Overview of the Soul Patts and Brickworks Merger

Two prominent Australian companies, Washington H. Soul Pattinson (commonly known as Soul Patts) and Brickworks, have announced a significant merger valued at approximately A$14 billion (around $9 billion). This deal has sent the shares of both firms soaring on the Sydney stock exchange.

Share Price Surge and Market Impact

Following the announcement, Soul Patts’ shares jumped by 13.78%, while Brickworks, Australia's leading brick manufacturer, surged by 22.32% as of early afternoon trading.

Details of the Merger Structure

The merger will create a newly listed company in Sydney that will acquire all outstanding shares of both Soul Patts and Brickworks. The combined entity’s portfolio spans diverse sectors including real estate, private equity, and credit, with total holdings valued at approximately A$13.1 billion.

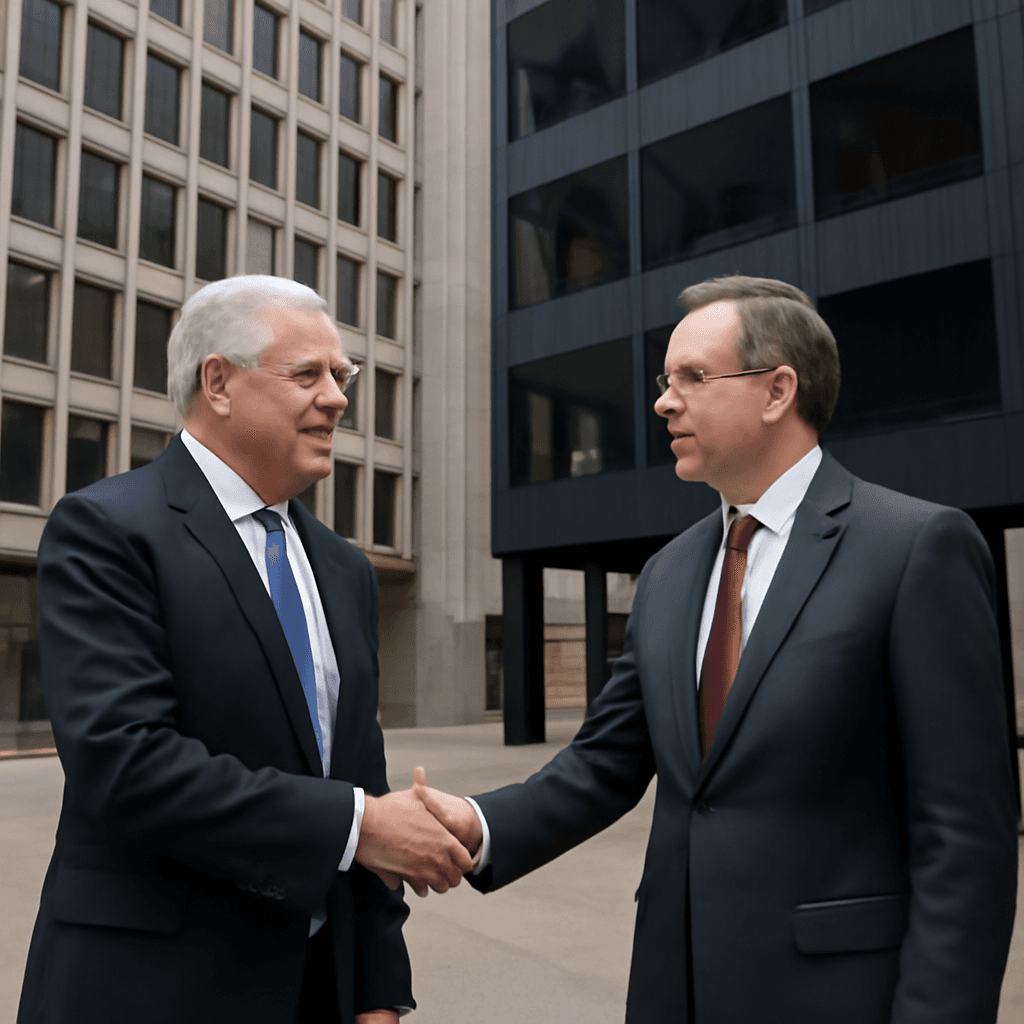

Todd Barlow, CEO and Managing Director of Soul Patts, emphasized the strategic and financial advantages of the merger, stating that it simplifies the corporate structure, increases scale, and enhances the investability of the new company.

Ending a 56-Year Cross-Ownership Arrangement

This merger will unwind a 56-year mutual ownership arrangement originally designed to prevent hostile takeovers and foster long-term investment. Historically, Soul Patts held a 43% stake in Brickworks, and vice versa, but critics argued that this structure hindered shareholder value and limited transparency.

The deal includes an implied value for Brickworks shareholders of A$30.28 per share, which reflects a 10.1% premium over the stock’s previous closing price.

Advisory Roles and Historical Context

Pitt Capital Partners is advising Soul Patts, with Citigroup Global Markets Australia advising Brickworks.

Efforts to dismantle the complex cross-shareholding between these two firms have taken place over the years, including attempts by asset managers and investors from 2012 to 2017. However, the Federal Court upheld the structure, deeming it not harmful to shareholders.

Investor Perspectives and Market Reactions

Some investors previously avoided these companies due to the complexity and the discount at which their shares traded compared to industry peers. However, market analysts note that the current merger is positively received, as evidenced by the strong share price reactions.

According to market experts, although this merger may not be among the largest in Australia’s M&A history, the enthusiastic investor response indicates confidence in the strategic move.