Escalation Between Israel and Iran Shakes Global Markets

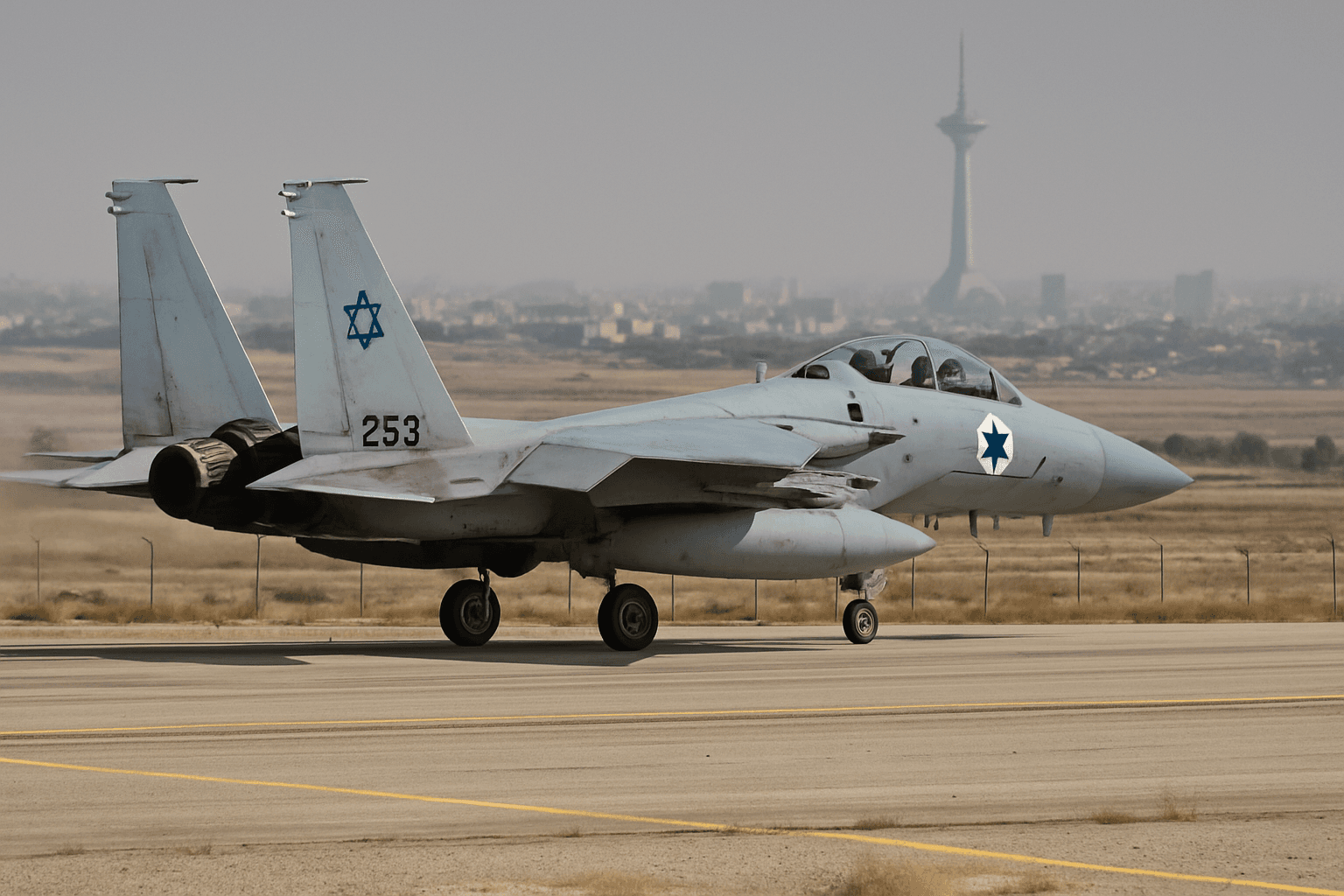

In the early hours of Friday, Israel launched a series of targeted airstrikes on sites linked to Iran's nuclear program, sharply deepening tensions in the Middle East. Following these attacks, Israel declared a state of emergency as Iran reported significant casualties in Tehran, including notable figures within its Islamic Revolutionary Guard Corps.

The strike's ripple effects were immediate: oil prices surged amid fears of a widening conflict, while U.S. stock futures took a hit, with Dow futures plunging more than 600 points. Asian markets also retreated, reflecting investor anxiety over potential regional instability.

Tragic Air India Crash Claims Nearly All Lives Onboard

Tragedy struck on Thursday when a Boeing 787 Dreamliner carrying 242 passengers crashed shortly after departing from Ahmedabad, western India, en route to London. Only a single passenger survived, while casualties also mounted on the ground near the crash site.

The accident triggered a sharp selloff in aerospace shares: Boeing's stock dropped 13%, with key suppliers GE Aerospace and Spirit AeroSystems declining 4% and 3%, respectively. Aviation experts caution against premature conclusions, emphasizing the need for thorough investigation before drawing comparisons to past Boeing incidents.

Markets React to Economic Data and Corporate Earnings

U.S. Stocks Edge Up Despite Geopolitical Uncertainty

Despite global tensions, U.S. indexes found footing thanks to softer-than-expected inflation data. The producer price index for May rose just 0.1%, below estimates, easing inflation concerns and supporting gains. The S&P 500 climbed closer to its record high, finishing the day less than 2% from its peak. The Nasdaq added 0.24%, with the Dow posting a modest 0.24% increase.

Oracle’s Earnings Boost Tech Sector Optimism

Software giant Oracle outperformed expectations, with robust revenue growth driven by surging demand for cloud and AI infrastructure. CEO Safra Catz projected a more than 70% increase in cloud infrastructure revenue for fiscal 2026, up sharply from the previous quarter. This upbeat outlook sent Oracle shares higher, lifting the broader technology sector.

Highlighting this bullish outlook, investment expert Victoria Greene predicts Oracle’s stock could climb to $300 within a year, inviting investors even after recent gains.

India’s Industrial Ambitions Amid Global Supply Chain Shifts

India is drawing attention as an alternative manufacturing hub amidst ongoing U.S.-China trade tensions. Its sizable youth workforce and recent incentives position it as a contender for expanded manufacturing roles. However, challenges such as logistical hurdles, bureaucratic delays, and uneven infrastructure remain significant obstacles to rapid growth.

Developing Rare Earth Supplies to Counter China’s Dominance

In response to China's export restrictions on rare earth metals, India is accelerating efforts to develop domestic production. With rich reserves along its coastline, particularly in Kerala, India could become a pivotal supplier for global partners seeking to diversify sources of these critical materials used in electronics and renewable energy technologies.

Officials are exploring ways to enhance rare earth magnet manufacturing through state-owned entities, aiming to fortify India’s role in the evolving global supply chain.

Key Takeaways

- Israel’s airstrikes on Iran amplify geopolitical risks, causing market volatility and spikes in oil prices.

- The Air India Boeing 787 crash resulted in 241 fatalities, impacting aerospace stocks and prompting detailed investigations.

- Softer inflation data fuels modest gains in U.S. stock markets despite ongoing international tensions.

- Oracle’s strong earnings highlight the accelerating cloud and AI growth sectors.

- India’s manufacturing potential grows amid supply chain diversification strategies, though infrastructural challenges persist.

- Efforts to boost India's rare earth production signal a shift toward alternative global mineral sources.