10-Year Treasury Yield Edges Lower as U.S. and China Continue Talks

The 10-year Treasury yield dipped slightly on Tuesday as American and Chinese officials resumed trade negotiations in London for a second consecutive day.

Specifically, the 10-year yield fell by 1.2 basis points to settle at 4.472%. Meanwhile, the 5-year Treasury yield gained over one basis point, reaching 4.016%, and the 30-year yield declined by 2.3 basis points to 4.931%.

Note: One basis point equals 0.01%, or one-hundredth of a percent. In bond markets, yields move inversely to prices — when prices rise, yields fall, and vice versa.

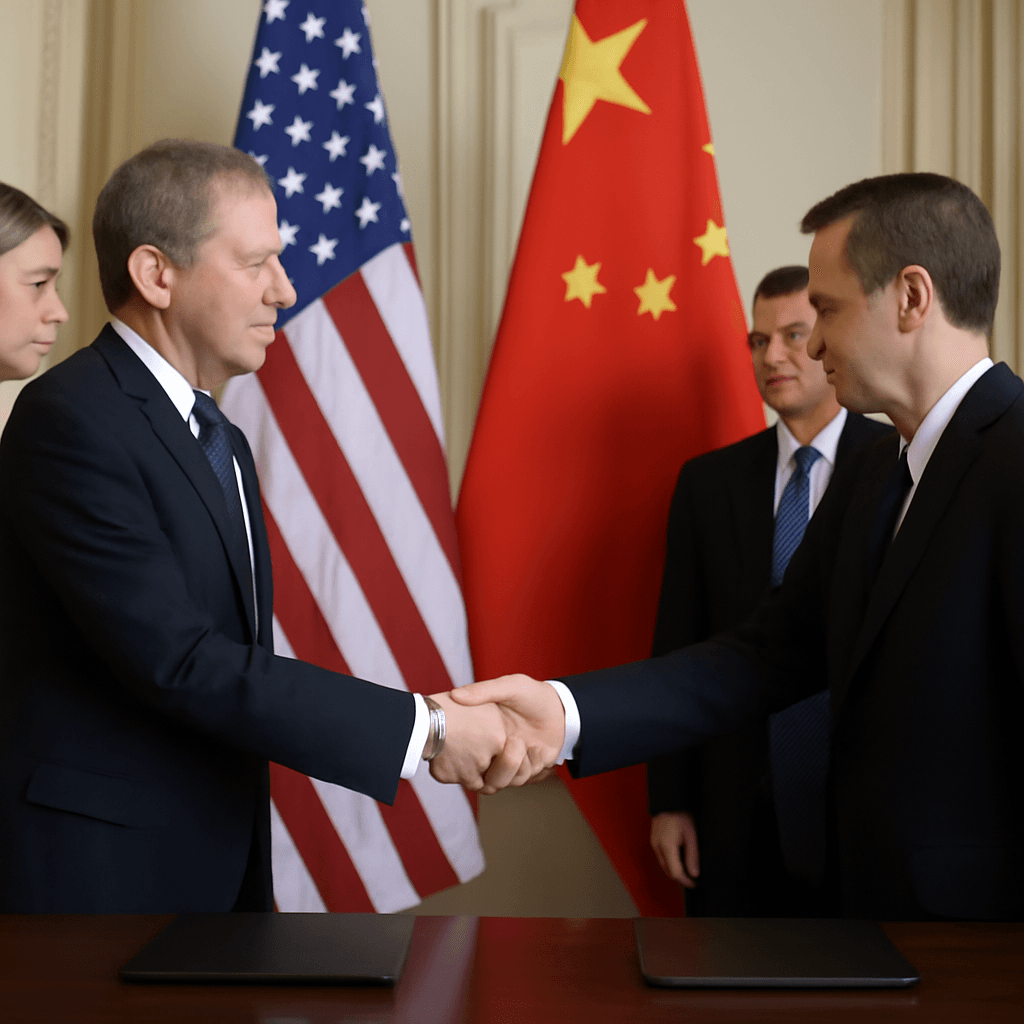

Diplomatic Efforts Underway in London

Trade talks kicked off on Monday in London, featuring top U.S. officials including Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick, and Trade Representative Jamieson Greer. The discussions carried on through Tuesday, with the delegation prepared to extend talks into Wednesday if necessary.

Speaking to reporters, Commerce Secretary Lutnick expressed optimism: "I think the talks are going really, really well. We're fully committed and all hands are on deck, working closely together."

Context: Rising Tensions and Economic Pressures

The renewed talks come amid weeks of growing trade tensions between the two nations, sparked by sweeping import tariffs imposed by the U.S. earlier in April on China and other key trade partners. These negotiations follow a recent high-level conversation between President Donald Trump and Chinese President Xi Jinping.

Why China Is Motivated to Negotiate

Economic factors are also at play — China is currently facing deflationary pressures that increase its urgency for a mutually beneficial trade deal. Consumer prices in China have declined for four months running, with the Consumer Price Index falling 0.1% year-on-year in May.

Looking Ahead

Market watchers will be closely monitoring these talks, as progress could ease uncertainty in global markets and influence Treasury yields. For now, the modest dip in the 10-year yield reflects cautious optimism amid delicate diplomatic maneuvering.