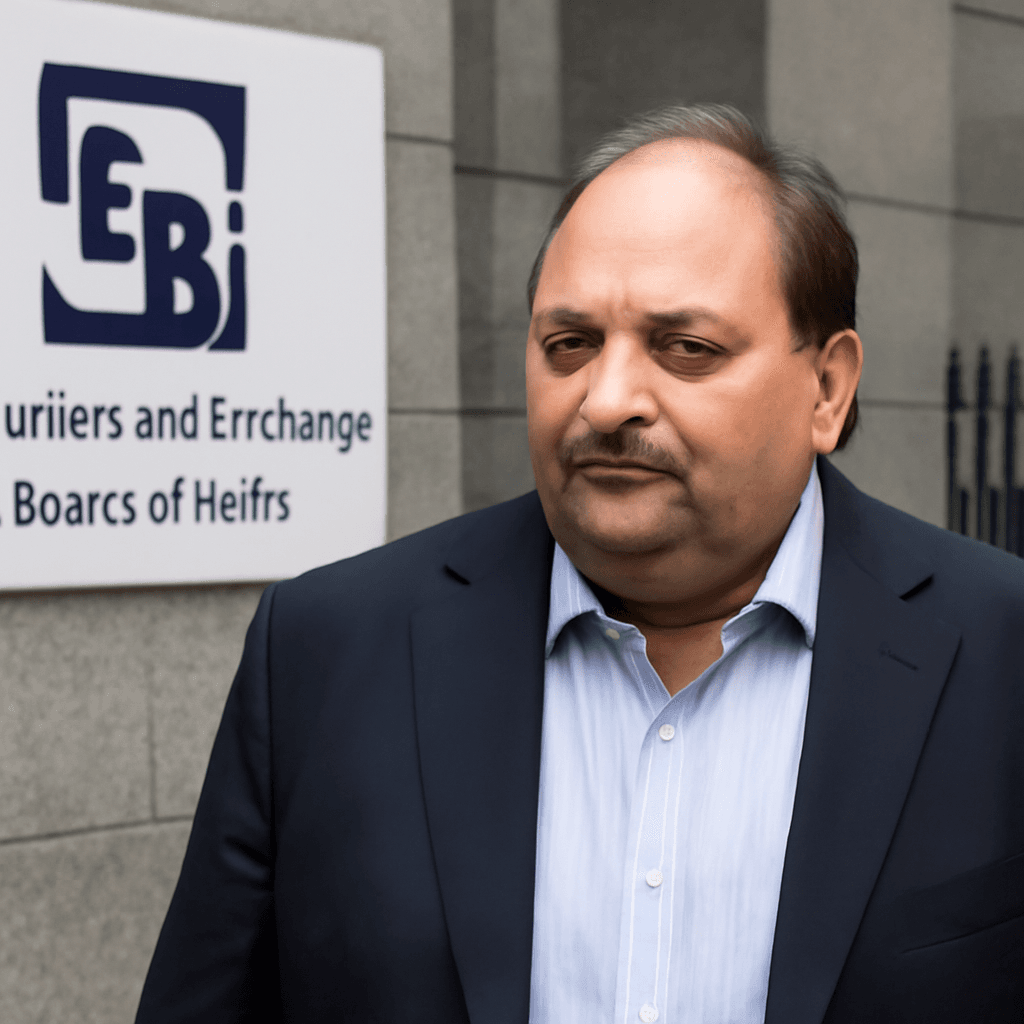

Sebi Targets Mehul Choksi’s Assets to Recover Insider Trading Penalty

The Securities and Exchange Board of India (Sebi) has ordered the attachment of bank accounts, mutual fund holdings, and shareholdings of Mehul Choksi to recover dues amounting to Rs 2.1 crore. This follows a penalty imposed on Choksi in an insider trading case related to Gitanjali Gems.

Background of the Case

Mehul Choksi, an absconding diamantaire and a key accused in a major bank fraud, was fined Rs 1.5 crore in January 2022 by Sebi for violating insider trading regulations. Despite notices, he has not cleared the penalty, prompting Sebi to initiate asset attachment proceedings. The total dues include the original fine plus interest amounting to Rs 60 lakh.

Details of the Regulatory Action

- Sebi directed banks, mutual fund houses, and depositories (NSDL and CDSL) to block any withdrawals or debits from Choksi’s accounts. Credits are allowed.

- All lockers and other financial holdings linked to Choksi have also been ordered to be attached.

- The regulator cited concerns that Choksi might dispose of assets, thereby delaying or obstructing recovery of the penalty.

Insider Trading Allegations

The penalty arises from insider trading activities involving unpublished price sensitive information (UPSI) communicated by Choksi in December 2017. He allegedly passed confidential information to a third party, who sold shares in Gitanjali Gems ahead of public disclosure regarding fraudulent issuance of Letters of Undertaking (LoUs) by entities linked to the Gitanjali Group.

Sebi found that these actions violated the Prohibition of Insider Trading regulations, restricting Choksi from participating in securities markets for one year.

Related Legal Context

Mehul Choksi is also embroiled in a massive ₹14,000 crore Punjab National Bank fraud case. He fled India in early 2018 and was recently detained in Belgium as part of extradition proceedings. His nephew, another accused in the case, remains incarcerated in the UK.

Next Steps and Enforcement

After issuing a demand notice in mid-May 2025 with a 15-day deadline to clear dues, Sebi proceeded with asset attachment on June 4, 2025, to expedite recovery. The regulator continues to monitor Choksi’s financial activities to ensure compliance.

Summary of Key Points:

- Rs 2.1 crore recovery includes Rs 1.5 crore fine and Rs 60 lakh interest.

- Accounts and holdings attached; no debits permitted without Sebi’s consent.

- Case linked to insider trading in Gitanjali Gems shares and fraudulent LoUs.

- Choksi implicated in major bank fraud, currently detained abroad awaiting extradition.