Trump's Economic Boom Promises Under Scrutiny

President Donald Trump has once again forecasted an unprecedented economic surge during his current term. However, a closer look at U.S. economic performance since the Reagan era suggests such a boom is improbable. The most robust growth and job creation periods occurred before Trump's first term, and repeating or exceeding those achievements now faces significant hurdles.

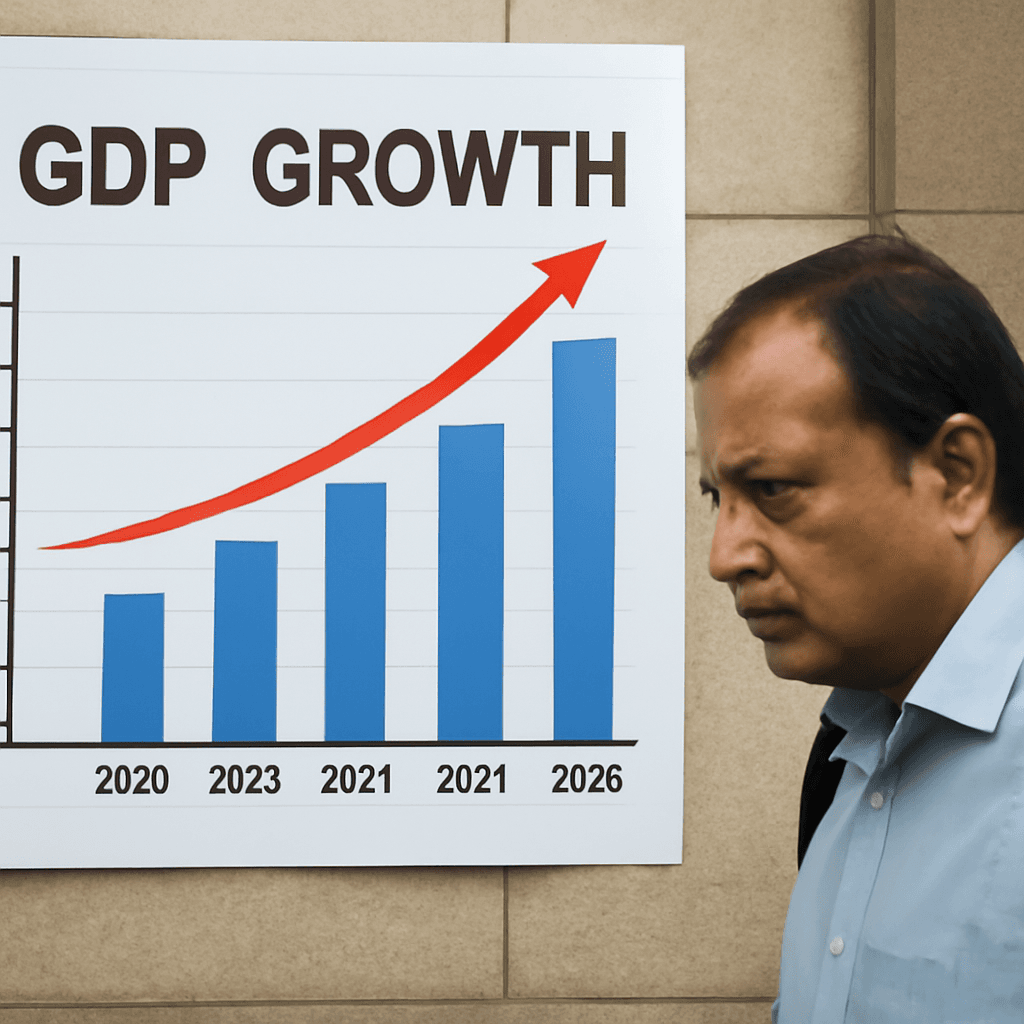

Looking Back: The Greatest U.S. Economic Booms

The standout economic period in recent decades was during Bill Clinton's presidency. His two terms saw nearly 4% average annual GDP growth, the addition of over 240,000 jobs per month, and inflation rates maintaining an impressively low average under 3%. The unemployment rate dropped from 7.3% at the start of Clinton’s term to 3.8% by 2000.

In contrast, Trump's first term recorded job growth of under 200,000 per month, paralleling the pace during the latter years of the previous administration. GDP growth averaged 2.3%, and inflation hovered just below previous levels. Of course, the COVID-19 pandemic skewed these figures due to the brief but severe recession experienced under his watch.

Examining the Spending Bill’s Impact on Growth

Despite talks of a "big beautiful bill," the proposed spending legislation largely preserves tax rates from 2017 instead of introducing new stimulative measures. Notably, the much-anticipated corporate tax cut from 21% to 15% did not materialize.

While the bill aims to make many existing tax provisions permanent and eliminates certain taxes on tips, overtime, and Social Security, these changes might produce unintended consequences—employers could seek ways to reduce wages when tips and overtime earnings aren't taxed.

Moreover, fears that failing to pass the bill would trigger a 68% tax hike are overstated. Analyses indicate a more likely scenario involves a modest 7% tax increase for about 68% of Americans, a far cry from the dramatic surge warned by the administration.

