Qualcomm Tops Wall Street Estimates with Strong Q3 Performance

Qualcomm, the semiconductor giant renowned for its Snapdragon smartphone chips, delivered better-than-expected results for the fiscal third quarter ending June 29, 2025. The company reported adjusted earnings per share (EPS) of $2.77, surpassing analyst projections of $2.71. Revenue came in at $10.37 billion, slightly above the anticipated $10.35 billion.

Despite these gains, Qualcomm shares dipped in after-hours trading, reflecting market caution amid forward guidance and sector volatility.

Guidance Signals Confidence Amid Industry Challenges

The chipmaker's outlook for the fourth quarter paints a promising picture, with expected adjusted EPS of $2.85 and revenue forecasted at $10.7 billion. Analysts were anticipating $2.83 EPS and $10.35 billion revenue, indicating Qualcomm's conservative yet optimistic stance.

Net income for the quarter increased significantly to $2.66 billion ($2.43 per share) from $2.13 billion ($1.88 per share) a year prior, underscoring the firm's robust profitability.

Handset Chips: Steady, But Facing Headwinds

Qualcomm’s core handset chip segment generated $6.33 billion in revenue, narrowly missing analysts' $6.44 billion forecasts. This division, supplying Snapdragon processors and modems for high-end smartphones like Samsung's flagship devices, remains pivotal.

Looking ahead, Qualcomm acknowledges the looming departure of Apple as a modem customer—a significant shift given Apple's recent strides toward developing proprietary chips. This transition places increased emphasis on Qualcomm’s ability to innovate and diversify.

