US Tariffs Surge to Highest Level in a Century, Roiling Global Trade

In an unexpected move reshaping international trade dynamics, the United States has dramatically increased import tariffs, with rates now climbing to historic levels unseen in a hundred years. These tariffs, enacted under President Donald Trump’s administration, are jolting businesses worldwide as countries scramble to evaluate their fallout.

Tariff Hikes: A Sharp Spike From 2.5% to Over 10-50%

Since January 2025, the average US import duty has skyrocketed from a modest 2.5% to between 10% and 50% on products from countries lacking updated trade agreements with Washington. The US Customs and Border Protection (CBP) began enforcing these new duties immediately, signaling a tough stance aimed at recalibrating America’s trade balance.

President Trump has repeatedly framed these tariffs as essential to reviving US manufacturing and protecting domestic workers, though critics warn of inflationary pressures and strained international relations.

India: Struggling Under a 25% Tariff and Potential Penalties

India finds itself confronting a steep 25% tariff on a broad array of exports, with additional unspecified penalties looming over its continued purchases of Russian oil. Indian exporters, such as Aurobindo Nayak of CI Ltd—a major tea exporter—express concern over the impact on premium teas like Assam and Darjeeling, prized by American consumers.

“American consumers will ultimately shoulder the cost,” Nayak remarked, highlighting how tariffs distort market prices and can stifle demand.

