Rolls-Royce Commits $75 Million to Expand Engine Plant in South Carolina

In a significant move highlighting its strategic expansion in the United States, British aerospace giant Rolls-Royce announced a $75 million investment to expand its engine manufacturing facility located in Aiken, South Carolina. This initiative aims to increase production capacity and create 60 new jobs, reflecting the company's deepening presence in the American manufacturing landscape.

What This Expansion Means for the U.S. Energy and Data Center Industries

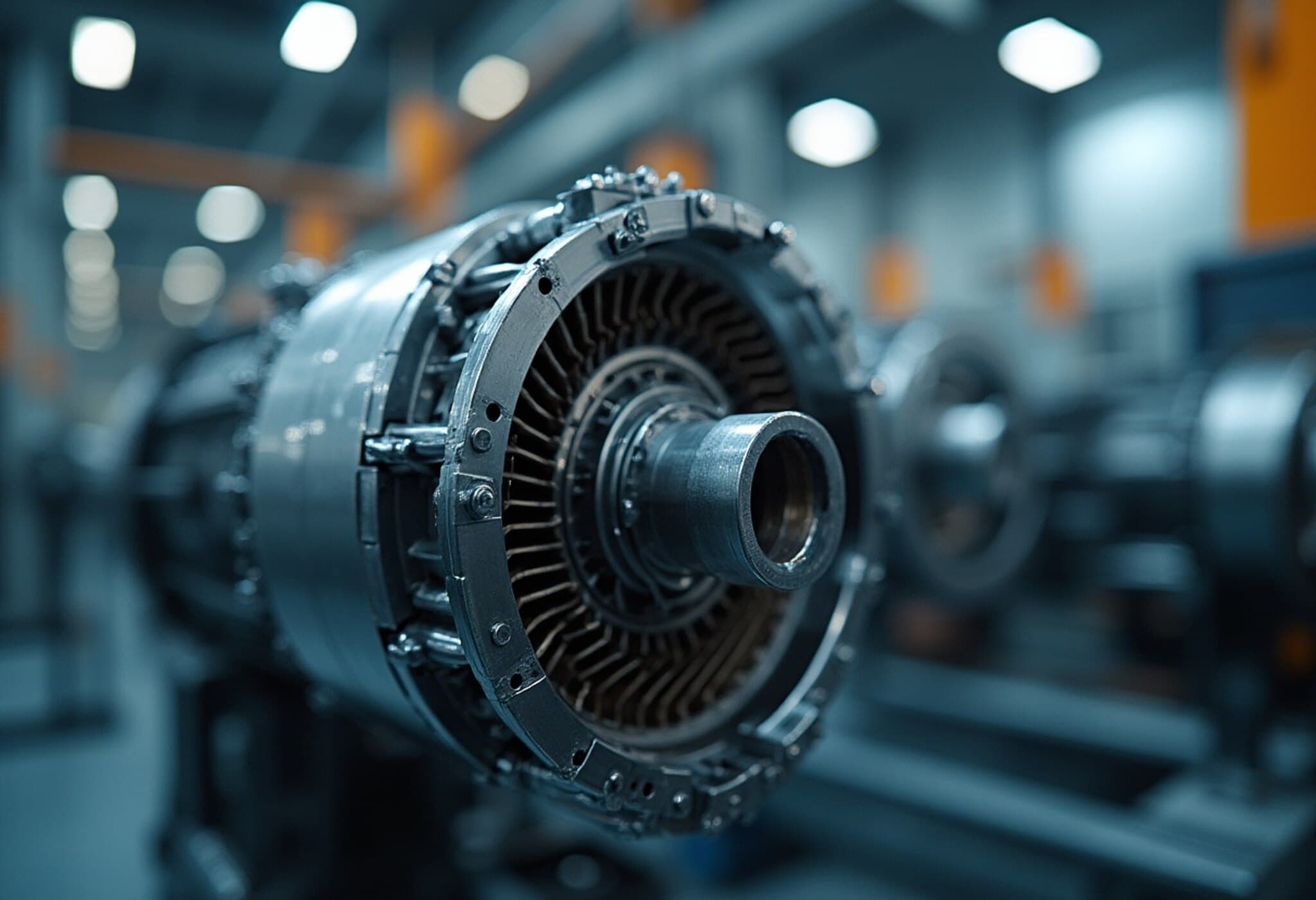

The South Carolina plant primarily produces the mtu Series 4000 diesel engines, critical components powering backup energy systems for data centers and essential infrastructure. With the surge in data center development across the U.S., driven by escalating digital demand, the expansion aligns with a growing need for reliable and domestically produced power solutions.

