India Pushes Back Against U.S. and EU Criticism on Russian Oil Imports

India has publicly contested accusations from the United States and the European Union concerning its ongoing imports of Russian oil, following a stark warning from former U.S. President Donald Trump about imposing significantly higher tariffs on Indian goods. This latest diplomatic friction highlights the complex global dynamics arising from energy security, geopolitics, and trade sanctions in the wake of the Russia-Ukraine conflict.

Context Behind India’s Import Strategy

The Indian Ministry of External Affairs emphasized that India's increased purchases of Russian oil began primarily because traditional supply chains were disrupted after the 2022 invasion of Ukraine. This realignment of energy sources was vital for ensuring energy stability and affordability for Indian consumers.

In a pointed statement, New Delhi took aim at what it perceives as hypocrisy, noting that some Western nations criticizing India continue substantial trade relations with Russia. "It is revealing that the very nations criticizing India are themselves indulging in trade with Russia," the ministry remarked, underscoring that unlike India’s situation, their trade with Russia lacks a pressing national necessity.

Trade Figures Highlight Double Standards

- EU-Russia trade totaled approximately €67.5 billion ($78.1 billion) in 2024 for goods, plus €17.2 billion in services in 2023.

- India’s overall trade with Russia climbed to a record $68.7 billion by March 2025, a striking 5.8-fold increase compared to the pre-pandemic year of 2019.

- The EU remains Russia’s third-largest trade partner globally, accounting for 38.4% of Russia’s total goods trade in 2024, although trade volume has significantly declined since 2021.

These figures were cited by India to highlight an uneven playing field, questioning why India faces punitive threats while the larger EU-Russia trade persists.

Trump’s Tariff Threat and Its Implications

Former President Donald Trump’s recent social media pronouncement threatened “substantially raising” tariffs on Indian goods, though no specific rates were disclosed. This threat follows his earlier statements about a 25% tariff on Indian exports coupled with undefined penalties tied to India’s oil and military equipment purchases from Russia.

Trump also accused India of profiting from discounted Russian oil by reselling it in global markets, allegations India rejects by pointing to broader geopolitical realities and previous U.S. encouragement.

India’s Defense: Energy Stability and U.S. Encouragement

India stood firm, recalling that the United States once actively supported India’s import of Russian oil to promote global energy market stability. Eric Garcetti, former U.S. Ambassador to India, publicly encouraged Indian oil purchases from Russia to bolster supply when global prices threatened to spike.

