Nvidia Set to Restart H20 AI Chip Sales to China Following U.S. License Assurances

Nvidia announced on Tuesday its plans to resume sales of the H20 general processing units (GPUs) to Chinese customers, following assurances from the U.S. government that necessary export licenses will be granted. This development marks a significant shift in U.S. tech export policy, highlighting an easing of tensions amid ongoing trade negotiations between Washington and Beijing.

Background: Export Restrictions and Trade Dynamics

In April 2025, Nvidia’s sales of the H20 GPUs to China were abruptly halted due to tightened U.S. export controls aimed at limiting advanced technology reaching Chinese markets. The H20 chips were originally designed with compliance measures to skirt these controls, but permission to sell them had still been withheld.

Last month, a preliminary trade agreement between the United States and China laid groundwork for a potential easing of some trade barriers. Among these were commitments from China to resume rare earth exports and concessions by the U.S. to loosen specific technology export restrictions, creating a more favorable environment for semiconductor commerce.

Leadership Advocacy: Jensen Huang’s Persistent Lobbying

Nvidia’s CEO, Jensen Huang, has been vocal in advocating against stringent export limitations, warning that such constraints could erode the United States’ competitive edge in the critical AI and semiconductor sectors. In his May statements, Huang disclosed that these restrictions had already disrupted Nvidia’s business operations in China and cautioned about their broader impact on the tech ecosystem.

