Wall Street Raises Doubts Over Government Inflation Data Accuracy Ahead of Key CPI Release

As financial markets brace for this week’s critical inflation reports, a simmering unease has surfaced beyond the headline figures. Leading economists, investors, and policy analysts have voiced growing skepticism about the reliability of U.S. government inflation data, just as the Bureau of Labor Statistics (BLS) prepares to publish its July Consumer Price Index (CPI) and Producer Price Index (PPI) readings.

Recent developments—including significant budget cuts forcing alterations in the BLS's data collection methods, combined with the abrupt firing of the bureau’s commissioner—have fueled concerns about potential compromises to data quality and impartiality. Given that BLS figures underpin pivotal policy decisions, Social Security benefit calculations, and broader economic forecasts, any doubts about their accuracy trigger far-reaching implications.

Budget Constraints and Leadership Shake-Ups Cloud Data Integrity

Over recent years, the BLS has faced chronic funding reductions, compelling it to reduce field staff and increasingly rely on imputed data—estimates substituted for missing responses—especially in its CPI measurements. The agency recently ceased gathering CPI data in several cities, substituting prices from other urban areas. Experts caution these 'different cell' imputations may increase variability and uncertainty in inflation readings.

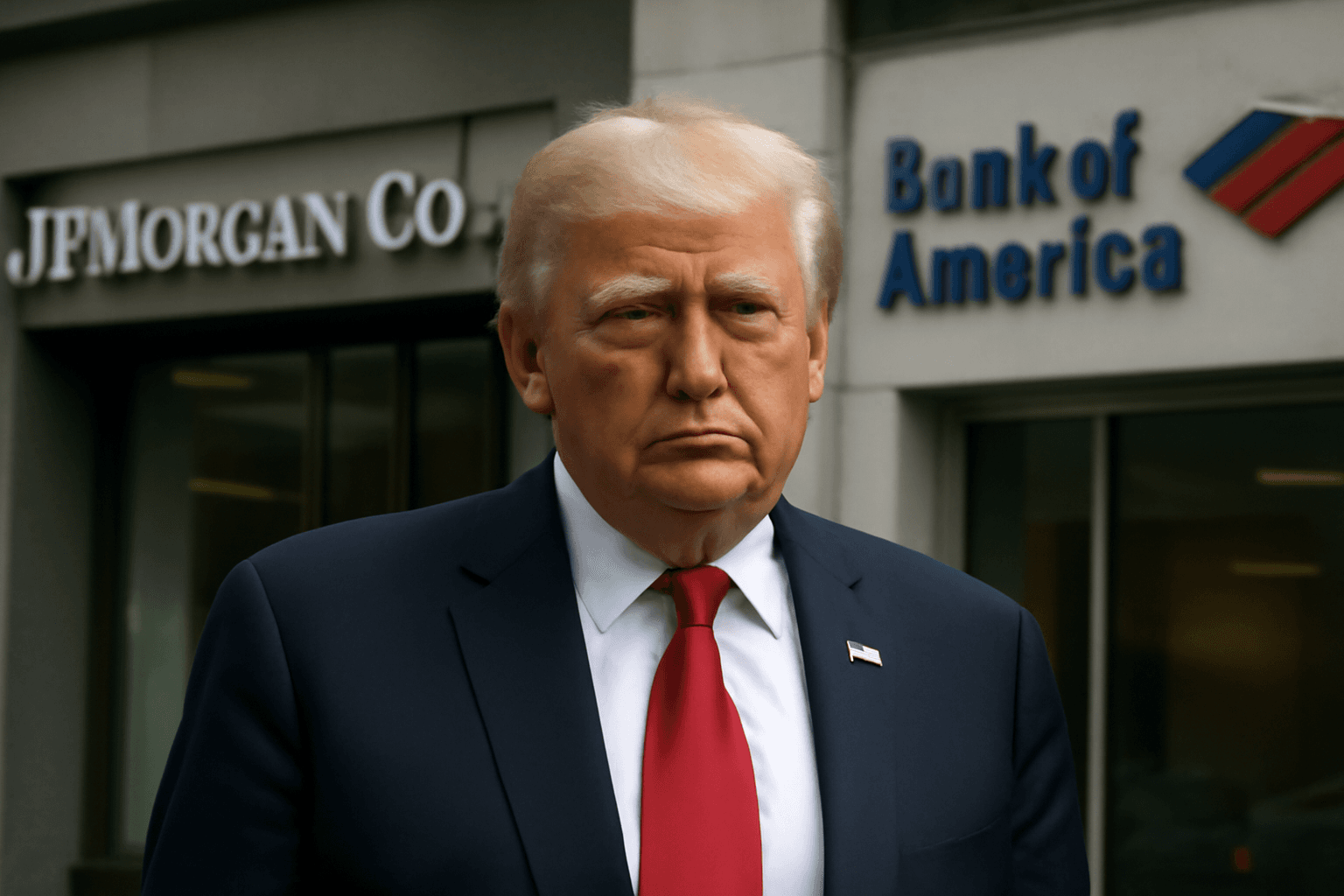

On top of these methodological shifts, the agency’s leadership was thrust into controversy when President Donald Trump dismissed Erika McEntarfer, then-commissioner of the BLS, shortly after the publication of July’s nonfarm payroll numbers. While allegations that the BLS manipulated data for political purposes remain unsubstantiated—drawing skepticism from most economists—the move intensified fears about political interference in a traditionally apolitical agency.

Jeffrey Gundlach, CEO of DoubleLine Capital, expressed his apprehensions on CNBC, stating, “I feel like this data that is coming out is getting much less reliable, and this has been building for a long time.” Likewise, Michael Gapen, Morgan Stanley’s chief U.S. economist, highlighted in a recent note how “questions are mounting over whether the quality of official data could be compromised by these leadership and budgetary challenges.”

Understanding the Stakes: Why Inflation Data Trust Matters

The BLS’s inflation metrics, particularly the CPI and PPI, are cornerstones for economic policymaking. The Federal Reserve’s decisions on interest rates hinge on these precise inflation signals, influencing borrowing costs, employment strategies, and market sentiment. Accurate inflation data also affect cost-of-living adjustments in Social Security and other federal programs.

Market forecasts anticipate a 0.2% rise in July's CPI with a year-over-year inflation rate near 2.8%. Core inflation excluding volatile food and energy prices is expected to show a modest uptick. These nuanced shifts could sway whether the Fed opts to hold rates steady or proceed with cuts later this year—a debate already sharply divided among economists.