Diversification: The Future Lies Beyond Smartphones

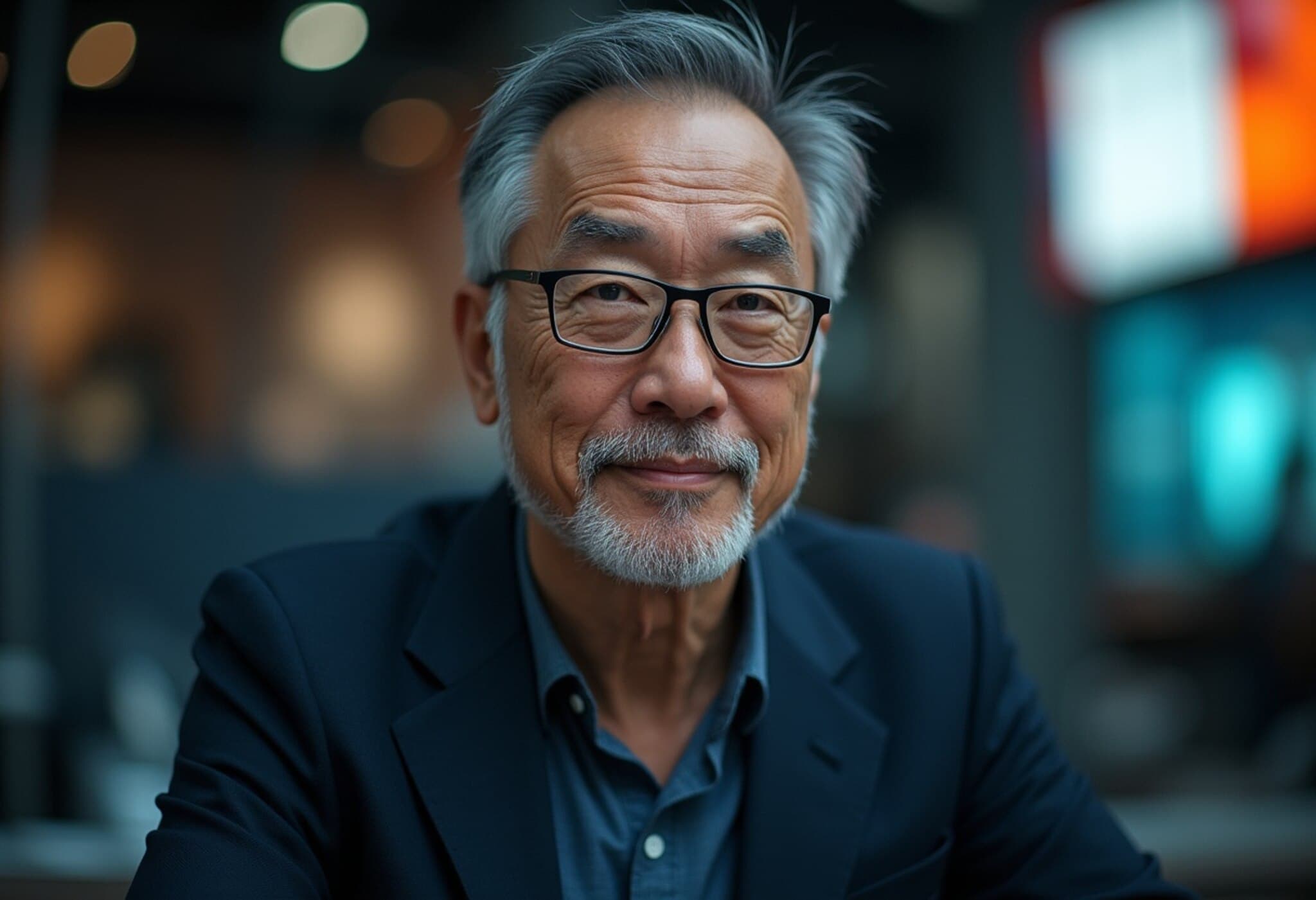

Qualcomm is proactively expanding into emerging technology arenas such as virtual and augmented reality, automotive solutions, and AI-enabled devices. CEO Cristiano Amon accentuated the company’s collaboration with Meta on AI-powered Meta Ray-Ban smart glasses as emblematic of its forward-looking strategy.

Meta’s Ray-Ban smart glasses, integrated with Qualcomm chips, are among the fastest-growing components within Qualcomm’s Internet of Things (IoT) division, which posted revenues of $1.68 billion this quarter. CFO Akash Palkhiwala highlighted Meta’s higher-than-expected chip usage, corroborating upbeat sales insights from EssilorLuxottica, Meta’s Ray-Ban parent company, which recently reported a more than threefold annual increase in smart glasses sales.

Amon described this as a manifestation of the company’s 'personal AI' approach—embedding artificial intelligence directly into wearable devices instead of relying solely on cloud processing. This aligns with broader industry trends towards decentralized intelligence and privacy-preserving technology.

Strategic Moves Into Data Centers and AI

Qualcomm is also staking a claim in the lucrative and rapidly evolving AI data center market. The company is in advanced talks with a major cloud hyperscaler to supply AI-focused chips, aiming to begin generating revenue from this segment by fiscal 2028.

This move diversifies Qualcomm’s portfolio beyond consumer electronics into infrastructure that powers AI workloads for enterprises globally, a sector dominated by established players but ripe for innovation.

Automotive and Licensing Revenue: Steady Growth Amid Market Shifts

The automotive chip business saw robust growth of 21%, reaching nearly $1 billion, though slightly trailing the 24% growth of the IoT segment. Qualcomm’s automotive chips play a crucial role in connectivity and infotainment systems across an expanding ecosystem of connected vehicles.

Separately, licensing fees under the Qualcomm Technology Licensing (QTL) segment—covering key patents in 5G technology—grew 11% to $1.32 billion, contributing to the firm’s recurring revenue streams and reflecting the ongoing global rollout of 5G.

Shareholder Returns and Capital Allocation

During the quarter, Qualcomm returned significant capital to investors, distributing nearly $1 billion in dividends and repurchasing approximately 19 million shares valued at $2.8 billion. These actions signal management’s confidence in the company’s financial health and long-term strategy.

Expert Analysis: Navigating Opportunities and Challenges

Qualcomm’s earnings beat underscores its resilience amid a complex semiconductor landscape marked by supply chain disruptions and intensifying competition. Their strategic shift towards AI-driven devices, especially in collaboration with heavyweights like Meta, positions the company for sustainable growth.

However, losing Apple’s modem business remains a critical headwind. The company’s ability to accelerate innovation in AI chips and IoT devices will be key to offsetting that loss. Furthermore, Qualcomm’s early engagement with hyperscalers could catalyze a competitive foothold in data center AI—a sector offering enormous upside but requiring significant R&D investment.

For investors and industry watchers, Qualcomm’s earnings reveal a company in transition—balancing current handset dominance with ambitious bets on emerging technologies that promise to shape the next decade.

Looking Ahead: What to Watch

- AI chip deployment: Progress in data center partnerships and product launches.

- Smart glasses adoption: Market reception and consumer demand evolution.

- Automotive expansion: Integration with autonomous and connected car systems.

- Licensing landscape: How 5G and future tech deals progress worldwide.

- Competitive dynamics: Qualcomm's positioning against rivals like MediaTek, Apple, and others.

Editor's Note

Qualcomm’s Q3 results spotlight a company navigating inevitable shifts in customer dynamics while seizing emerging growth avenues. Their focus on “personal AI” and expansion into AI and IoT reflect a well-calibrated response to both market challenges and opportunities. For readers tracking technology investments or industry innovation, Qualcomm stands as a bellwether for how chipmakers can thrive beyond just smartphones. Yet, the road ahead demands unwavering focus on execution and market adaptation.