U.S. Office Space Market Hits a Turning Point in 2025

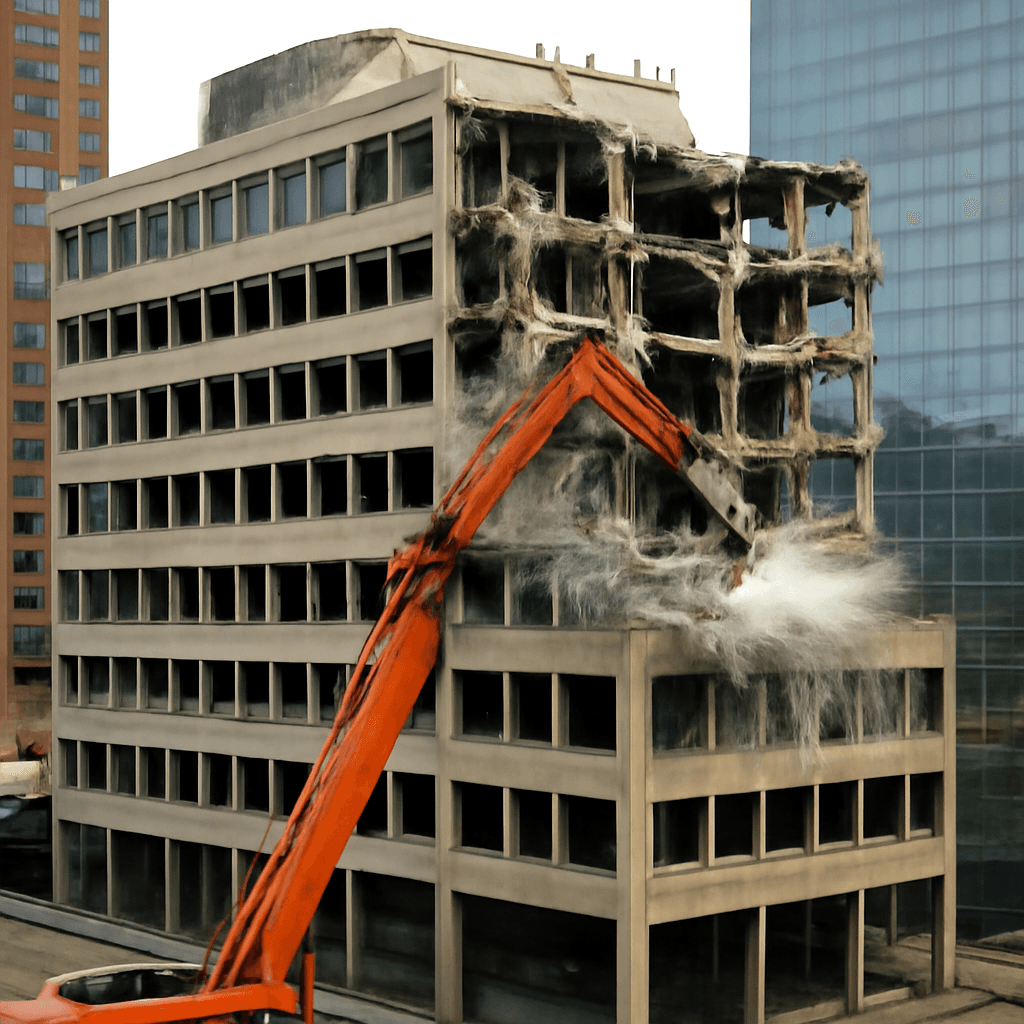

For the first time in at least 25 years, the United States is witnessing a net reduction in office space, as demolitions and conversions outpace new constructions. This shift marks a significant turning point for the commercial real estate sector that has been grappling with substantial challenges over recent years.

Declining Office Footprint Across Major Markets

Across the 58 largest U.S. markets, approximately 23.3 million square feet of office space is projected to be removed from the market by the end of 2025, either through demolition or conversion for alternative uses. In contrast, only about 12.7 million square feet of new office space is expected to be completed, resulting in a net reduction in office inventory.

Rising Vacancy Rates and Remote Work Impact

This decline in office space supply comes amid persistently high vacancy rates, which have hovered near a historic peak of 19% as remote and hybrid working models have reshaped workforce habits since the pandemic began. With fewer employees regularly reporting to physical offices, demand has softened dramatically.

Signs of Market Recovery and Increased Leasing Activity

Despite elevated vacancies, there are encouraging signs of stabilization. For the past four quarters, net absorption — the net amount of office space occupied — has been positive following six consecutive quarters of decline. Furthermore, office leasing activity surged by approximately 18% in the first quarter of 2025 compared to the previous year.

This uptick is partially driven by more employers mandating full-time office attendance and a tightening labor market encouraging workers to accept in-person roles.

Impact on Rents and Prime Office Space

With supply contracting and demand gradually improving, office rents, particularly in prime locations and for new Class A buildings, are beginning to stabilize and rebound. This trend benefits institutional real estate investment trusts (REITs) focusing on high-quality office assets.

Conversion Boom: Transforming Office Spaces into Residential Units

Developers are accelerating plans to repurpose obsolete office buildings. Over the next several years, an additional 85 million square feet of office space is slated for conversion to other uses, predominantly multifamily residential units.

Since 2016, office-to-residential conversions have created around 33,000 new apartments and condominiums, with an average conversion yielding roughly 170 residential units. Currently, approximately 43,500 units are in the pipeline from ongoing conversions.

Challenges to Conversion Growth

Despite the positive impact of downsizing office inventory, several obstacles remain:

- The availability of suitable office buildings for conversion is limited and will decrease over time.

- High costs related to construction labor, materials, and financing continue to pose financial challenges for developers.

These factors suggest that the market adjustment will be gradual rather than immediate.

Outlook for the U.S. Office Market

The evolving office landscape reflects fundamental changes in work habits and urban development priorities. As obsolete office spaces are removed or innovatively repurposed, commercial real estate stands to benefit from a leaner, more efficient inventory and revitalized urban neighborhoods.