Trump Administration Demands Profit Share from Semiconductor Giants Nvidia and AMD

In a move that has sent ripples through the global technology sector, the Trump administration has negotiated an unprecedented deal requiring leading American chipmakers Nvidia and AMD to surrender 15% of their profits from sales of high-end semiconductors in China to the U.S. government. This controversial agreement, confirmed in mid-August 2025, marks a significant escalation in Washington’s assertive stance on technology exports amid ongoing geopolitical tensions with China.

Background: Restricting Sales, Then Taking a Cut

Earlier this year, the Trump administration clamped down on sales of Nvidia’s advanced H20 AI chips to China, emphasizing national security concerns by suspending exports. However, after months of negotiation, export licenses for select products, including AMD’s MI308 processors, have begun trickling through, but not without strings attached.

The new terms reportedly compel Nvidia and AMD to channel a substantial portion—15%—of their revenue generated from Chinese markets straight into U.S. federal coffers. This approach, according to officials, is a novel way to ensure that American technological dominance yields direct fiscal benefits, especially amidst broader trade frictions.

Market Reactions and Industry Concerns

The announcement has sparked immediate concern among investors and industry watchers alike. Nvidia and AMD shares declined in pre-market trading—by roughly 1.8% and 3.3%, respectively—reflecting uncertainty about the long-term implications on profitability and international competitiveness.

Industry representatives have voiced ambiguity and caution. When contacted, an Nvidia spokesperson reaffirmed compliance with U.S. export regulations without detailing the specifics of the revenue-sharing arrangement, stating: "We follow rules the US government sets for our participation in worldwide markets." AMD has remained silent on the issue.

Expert Insight: Balancing Security and Business Interests

Critics, including former Commerce Department adviser Alasdair Phillips-Robins, argue that this arrangement could undermine the traditional alignment of national security with trade policy.

"If accurate, this move indicates a troubling trade-off where national security safeguards are being sacrificed to fill Treasury coffers," Phillips-Robins commented.

This tension highlights the complex interplay between technological innovation, economic strategy, and geopolitical rivalry, particularly as the U.S. seeks to maintain a technological edge without alienating key global markets like China.

Contextualizing the Agreement amid U.S.-China Tech Tensions

China’s Foreign Ministry condemned the U.S. measures as attempts to suppress China's technological advancement through trade restrictions. The ministry has repeatedly accused the U.S. of weaponizing technology policy for strategic containment.

