Adapting Crypto Security Amid Rising Kidnapping Threats

A surge in kidnappings targeting cryptocurrency executives has forced prominent crypto enthusiasts to rethink their security measures. One family, known as the 'Bitcoin Family,' has overhauled its approach to safeguarding digital assets, moving away from conventional hardware wallets to an innovative global storage strategy.

A Decentralized Storage Approach

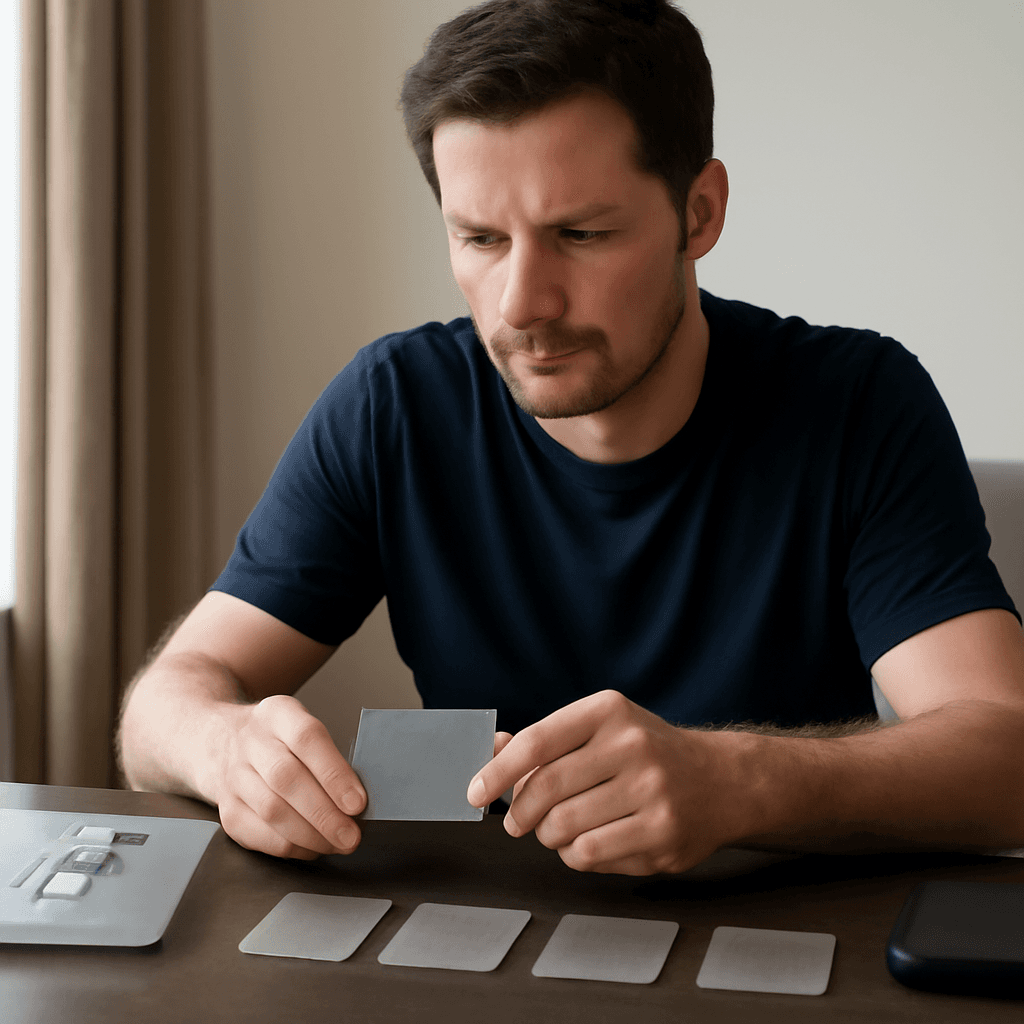

Since investing fully in bitcoin in 2017, the family has embraced a nomadic lifestyle, now residing across multiple countries. They have developed a hybrid security system by dividing their 24-word bitcoin seed phrase into four separate parts, each encrypted and stored on different continents, including Europe and South America.

Some seed fragments are preserved using blockchain-based encryption services, while others are physically etched into fireproof steel plates by hand, then concealed in various locations worldwide. This ensures that even if a thief accesses multiple parts of their seed phrase, they cannot reconstruct the full key without all four components.

Enhanced Security Measures in Wallet Management

In addition to their cold storage strategy, the family employs multi-signature protocols to protect funds held in hot wallets. These wallets require approval from multiple parties before transactions can proceed, minimizing the risk of unauthorized transfers.

Previously reliant on hardware wallets, the family abandoned these due to concerns over potential backdoors and remote access vulnerabilities discovered in 2023. Instead, they now rely on encrypted backups and offline storage methods free from third-party devices.

Responding to Escalating Physical Threats

Physical security concerns have intensified after multiple kidnappings of crypto executives globally, including ransom and torture cases aimed at extracting access keys. This trend has driven increased interest in kidnapping and ransom insurance policies tailored for cryptocurrency holders.

The family has also made lifestyle adjustments for their safety. After receiving threatening messages linked to information gleaned from social media, they ceased public postings from their residence in Thailand and changed locations. They have completely refrained from posting home or travel updates to reduce exposure.

Technology and Trading Evolution

Alongside storage innovations, the family uses decentralized trading platforms and algorithmic trading bots to manage their assets without exposing keys to centralized entities. Approximately 65% of their crypto holdings remain in cold storage across four continents, while the rest is allocated for active trading under strict multi-signature protection.

Beyond multi-signature setups, they are exploring multi-party computation (MPC) technology, which distributes encrypted shares of private keys among several parties. MPC enhances security by ensuring no single individual holds the entire key, further reducing the risk of theft.

Looking Ahead: Goals and Privacy

The family's long-term plan envisions bitcoin reaching $1 million by 2033, with their diversified portfolio including ether, layer-1 blockchain tokens, and AI-focused investments. Despite their public persona, growing concerns for their children's safety have prompted consideration of reducing their public exposure.

Their pioneering methods highlight a shift in crypto security, emphasizing decentralization, multi-factor safeguards, and global distribution to mitigate emerging risks in a volatile environment.