Adam Wood, managing director of Rolls-Royce Power Systems in America, emphasized, “This increased investment strengthens our ability to serve our U.S. customers — especially in the fast-growing American data center industry.” The move underscores Rolls-Royce’s strategic pivot beyond aerospace into energy and power systems, responding to market shifts and the rising prominence of energy resilience.

Shifting Manufacturing Geography: From Germany to the U.S.

Currently, many components of the mtu Series 4000 engines are manufactured in Germany and shipped to the U.S. as finished products. The new investment will enable the South Carolina plant to machine additional components locally, reducing supply chain complexities and enhancing the agility of U.S.-based production. This is a critical strategic step towards bolstering domestic manufacturing capabilities, particularly in an era where supply chain resilience has become a national priority.

Adam Riddle, Rolls-Royce CEO for North America, stated, “We are proud to support America's growing demand for reliable, domestically made energy systems that strengthen our nation's energy independence and security.” This commitment aligns with broader geopolitical and economic trends emphasizing American industrial self-reliance, particularly in sectors tied to critical infrastructure and national security.

The South Carolina Plant as a North American Power Systems Hub

Set to become a cornerstone of Rolls-Royce’s North American strategy, the South Carolina facility’s expansion starts in early 2026, with enhanced production expected by July 2027. The increased capacity will serve not just current customers but position the facility as a key hub for future energy solutions in the region.

Contextualizing the Expansion Amid Global Energy Transitions

Notably, this announcement follows Rolls-Royce’s recent collaboration with the United Kingdom and Czech Republic on small modular reactors (SMRs)—advanced nuclear technology representing a new frontier in clean energy. According to reports, Rolls-Royce aims to export up to six SMRs to the Czech Republic under this partnership, illustrating a broader diversification beyond traditional aerospace manufacturing.

This concurrent focus on nuclear innovation and domestic manufacturing expansion signals Rolls-Royce’s ambition to be a pivotal player in the transition toward more secure, sustainable, and locally sourced energy systems globally, and particularly in the strategic North American market.

Expert Insights: What This Means for U.S. Industry and Jobs

- Economic Impact: The creation of 60 new jobs will provide a meaningful boost to local economies in South Carolina, contributing to workforce development in advanced manufacturing sectors.

- Supply Chain Resilience: By localizing component production, Rolls-Royce reduces dependency on transatlantic supply lines—a critical advantage amid ongoing global logistics uncertainties.

- Energy Security: Enhancing domestic production of power engines supports national efforts to secure uninterrupted energy supply for critical infrastructure, a concern heightened by increasing cyber and geopolitical threats.

From a broader policy perspective, this expansion dovetails with U.S. government initiatives encouraging reshoring of critical manufacturing and investment in infrastructure resilience. It also reflects the private sector’s response to evolving market and geopolitical landscapes that prioritize dependable domestic supply chains.

Looking Ahead: The Future of American Manufacturing and Energy

Rolls-Royce’s facility expansion is more than just a financial investment — it’s a strategic signal that the era of globalized, offshore production is evolving. Companies that can combine technological innovation with domestic manufacturing are poised to redefine competitive advantages in high-tech, energy-critical industries.

For U.S. policymakers, industry leaders, and workers, opportunities and challenges lie ahead as traditional aerospace manufacturers like Rolls-Royce embrace diversified energy portfolios and local production. How this plays out could shape job markets, supply chains, and national security infrastructure for decades to come.

Editor’s Note

Rolls-Royce's $75 million expansion in South Carolina offers a compelling glimpse into the intersection of advanced manufacturing, energy innovation, and national security. As the company transitions beyond aerospace into power systems and modular nuclear technology, this move raises critical questions: How will such expansions influence America's industrial future? What role will domestic manufacturing play in shaping energy independence and economic resilience? For stakeholders, this story is a vital example of how thoughtful investments can drive not only business growth but also broader societal benefits.