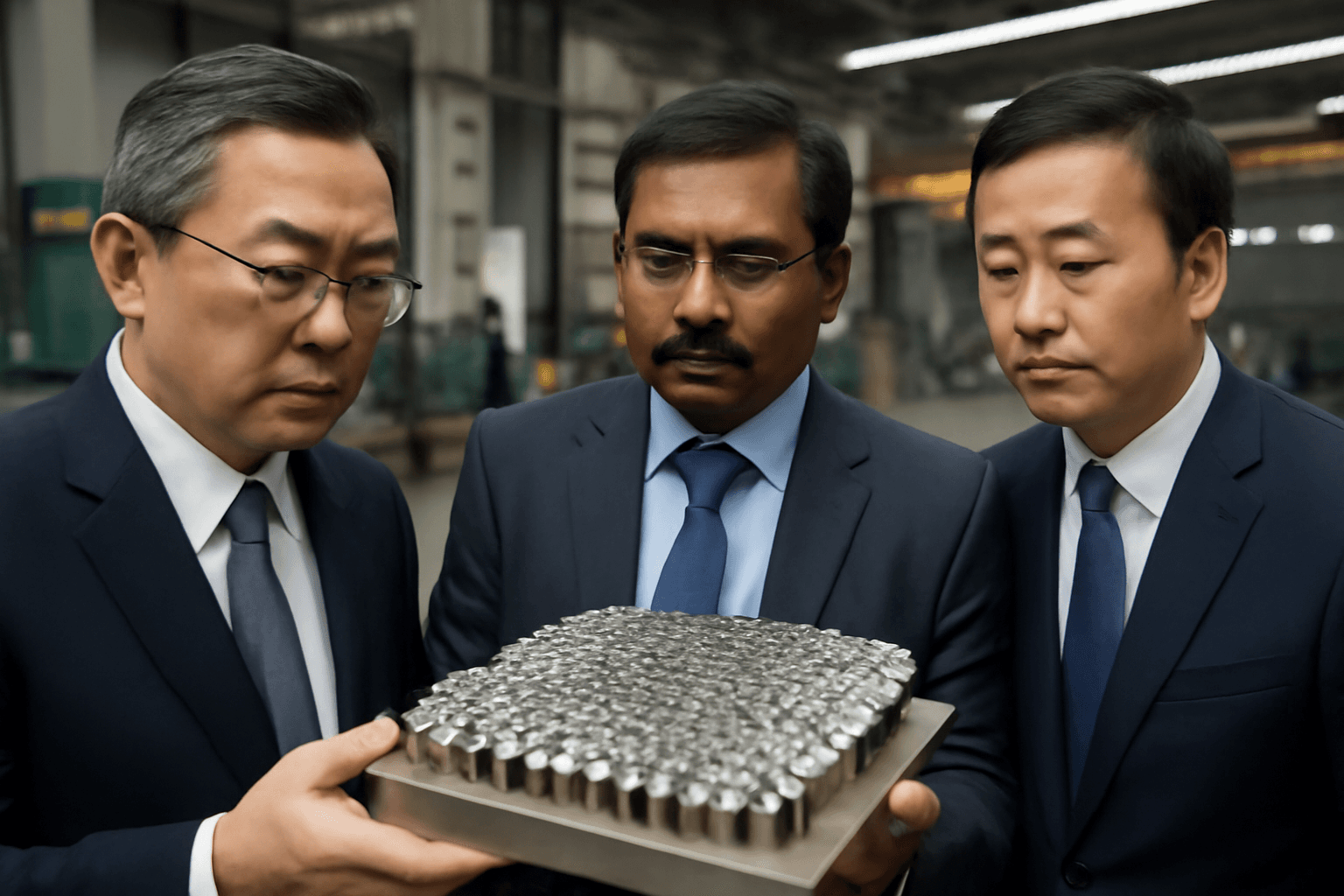

In a recent high-profile meeting at the White House, Huang engaged directly with President Donald Trump and key policymakers. During this discussion, he emphasized Nvidia’s alignment with U.S. priorities such as job creation, domestic manufacturing (onshoring), and sustaining American leadership in the global artificial intelligence arena. This strategic dialogue underscored the balancing act between safeguarding national security and nurturing industrial competitiveness.

Technological Innovation Amid Compliance

Nvidia also unveiled the NVIDIA RTX PRO, a new GPU designed for smart industrial applications, including logistics and factory automation, which is fully compliant with current export regulations. This development reflects the company’s efforts to innovate without compromising U.S. regulatory frameworks.

Engagement Across Borders: Dialogue in Beijing

Parallel to U.S. discussions, Huang’s meetings with Chinese government and industry officials focused on exploring AI’s potential benefits and collaboratively advancing safe and secure AI technologies. These cross-border conversations highlight the complex interdependency between American tech companies and Chinese markets, as well as the shared stakes in ethical AI development.

Contextual Insights: What This Means for the Global Tech Landscape

- Strategic Decoupling vs. Cooperation: Nvidia’s renewed sales suggest a nuanced recalibration in U.S.-China tech relations, balancing national security concerns with the economic imperative of staying deeply engaged in China’s vast AI market.

- Impact on Innovation and Supply Chains: Resumption of chip sales could alleviate some supply chain bottlenecks and catalyze innovation that thrives on cooperation, yet it also raises questions about intellectual property protection and technological sovereignty.

- Precedent for Future Export Policies: The U.S. government’s willingness to license these sales may signal a more flexible approach toward managing competitive risks while fostering American companies’ global growth.

Looking Ahead: Critical Questions

While the resumption of sales is promising for Nvidia and its investors, it invites scrutiny of long-term policy coherence around export controls. How will the U.S. balance industry advocacy with geopolitical priorities? What frameworks will ensure that exported technologies do not undermine U.S. security interests? Moreover, how will Chinese regulatory agencies respond to an influx of advanced American AI hardware amid ongoing technological rivalry?

Expert Commentary

From a policy analyst’s viewpoint, this episode is emblematic of the dilemmas facing global tech leadership in a fractured geopolitical environment. Nvidia’s navigation between compliance and competitiveness showcases the intricate linkage between diplomacy, innovation, and market realities. For the U.S., facilitating controlled exports while maintaining technological edge requires dynamic, informed policy-making that can adapt swiftly to evolving risks.

Editor’s Note

The latest announcement from Nvidia reveals not just a business transaction but a broader narrative about how technology firms operate as bridges — and sometimes battlegrounds — between two of the world's largest economies. As the U.S.-China relationship continues to oscillate between cooperation and competition, the management of critical AI technologies will remain a litmus test of global economic and security strategies. Readers are encouraged to ponder: How will export licenses shape the future of AI innovation? Can a delicate equilibrium be maintained that fosters growth without sacrificing security?