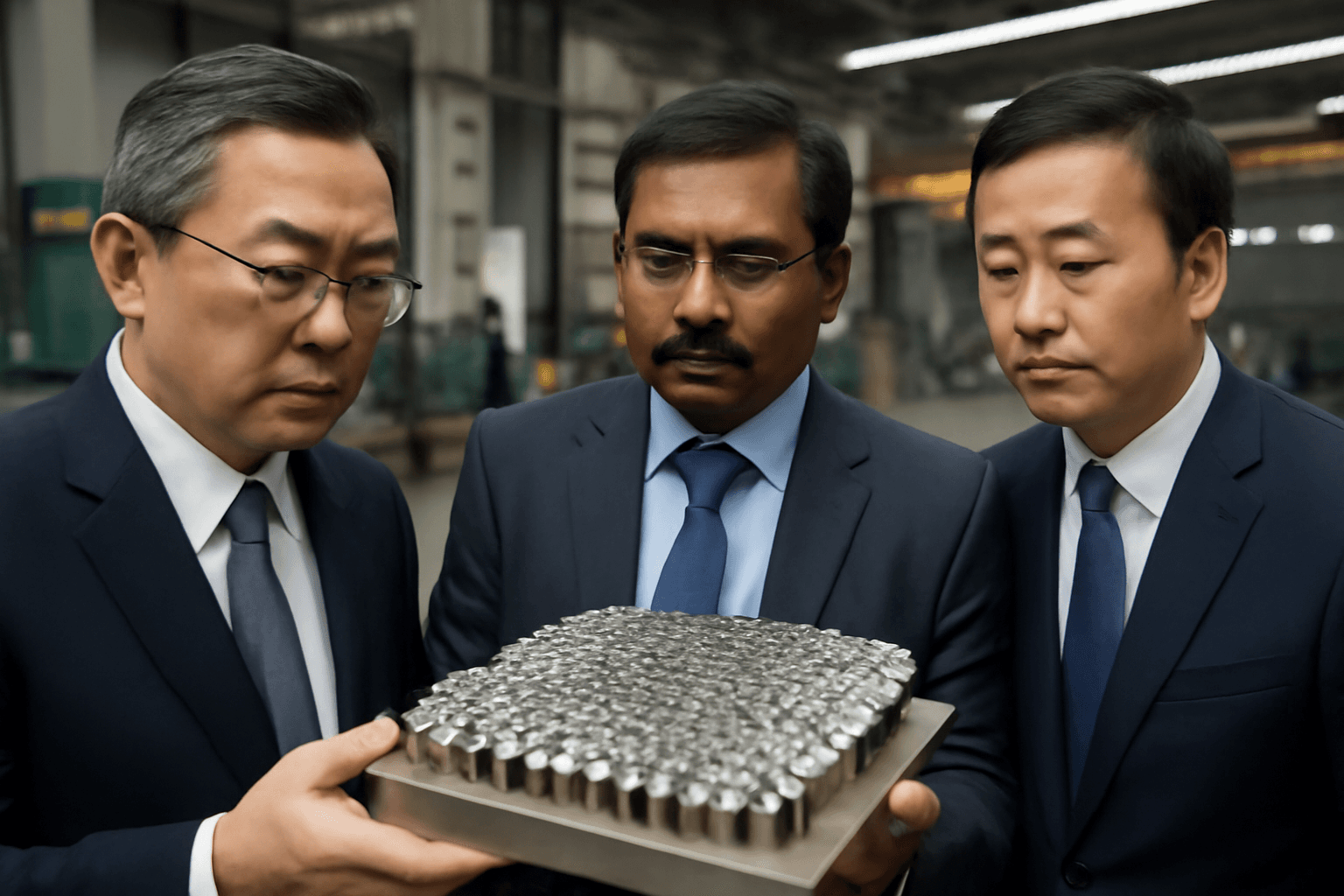

Meanwhile, U.S. Commerce Secretary Howard Lutnick framed the partial resumption of AI chip exports not only as a calculated economic concession but also as a means to secure vital rare earth elements from China. He downplayed the significance of the H20 chip, describing it as Nvidia’s "fourth-best" chip, suggesting that the most sensitive technology remains off-limits.

Trump's Broader Economic Playbook

This deal fits into a larger pattern of President Trump’s recent pressure tactics on the American tech industry. Last week, Trump publicly questioned Intel’s incoming CEO Lip-Bu Tan over alleged conflicts of interest related to China and urged CEOs to prioritize investments that boost U.S. manufacturing and employment.

Such maneuvers reflect a growing trend of political leaders leveraging economic tools to enforce national priorities, raising questions about corporate autonomy, global supply chains, and the future of U.S.-China tech relations.

What Lies Ahead?

- Implementation details of the profit-sharing deal remain unclear.

- Industry stakeholders are watching how this affects U.S. semiconductor competitiveness in China.

- Upcoming meetings between Trump and Intel’s CEO may signal further intervention in tech sector governance.

Editor’s Note

This unprecedented 15% revenue-sharing agreement spotlights the increasingly complex intersection of national security, trade policy, and corporate America's global ambitions. It raises critical questions about the sustainability of imposing financial levies on private companies as a tool of geopolitical strategy. Will this move safeguard U.S. interests, or will it invite unintended economic consequences? As semiconductor technology becomes central to both economic prosperity and national defense, balancing open markets with strategic control remains a tightrope walk for policymakers and industry leaders alike.