Despite recent developments suggesting progress in Pakistan's cryptocurrency sector, the State Bank of Pakistan (SBP) and the Finance Ministry have reaffirmed that all cryptocurrency transactions remain illegal under the country's current regulations.

On May 28, 2025, Pakistan Crypto Council CEO Bilal Bin Saqib announced the establishment of the nation’s first government-backed Strategic Bitcoin reserve and had previously signed a deal with World Liberty Financial Inc (WLFI), a company controlled primarily by the Trump family. These moves initially raised hopes of a crypto-friendly shift in policy.

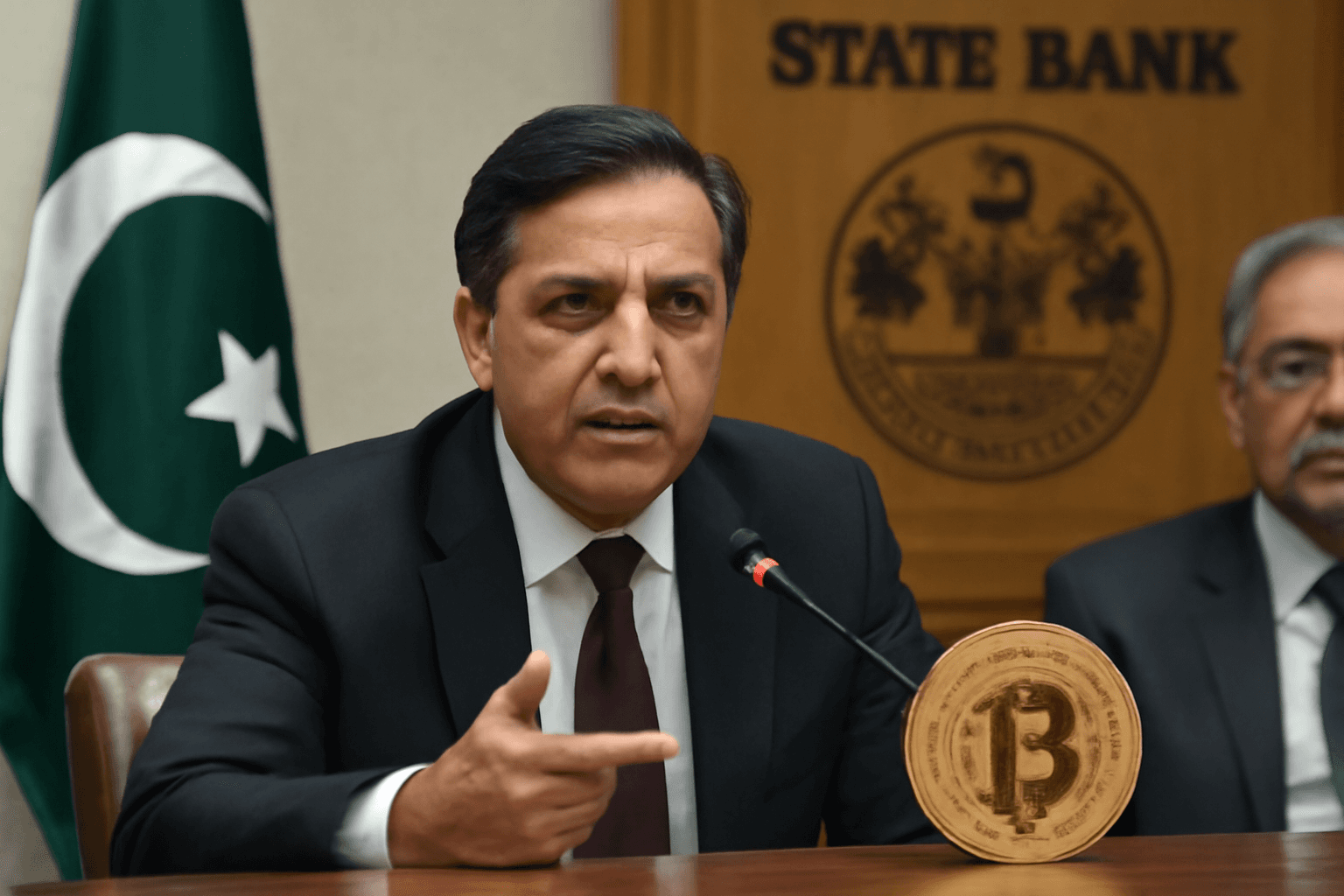

However, the following day, the SBP and Finance Ministry clearly stated that digital currencies are still banned in Pakistan. Finance Secretary Imdadullah Bosal emphasized to the National Assembly’s Standing Committee on Finance and Revenue that cryptocurrency is not recognized as legal tender, and a formal regulatory framework would only be developed following a government decision.

Government Policy and Regulatory Concerns

The Standing Committee expressed frustration over inconsistent government actions. Lawmakers pointed out the contradictory signals where the government appears to promote cryptocurrency investments despite the ongoing ban. Additionally, committee member Mohammad Mobeen questioned why cryptocurrency regulation fell under government jurisdiction rather than the SBP, Pakistan’s central banking authority. He also criticized the allocation of power resources for crypto mining operations given the digital currency’s illegal status.

Risks to Financial Stability

Committee member Shahram Tarakai warned that cryptocurrency could lead to illicit foreign exchange outflows, further straining Pakistan’s financially fragile economy. There were also concerns raised about private sector involvement and the use of illegal hawala channels to circumvent financial laws.

Furthermore, Pakistan’s Financial Monitoring Unit (FMU) continues to prosecute cryptocurrency-related violations and coordinates with law enforcement agencies to enforce existing prohibitions.

The committee highlighted the lack of global recognition of cryptocurrencies, noting that El Salvador remains the only country to have legalized Bitcoin, and even that nation has reportedly been reconsidering its policy.

Member of the National Assembly Sharmila Farooqi advocated for the immediate regulation of cryptocurrencies to curb risks including money laundering and to safeguard Pakistan’s repute following its removal from the Financial Action Task Force’s grey list.

In summary, while there are isolated moves suggesting interest in cryptocurrencies, Pakistan’s official stance remains one of prohibition, underscoring the need for a clear and consistent regulatory approach to address the emerging challenges and opportunities associated with digital assets.