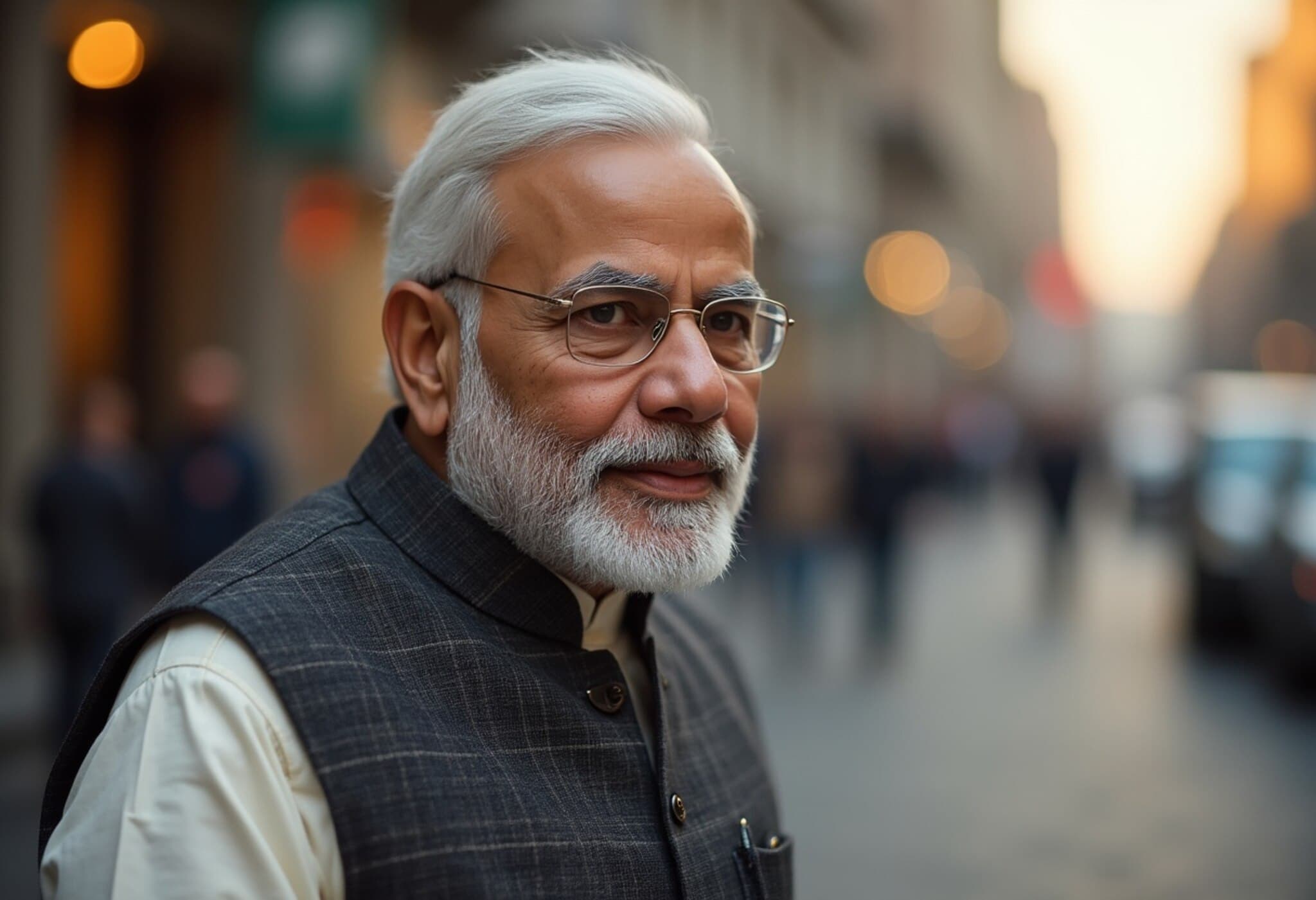

Prime Minister Narendra Modi has assured that farmer interests remain a top priority amid these trade tensions, underscoring India's commitment to safeguarding its agricultural sector.

Thailand’s Negotiated Discount vs. Laos’ Heavy Burden

Thailand managed to negotiate its tariff drop from an anticipated 36% to a more manageable 19%. This reduction is seen by industry leaders, like Richard Han of Hana Microelectronics, as a tax Americans will bear rather than an immediate supply chain disruption.

Meanwhile, Laos faces one of the harshest increases — a staggering 40% tariff. Xaybandith Rasphone, vice-president of Laos’ national chamber of commerce, warns that nearly 60 companies employing close to 60,000 people could see severe repercussions, including indirect job losses. This stark disparity reveals how tariff policies unevenly impact regional economies.

North America: Mixed Outcomes for Canada and Mexico

Canada’s tariffs rose from 25% to 35%, although many goods remain exempt under the United States–Mexico–Canada Agreement (USMCA). However, escalating costs for raw materials like steel and aluminum threaten to push up production expenses, as noted by David Hope from Hope Aero.

Mexico, benefiting from a 90-day reprieve, has bought crucial time to negotiate and avert immediate tariff hikes. Jaime Chamberlain, a major importer of Mexican produce, emphasized the delicate nature of negotiations and the risk to farmers who rely on export markets.

Europe: EU Faces Moderate Hike, Switzerland Takes a Hard Hit

The European Union achieved a tariff ceiling at 15%, up from 4.8%, a compromise some industry experts decry as a “surrender.” The Italian Institute of International Political Studies forecasts a GDP drop of 0.2%, with agriculture, pharmaceuticals, and automotive sectors bearing the brunt.

Switzerland, in contrast, was blindsided by a sharp increase to an unprecedented 39%. Despite last-minute talks, Swiss authorities failed to secure a lower cap, which has sparked concern among industries and calls for assertive diplomatic action against what’s viewed as protectionism.

Brazil’s Drastic 50% Tariff and Broad Ripple Effects

Accused by President Trump of unfair treatment of US tech firms, Brazil faces an aggressive tariff surge from 10% to 50%. Although some products like orange juice and aircraft remain exempt, Brazil’s coffee exporters warn of potential price hikes for American consumers and the challenge of redirecting 8.1 million tonnes of coffee exports typically destined for the US.

A Broader Picture: Global Tensions and Strategic Responses

This latest round of tariffs is part of President Trump’s broader strategy, which includes proposals for 100% duties on semiconductors. Meanwhile, China faces possible tariff hikes in August unless diplomatic progress is achieved.

Notably, some affected nations such as India, China, and Brazil are exploring a coordinated response through the BRICS coalition, highlighting the shifting alliances and complexities within global trade politics.

Expert Commentary: Economic and Policy Implications

- Inflation Risks: Tariffs act like a hidden tax on consumers, often fueling inflation rather than protecting domestic jobs.

- Supply Chain Disruption: Manufacturers dependent on global inputs may face cost increases and sourcing challenges, weakening competitiveness.

- Diplomatic Fallout: Trade tensions risk escalating into broader geopolitical conflicts, impacting international cooperation.

- Policy Dilemmas: While intended to protect industries, tariffs frequently trigger retaliations, calling for nuanced trade negotiations rather than unilateral actions.

Looking Ahead: What This Means for Businesses and Consumers

Businesses worldwide must now grapple with uncertain costs and shifting markets, while consumers could face higher prices on everyday goods—from coffee to electronics. The evolving landscape underscores the importance of adaptive strategies, cross-border dialogue, and economic resilience.

The recent surge in US tariffs represents more than just numbers on paper—it signals a fundamental recalibration of global trade relationships. While intended to boost domestic industry, the real question is whether these protectionist measures might backfire, sparking inflation and supply issues that ultimately hurt American consumers and international partners alike. As nations respond—some with negotiations, others with retaliations—the path forward hinges on thoughtful diplomacy and balanced economic policies. Readers should consider how these developments may affect their local economies and global markets in the months ahead.