his acknowledged alignment with China. This includes economic pressure and alliances with countries opposing Indian regional interests, marking a sharp departure from previous bipartisan US efforts to maintain a balanced relationship with India.

Expert Insights: What Lies Beneath the Tariffs?

Trade experts suggest that the selective tariff imposition may reflect underlying geopolitical agendas rather than purely economic justifications. India’s growing strategic autonomy, its deepening ties with Western democracies, and its stance on Russia might be factors provoking punitive measures disguised as trade policy.

Conversely, China’s indispensable global economic clout and integral position in supply chains might shield it from similar penalties, despite comparable behavior in sourcing Russian oil.

Energy analysts warn that such inconsistent policies could undermine US credibility and complicate energy market dynamics, raising costs for consumers and shaking investor confidence.

Looking Ahead: Questions for US Policy and Global Energy Markets

- Can the US reconcile these contradictions to establish a coherent and fair trade policy vis-à-vis India and China?

- How might these tariffs influence India’s energy sourcing decisions and geopolitical alignment?

- What are the broader implications for the global effort to apply sanctions on Russia without destabilizing oil markets?

Editor’s Note

The US imposition of steep tariffs on India, while sparing China despite similar behavior, signals a tangled web of economic policy fused with geopolitical rivalry. This inconsistency prompts a reevaluation of American trade and foreign policy coherence in an era where energy security, global alliances, and economic interests intersect more than ever. For policymakers and market watchers alike, the unfolding saga raises essential questions about the future of US-India relations and the credibility of America’s stance on global energy and sanctions regimes.