Expert Insights and Underreported Concerns

- Survey Response Declines: The BLS primarily relies on phone and mail surveys for job and price data, but response rates have steadily declined. This trend compounds reliance on statistical imputations, increasing risks of measurement error.

- Imputed Data Impact: Approximately 35% of BLS price data involves some form of imputation. While localized imputations are generally reliable, using data from different urban areas introduces uncertainty—a factor often overlooked in market analyses.

- Political Ramifications: Beyond technical issues, the recent commissioner firing raises critical questions about safeguarding the independence and credibility of government statistics—a matter of democratic importance as well as market integrity.

- Potential Market Volatility: Increased data volatility could trigger sharper market swings as investors react to inflation reports, complicating Fed policy guidance and Treasury market forecasts.

Looking Ahead: What Investors and Policymakers Should Watch

While some economists, including Bank of America’s Aditya Bhave, maintain cautious confidence in the data’s core reliability, they urge care in interpreting initial job growth figures and inflation estimates that may undergo sizable revisions. Wall Street will scrutinize tariff-sensitive components within the CPI closely, as their movement could materially influence the Fed’s monetary stance.

With opinions split between those expecting rate cuts later this year and others forecasting a hold, precision and transparency in government data collection remain crucial to informed decision-making. Morgan Stanley’s Gapen encapsulates the challenge: “The new BLS methods shouldn’t bias inflation estimates systematically but are likely to increase volatility, making the details behind the numbers more important than ever.”

Editor’s Note: Navigating Data Trust in a Politicized Era

Behind every inflation number lies a complex web of data collection, statistical methods, and institutional integrity. In an era of political polarization and fiscal constraints, the trustworthiness of government economic data is not just a technical issue—it feeds into market confidence, policy validity, and public trust.

This week’s CPI and PPI reports are more than economic barometers; they are litmus tests for how well American institutions adapt to challenges while maintaining transparency and impartiality. Observers should watch not only the figures themselves but also how revisions unfold and what insights experts share in the aftermath.

Ultimately, these unfolding dynamics raise pivotal questions: How can we safeguard the independence of key statistical agencies amid political pressures? What investments are needed to modernize data collection for a rapidly evolving economy? And how should market participants balance reliance on government data with growing uncertainties? These debates will shape the future of economic policymaking and market stability alike.