Understanding the Unprecedented Nvidia and AMD Revenue Sharing with the U.S. Government

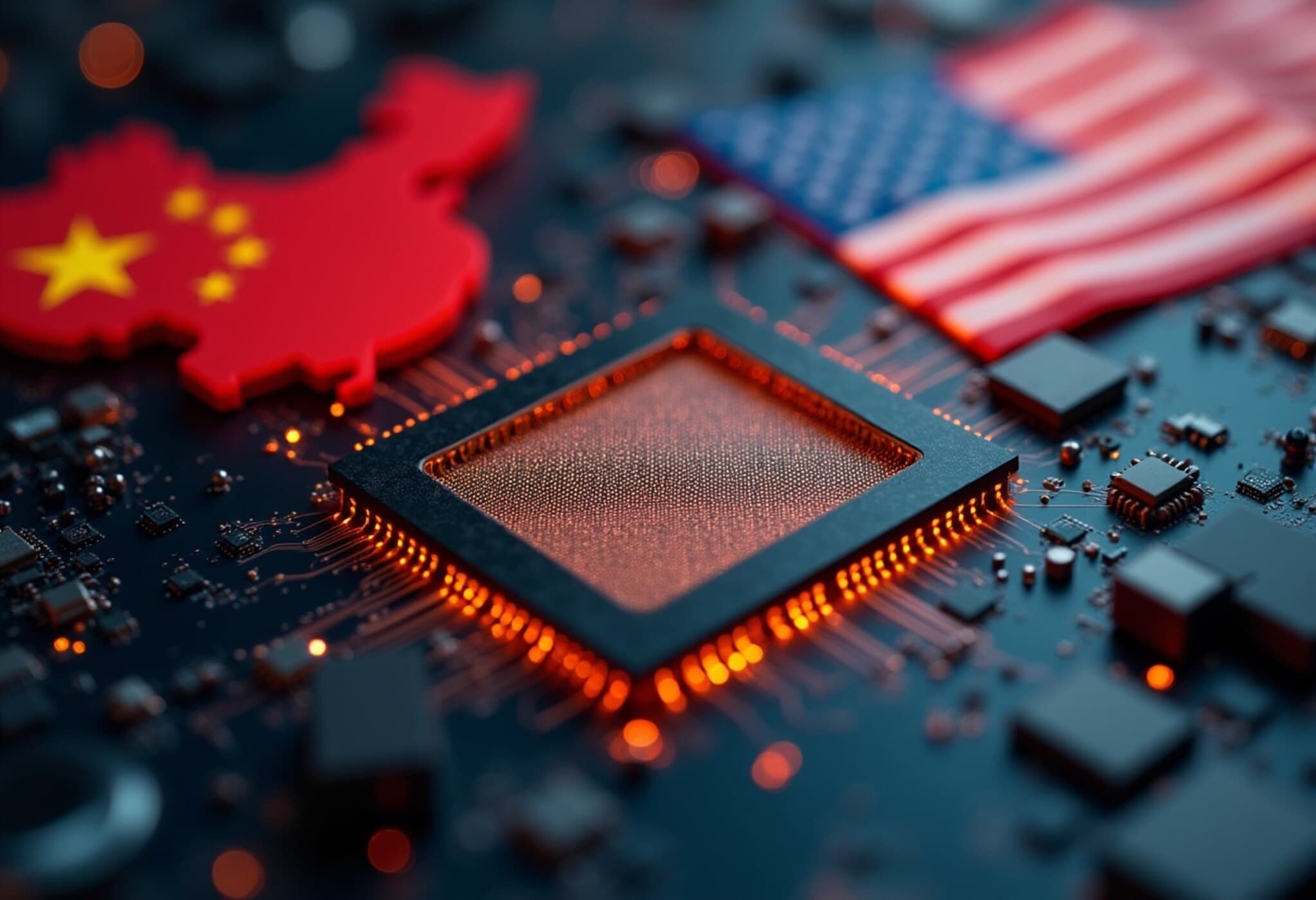

In a unique development stemming from U.S.-China technology tensions, semiconductor giants Nvidia and AMD have reportedly agreed to remit 15% of their revenue from chip sales to China back to the U.S. government.

