Investment Bank Highlights Strategic Importance of MP Materials

Morgan Stanley has upgraded MP Materials, the sole operator of a rare earth mine in the United States, to a buy-equivalent rating, setting a price target of $34 per share. This target suggests a potential upside of 32% from the previous close. The upgrade reflects the company's growing strategic value amid escalating geopolitical tensions that are disrupting global mineral supply chains.

MP Materials: U.S. Rare Earth Mining Leader

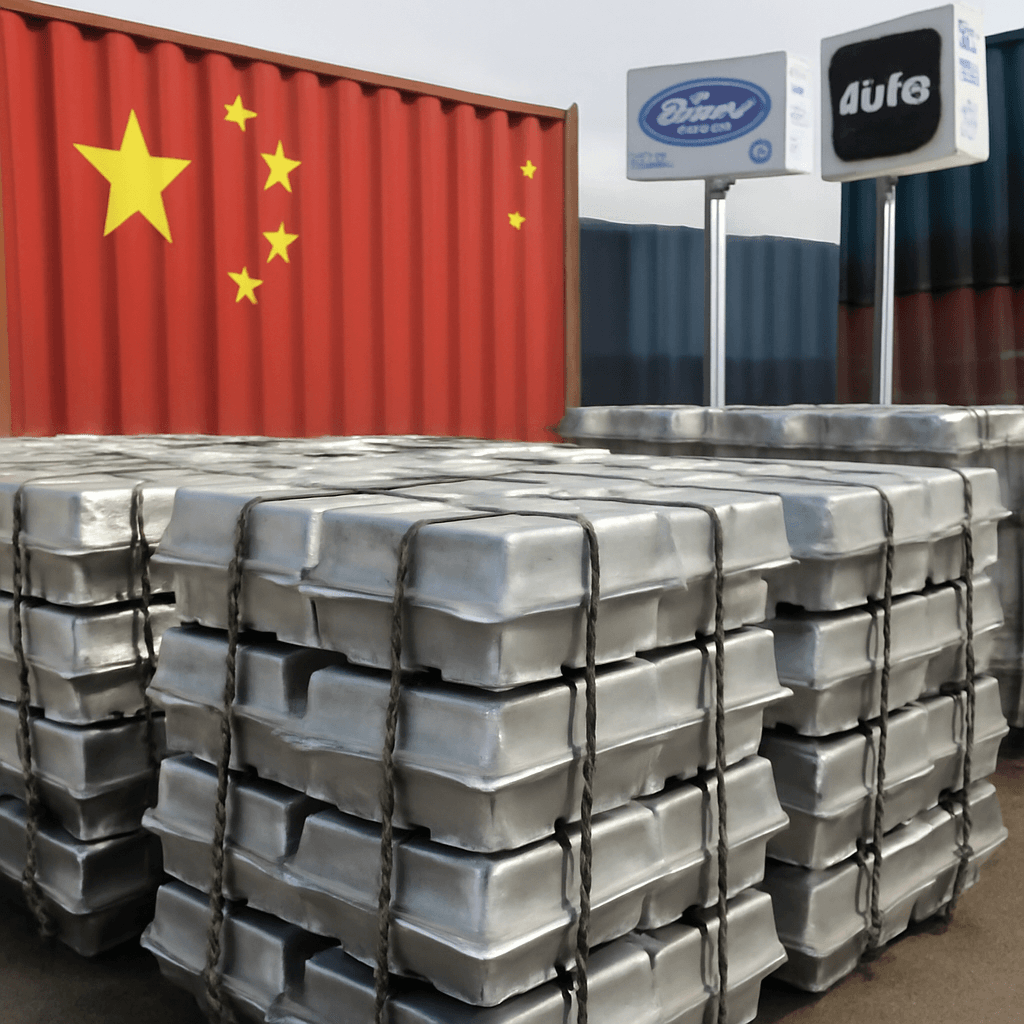

MP Materials operates the only rare earth mine in the U.S., located at Mountain Pass, California. Rare earth elements are critical components in numerous advanced technologies, yet China currently dominates global refining and processing of these minerals, amplifying supply concerns especially with recent geopolitical frictions.

Geopolitical Impact on Critical Mineral Supply Chains

Amid ongoing tensions, trade restrictions imposed by China, including export limits on seven rare earth elements since April, have emphasized the necessity for a secure, domestic supply in the U.S. Although trade discussions have continued, these restrictions remain in effect, prompting heightened interest in domestic miners like MP Materials.

Policy Support Bolsters Domestic Rare Earth Production

Recently, modifications to the Defense Production Act have started allowing the U.S. government to offer subsidies above market prices for rare earth materials, aiming to strengthen domestic supply chains. MP Materials stands out as the best-positioned company to benefit from this support.

Future Growth and Production Plans

The company is advancing a fully domestic rare earth supply chain, including plans to commence commercial production of magnets integral to electric vehicle motors, offshore wind turbines, and potentially humanoid robotics in the near future.

Financial Outlook

- Expected negative free cash flow in 2025 and 2026

- Strong balance sheet positioning the company for positive free cash flow acceleration starting in 2027

The share price responded positively to this outlook, rising over 5% shortly after the announcement.