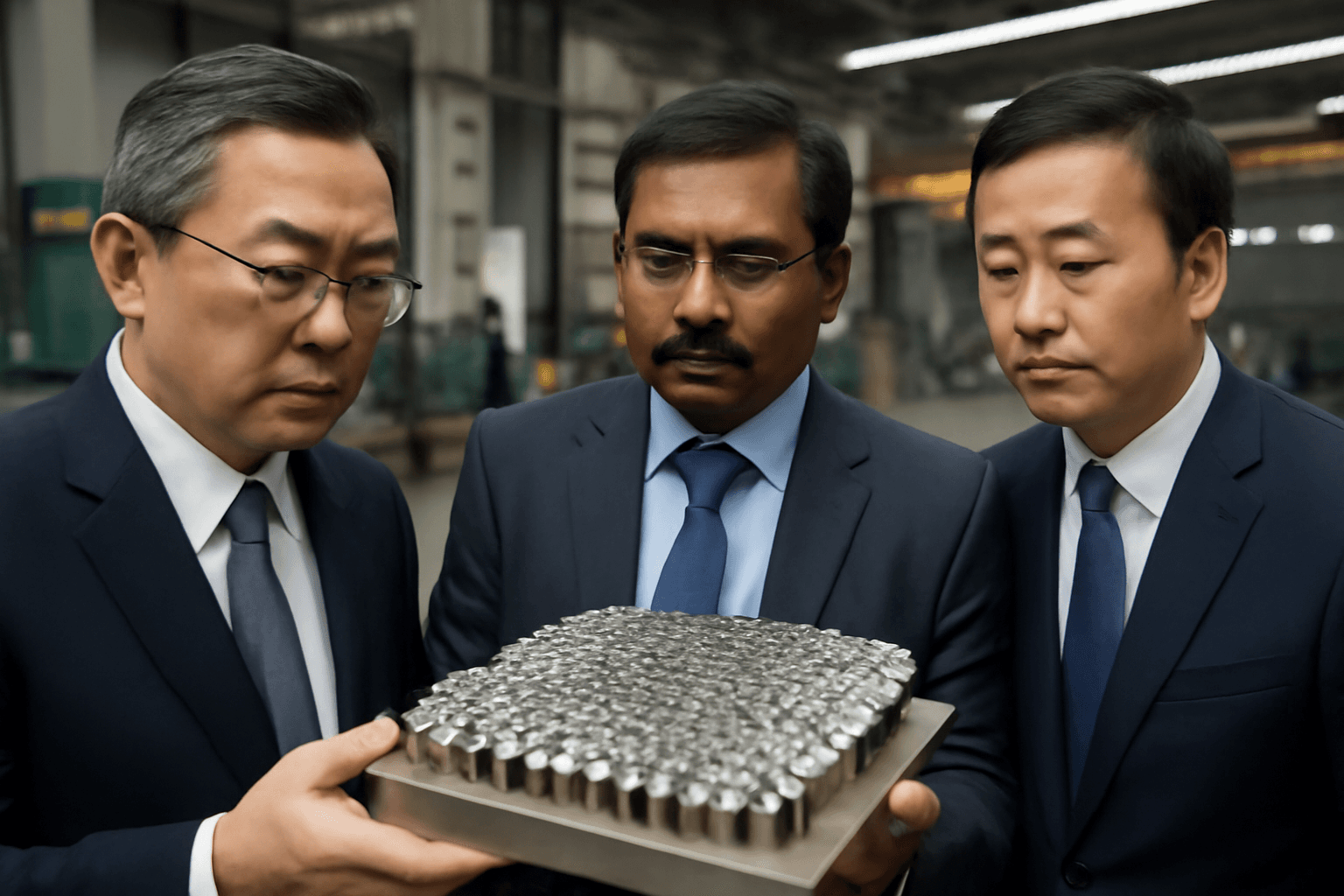

Nvidia and AMD Strike Unprecedented Deal with U.S. Government Over China Chip Sales

In a move that highlights the growing complexity of the global semiconductor trade, chip giants Nvidia and AMD have agreed to remit 15% of their revenue from certain chip sales in China back to the U.S. government. This groundbreaking agreement, reported by the Financial Times, allows both companies to secure export licenses for key products — Nvidia's H20 AI chip and AMD's MI308 GPU — ensuring continued access to the lucrative Chinese market.

Strategic Trade Negotiations Amid Rising Geopolitical Tensions

This deal surfaces as tensions between the United States and China continue to ripple through the semiconductor industry, a sector critical to modern technology and national security. Under the administration's stringent export controls and tariffs, companies face significant hurdles when attempting to sell advanced chips in China.

According to Financial Times sources, this 15% revenue-sharing scheme is part of a calculated U.S. strategy to leverage economic gains while maintaining control over high-tech exports.

Contextualizing the Arrangement: Trade Policy and Corporate Strategy

- Export Licenses Gained: Nvidia’s H20 chip, designed for complex AI computations, and AMD’s MI308 GPU will remain available to China under this agreement.

- Revenue Sharing Impact: The 15% fee functions like a surtax, channeling funds back to the U.S. Treasury while allowing companies to continue business in a critical market.

- Presidential Engagement: Notably, Nvidia CEO Jensen Huang met with former President Donald Trump last week, underscoring the high stakes and political involvement in this sector.

- Trump’s Tariff Stance: Previously, Trump advocated a 100% tariff on imported semiconductors unless the manufacturing occurred domestically, signaling pressure to boost U.S. chip production.

Expert Insight: Navigating Between Protectionism and Globalization

This agreement reflects the U.S. government's evolving approach to balancing national security concerns with global economic realities. The semiconductor supply chain is deeply interconnected, and outright bans could have severe ripple effects on innovation and supply stability.

According to Jane Mitchell, a semiconductor policy analyst at the Brookings Institution, "This 15% revenue share deal might be a diplomatic compromise—securing fiscal benefit from sales while maintaining a foothold in China’s vast market. However, it also raises questions about long-term supply chain resilience and the potential for technology leakage."

Broader Implications for the Semiconductor Industry

As the U.S. pushes to encourage domestic chip manufacturing, with billions invested in incentives like the CHIPS Act, this export licensing deal sets a precedent for nuanced trade policies that go beyond blunt tariffs or outright bans.

Industry observers suggest:

- Companies could face increased compliance complexities and costs associated with revenue sharing and export licenses.

- Competitors in regions like Taiwan and South Korea may react strategically, potentially accelerating their own advancements.

- Chinese market dynamics could shift, with local firms striving harder to develop competitive alternatives amid limited access to U.S. semiconductor technology.

What Remains Unclear?

While the arrangement is a significant development, several critical questions remain unanswered:

- How will the 15% revenue share be audited and enforced?

- Will similar deals emerge for other chipmakers or technology sectors?

- How might this framework evolve under different U.S. administrations or in response to escalating U.S.-China tensions?

Editor’s Note

The semiconductor industry sits at the crossroads of technology, geopolitics, and economics. This novel revenue-sharing agreement between Nvidia, AMD, and the U.S. government illustrates the intricate dance of protecting national interests while engaging with a globalized economy.

As policymakers refine their strategies to foster domestic innovation and security, and as companies navigate these complex waters, the coming years will be pivotal. Observers should watch closely how these arrangements affect global chip supply chains, technological leadership, and ultimately, the consumer electronics that shape everyday life.

Key takeaway: This deal underscores that in today’s tech landscape, trade policies are not just about tariffs—they are about crafting nuanced economic incentives that reflect both national priorities and the realities of an interconnected global market.