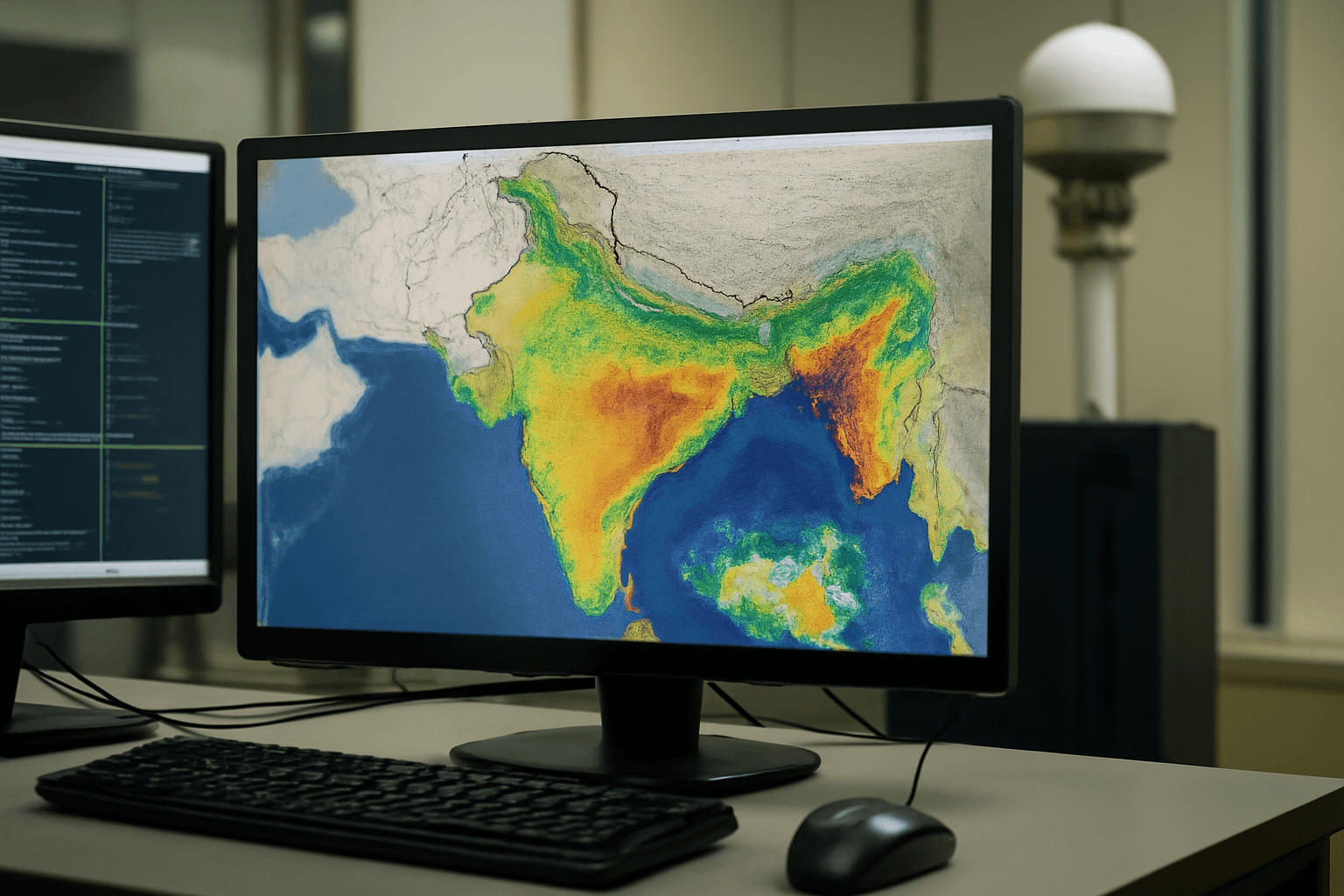

India's PC market showcased remarkable growth in the first quarter of 2025, achieving 3.3 million shipments—an increase of 8.1% compared to the previous year. This upward trend was largely fueled by a significant demand for notebooks and the burgeoning adoption of AI-powered computers. Consumer sales were particularly boosted by Republic Day promotions and the expansion of online retail.

According to data from the International Data Corporation (IDC), the surge in shipments included a noteworthy 13.8% rise in notebook sales year-over-year, with AI notebooks experiencing a staggering growth of 185.1%. The consumer segment led this charge, achieving an 8.9% increase, thanks in part to promotional campaigns during Republic Day and robust inventory pushes throughout March. Online sales channels performed exceptionally well, growing 21.9% year-over-year as vendors enhanced their digital offerings through attractive discounts and cashback deals.

Particularly noteworthy is the premium notebook segment, with models priced over $1,000 witnessing an 8% growth, reflecting consumers’ willingness to invest in high-quality devices. This trend correlates with the rising acquisition of AI-enabled PCs, as enterprises increasingly seek to enhance productivity, security, and automation capabilities. The commercial segment also reported a 7.5% growth, spurred by demand from businesses for commercial notebooks. However, the government sector faced challenges, with a significant 27.4% decline in desktop purchases contributing to an overall 2.4% drop in desktop shipments.

Bharath Shenoy, the research manager at IDC India & South Asia, remarked that PC vendors are improving customer accessibility across India by establishing new brand stores and expanding their presence in large retail formats, accompanied by enticing discounts. Nevertheless, he cautioned that increased channel inventory resulting from strong shipments may pose short-term challenges.

The gaming sector has emerged as a vital growth contributor within the consumer segment, as gamers increasingly pursue high-performance laptops for both entertainment and competitive gaming. This demand coincides with the business sector's shift towards AI-enhanced devices, creating a dual-engine growth model for the industry. HP maintained its leadership in the market with a 29.1% share, excelling in both consumer and commercial sectors, while Lenovo captured the second position with an 18.9% share. Dell followed closely in third with 15.6%, while Acer and Asus held shares of 15.4% and 6%, respectively. Notably, Acer's consumer segment soared by 95.5% year-over-year, thanks to aggressive strategies in both online and offline markets, whereas Asus concentrated on bolstering its commercial presence with a 41.1% growth from a smaller base.