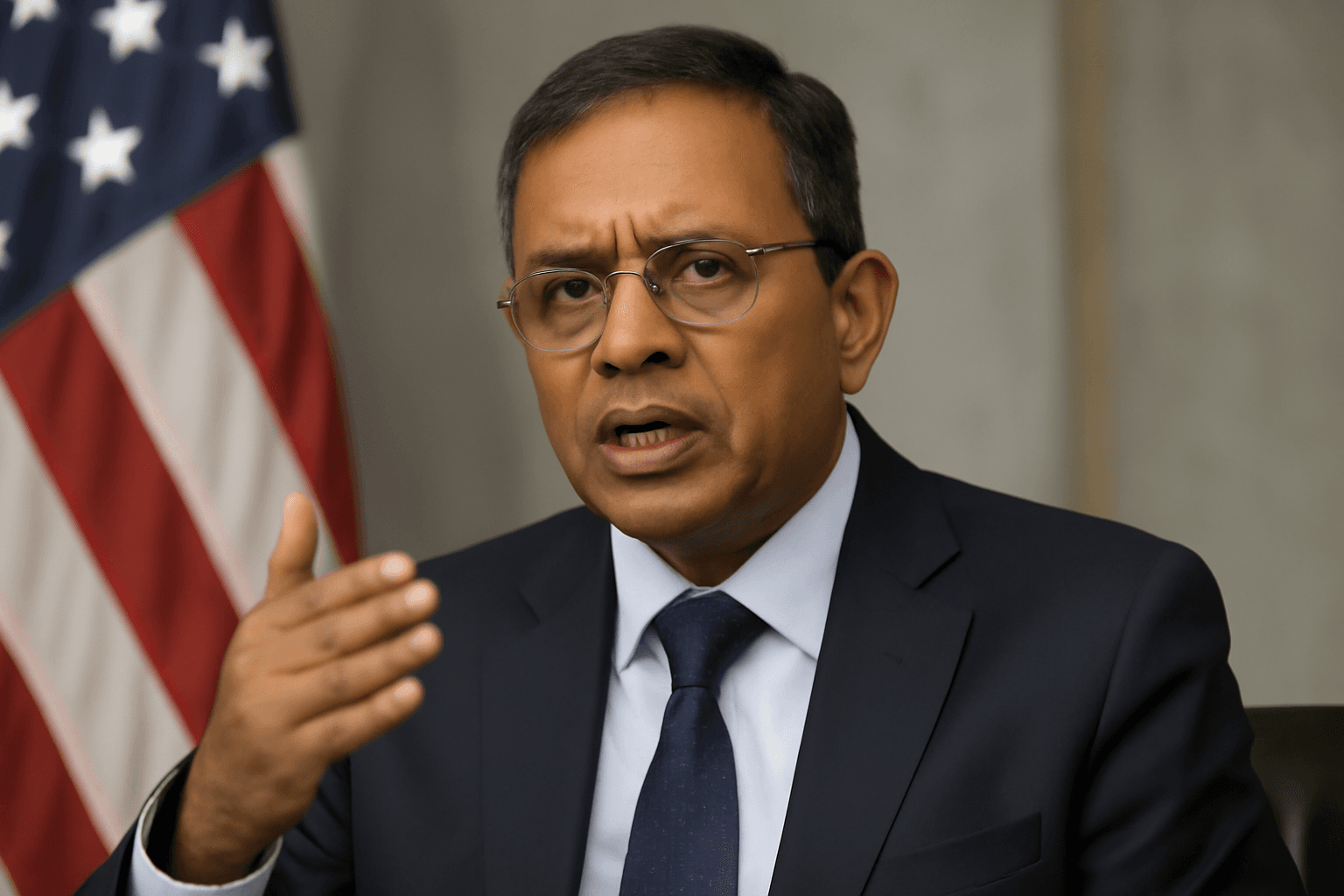

Hardeep Singh Puri, India’s Minister of Petroleum and Natural Gas, underscored this rationale in a CNBC interview, noting that without such purchases, oil prices could have surged to $130 per barrel amid global market turmoil.

The Complexity of U.S. Trade with Russia

India also pointed out that the U.S. continues to import key materials from Russia, including uranium hexafluoride critical to its nuclear sector, palladium for electric vehicles, and various fertilizers and chemicals. In 2024, U.S.-Russia bilateral trade totaled $5.2 billion — smaller than pre-pandemic levels but without reciprocal tariffs imposed on Russia.

Considering this, India labeled the targeting of its trade practices as "unjustified and unreasonable," reaffirming its intent to protect national interests and economic security.

Expert Analysis: Divergent Perspectives on Trade and Policy

Rachel Ziemba, adjunct senior fellow at the Center for a New American Security, acknowledged the legitimacy of some Indian concerns, recalling that it was the previous U.S. administration’s policies, including the establishment of price caps, which steered Indian trade behavior.

Meanwhile, former Indian Finance Secretary Subash Garg predicts little chance of a comprehensive India-U.S. trade agreement soon due to fundamentally different trade positions. Garg suggests India should pragmatically accept potential tariffs, focusing on domestic consumption and alternate markets to offset any export losses.

Broader Implications: Navigating a Fractured Global Energy Landscape

The unfolding dispute sheds light on the difficult balancing act economies face amid broad sanctions regimes targeting Russia. It also highlights questions around consistency in enforcing trade restrictions and the geopolitical ramifications of importing energy from sanctioned countries.

For the world’s third-largest energy consumer, ensuring affordable and secure energy supplies remains paramount, particularly when global markets are volatile and geopolitics turbulent.

Key Questions Moving Forward

- How will global powers reconcile their economic interests with geopolitical sanctions?

- Can a middle path be found that respects national energy security without undermining broader sanction objectives?

- What role will emerging economies like India play as they assert independent foreign policy choices amid pressures from major allies?