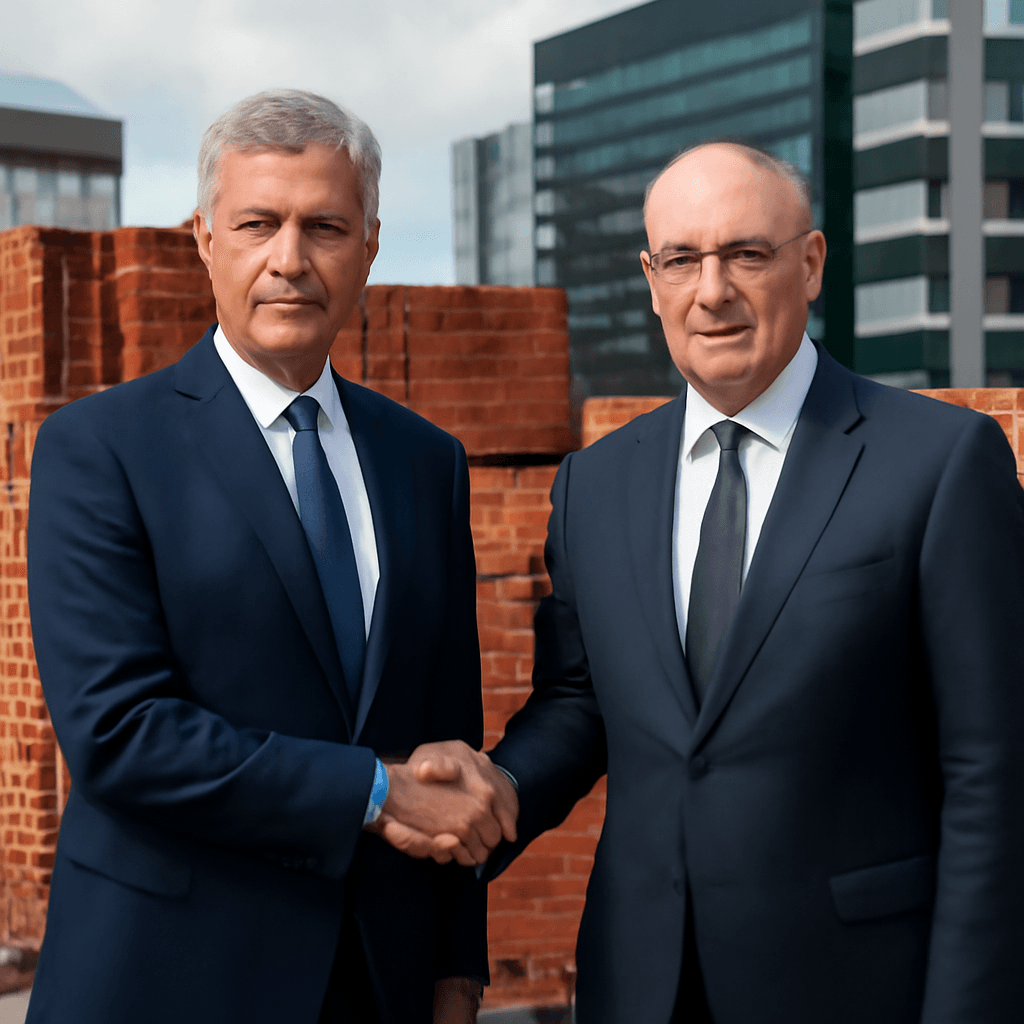

Overview of the Merger

Australian investment company Washington H Soul Pattinson has announced plans to acquire its building products affiliate, Brickworks, in a transaction valuing Brickworks at approximately A$4.62 billion (US$3 billion). This move will result in the formation of a new entity listed in Australia with a total valuation estimated at A$14 billion (US$9 billion).

Ownership Structure and Shareholder Details

The merger will create a combined company where Washington H Soul Pattinson shareholders will hold a majority stake of 72%. Brickworks shareholders will own around 19% of the new firm, while the remaining shares will be allocated to new investors.

Before the deal, Soul Pattinson already owned a 43% stake in Brickworks, which in turn held a 26% stake in Soul Pattinson, reflecting the affiliation between the two companies.

Financial Commitments and Premium Offer

The new company has secured commitments for A$550 million worth of shares, with full underwriting provided by Aitken Mount Capital to support the transaction.

The acquisition offer implies a value of A$30.28 per Brickworks share, representing a premium of 10.1% over the stock's last closing price, providing an incentive for Brickworks shareholders to approve the transaction.

Strategic Implications

This merger aims to consolidate Australia’s building products market by integrating the complementary strengths of both companies, enhancing operational efficiencies, and creating shareholder value in a competitive industry.