Introduction: U.S. Dependence on Foreign Nuclear Fuel

The United States faces a significant challenge in securing its nuclear fuel supply as it heavily relies on foreign state-owned enterprises. With ambitious plans to expand nuclear power generation, the demand for enriched uranium is set to surge.

President’s Nuclear Power Expansion Goals

The goal to quadruple U.S. nuclear power capacity to 400 gigawatts by 2050 underscores a pressing need for domestic enrichment capabilities. Nuclear energy, enjoying bipartisan support, is pivotal to the country’s clean energy transition and energy security initiatives.

Current Nuclear Fuel Supply Landscape

- 70% of U.S. nuclear fuel is sourced from foreign countries.

- 27% of fuel comes from Russia, a major geopolitical adversary.

- Russian uranium imports will be banned by 2028 due to geopolitical tensions following Russia's invasion of Ukraine.

Western uranium enrichment is controlled primarily by non-U.S. state-backed players, including French and European consortiums.

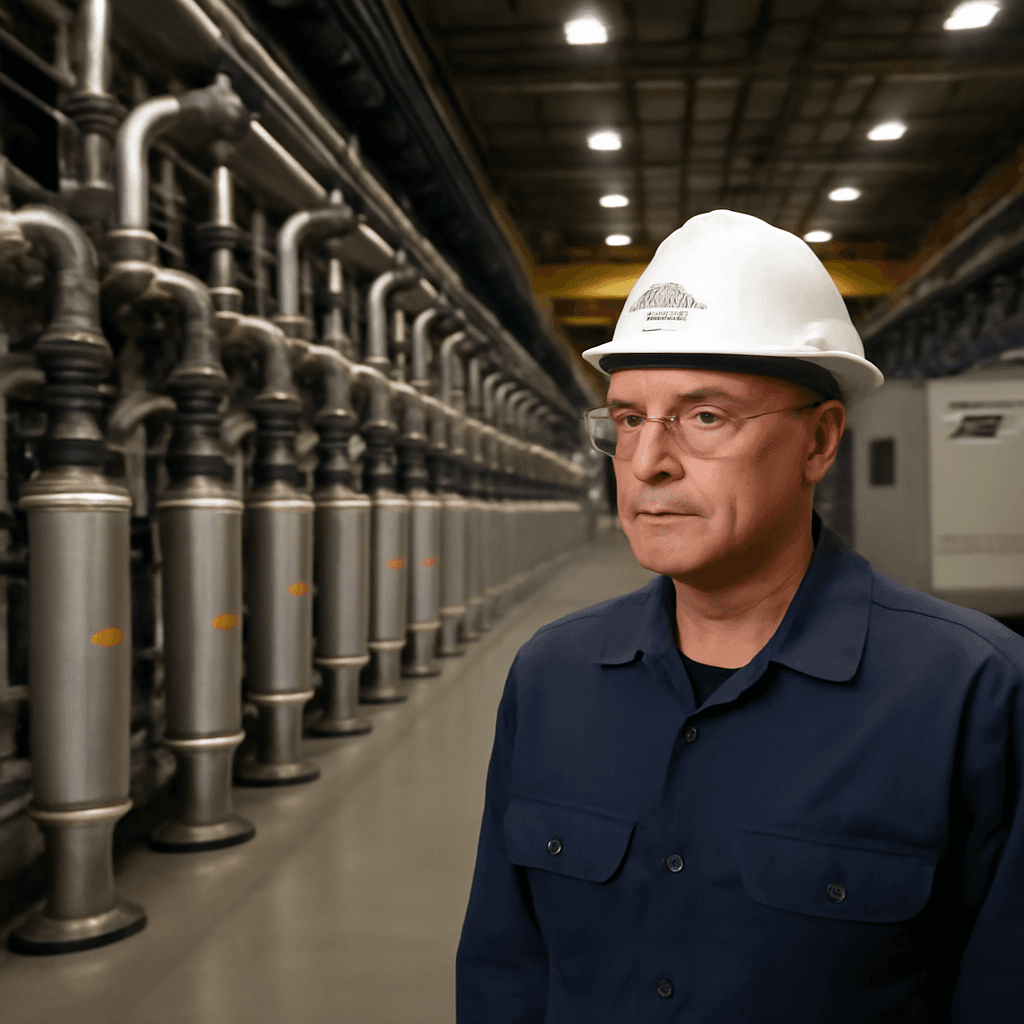

Centrus Energy: A Domestic Solution to Fuel Supply Challenges

Centrus Energy stands out as the only American-owned, publicly traded uranium enrichment company aiming to establish a reliable domestic nuclear fuel supply chain and introduce healthy market competition.

Market Position and Capabilities

- Licensed by the Nuclear Regulatory Commission to produce low-enriched uranium (LEU) domestically.

- Holds the only U.S. license for producing high-assay low-enriched uranium (HALEU), crucial for next-generation reactors.

- Operates an enrichment facility in Piketon, Ohio, potentially able to supply about 25% of the U.S. nuclear fuel demand, equivalent to the recent Russian uranium imports.

The Ohio plant has yet to commence full commercial operations but is producing small amounts of HALEU currently purchased by the Department of Energy.

Historical Context of U.S. Uranium Enrichment

The U.S. previously led the uranium enrichment industry, operated by the federal government until the 1990s. Post-privatization and increasing foreign competition led to domestic challenges, culminating in bankruptcy and market withdrawal of previous entities.

Challenges and Strategic Outlook

Despite reliable European partners, dependency on foreign state-owned corporations poses risks amid global trade tensions. Centrus’ CEO emphasizes the need for robust domestic enrichment capacity to ensure supply security and competitive market dynamics.

Key strategic points include:

- Replacing Russian uranium imports banned by 2028.

- Expanding enrichment capacity to meet growing nuclear power demands.

- Government collaboration through public-private partnerships to secure funding and support.

Government Support and Industry Outlook

Federal directives aim to bolster uranium enrichment capabilities in the U.S. Congress has allocated $3.4 billion to support domestic enrichment initiatives and reduce foreign dependence.

Centrus is actively pursuing this funding and balancing private financing efforts. The company envisions not only restoring domestic supply but also capturing greater market share in both LEU and HALEU segments.

Conclusion: Toward a Competitive American Nuclear Fuel Industry

Centrus Energy’s efforts represent a critical step toward reestablishing the U.S. as a significant player in uranium enrichment. Success depends on increasing domestic capacity, fostering competitive markets, and leveraging public-private collaboration to ensure energy security amidst rising nuclear ambitions.