This arrangement, which was engineered under then-President Donald Trump's administration, grants the companies export licenses to sell advanced chips like Nvidia's H20 and AMD's MI308 in China—one of the globe's largest and most competitive markets.

What Does This Mean for Nvidia and AMD?

The deal reflects a strategic trade-off. Previously, stringent export curbs had blocked both companies from shipping their high-performance AI chips to China. Nvidia's H20 chip was specifically redesigned to comply with these export controls, enabling it to re-enter the Chinese market. AMD followed suit with the resumption of shipments of its MI308 chip.

From a business perspective, analysts view the 15% revenue sharing as a calculated compromise. Despite the financial cut, maintaining access to China—which represents billions in potential sales—is generally seen as a win compared to being shut out entirely.

- Ben Barringer, a global technology analyst, highlighted that "85% of revenue is better than zero," emphasizing the pragmatic investor stance toward the deal.

- Still, questions linger about whether Nvidia and AMD will need to adjust pricing to offset this effective levy and how sustainable such revenue sharing might be if sales volumes surge.

Long-Term Implications and Investor Sentiment

While short-term certainty for exports to China is a positive, industry experts caution about potential uncertainties ahead. George Chen, partner and co-chair at The Asia Group, noted the possibility that future U.S. administrations could demand even higher revenue shares as American interest in protecting its semiconductor leadership intensifies.

Notably, Nvidia and AMD’s shares experienced only marginal declines following the news, signaling investor confidence that the deal preserves critical China market access.

The Trump Administration’s Unorthodox Approach

This revenue-sharing arrangement departs from traditional export controls and tariffs. Analysts describe it as an "unusual" yet very Trump-esque deal—transactional and direct. The deal mirrors President Trump’s reputation as a tough negotiator who seeks immediate returns rather than prolonged diplomatic maneuvers.

Neil Shah from Counterpoint Research equates the 15% revenue payment to an "indirect tariff at source," while Daniel Newman, CEO of The Futurum Group, characterizes it as a "tax for doing business in China." However, experts like Nick Patience suggest such a model is unlikely to extend beyond semiconductors to sectors like software or services, where business models are more complex.

Geopolitical Context and China’s Potential Response

Semiconductors lie at the heart of current U.S.-China technology tensions. The U.S. views chips as critical to economic and national security, underpinning everything from AI innovations to military hardware.

China, meanwhile, faces a dilemma. It desperately needs cutting-edge chips to propel AI ambitions but is wary of the costs and perceived risks. Tensions recently escalated when Chinese state-affiliated media accused Nvidia's H20 chips of harboring "backdoors." Nvidia firmly denied these claims.

The Chinese state-run Global Times criticized the U.S. approach, suggesting it undercuts Washington’s original security argument for export restrictions, instead revealing an economic leverage strategy.

Though the Chinese government has yet to officially comment on the revenue-sharing deal, it represents a contentious chapter in the broader tech rivalry.

Broader Industry and Policy Implications

- The deal highlights how critical semiconductor technology has become in U.S. strategic policy and economic diplomacy.

- It raises questions about the future shape of export controls—whether direct revenue-sharing or "pay-to-play" models might become a template in other sensitive technology sectors.

- It emphasizes the growing complexity for multinational companies navigating geopolitical flashpoints while trying to tap lucrative foreign markets.

Conclusion

The Nvidia and AMD agreement with the U.S. government reflects the intersection of national security concerns, global technology competition, and high-stakes business strategy. While securing access to China preserves commercial opportunity, the revenue-sharing model opens a novel front in trade and export controls that could reverberate throughout the semiconductor industry and beyond.

Editor’s Note:

This unprecedented 15% revenue levy imposed on Nvidia and AMD's China sales not only underscores the instrumental role of semiconductors in geopolitical strategy but also signals a shift toward more transactional and economically leveraged trade policies from the U.S. government. Readers should watch closely how this affects pricing, competitive dynamics with Chinese chip makers like Huawei, and potential ripple effects across other strategic sectors. The deal also raises critical questions about the balance between safeguarding technology leadership and engaging pragmatically in global markets.