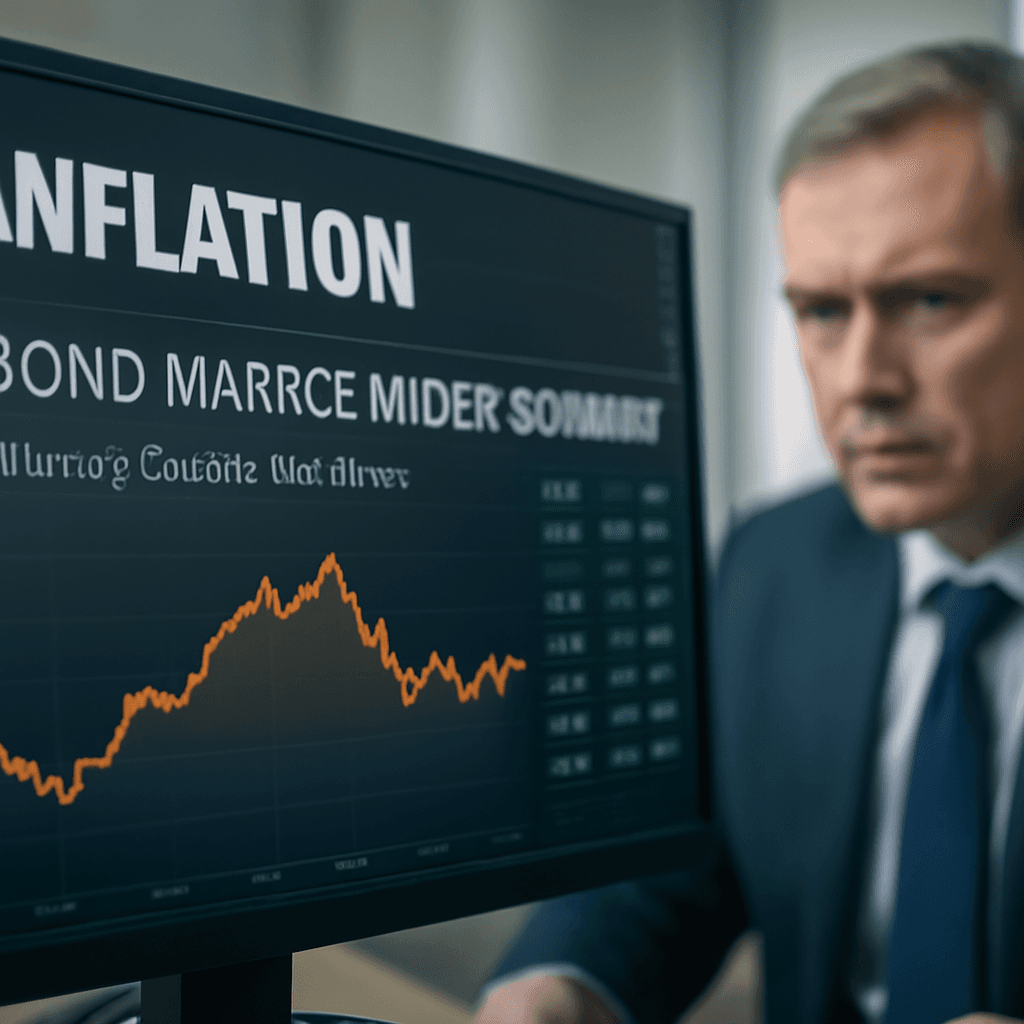

Signs of Economic Slowdown

Inflationary pressures and recently imposed tariffs are already curtailing consumer spending, signaling a deceleration rather than acceleration in growth. Job creation has moderated over recent months, unemployment claims are rising, layoffs are increasing, and many consumers are tapping credit cards just to cover essential expenses.

Additionally, reductions in welfare programs such as Medicaid and food stamps pose significant challenges for lower-income households, potentially deepening the economic drag embedded in the bill.

Budget Deficits and Federal Spending Cuts

The bill projects to increase the national deficit by between $2.4 trillion and $3.3 trillion over the next decade, adding pressure to a federal debt that already stands at a staggering $36.2 trillion. This growing fiscal imbalance could prompt investors to demand higher interest rates to offset perceived risks, increasing borrowing costs for the government.

Further complicating matters, spending cuts are impacting vital areas such as technology, healthcare, and education—sectors that traditionally drive competitiveness and growth in the U.S. economy.

Why Past Successes Aren't a Guarantee for Today

Clinton’s economic success was achieved in an environment with higher tax rates, yet led to the addition of more than 22 million jobs and a transition from budget deficit to surplus. Currently, no proposed policies seem geared toward replicating such outcomes. Even though the current administration is presiding over a significant technological revolution, the policy framework lacks the bold measures needed for a similar growth explosion.

Looking Ahead: What Would It Take to Ignite Real Growth?

For this "big beautiful bill" to foster meaningful prosperity across all Americans—not just benefit a select few billionaires—it would require substantial changes. Bold, growth-oriented reforms targeting innovation, equitable income growth, and strategic investments in key sectors could help spark a sustainable economic revitalization.

Until then, expectations for a dramatic economic boom remain cautious at best.