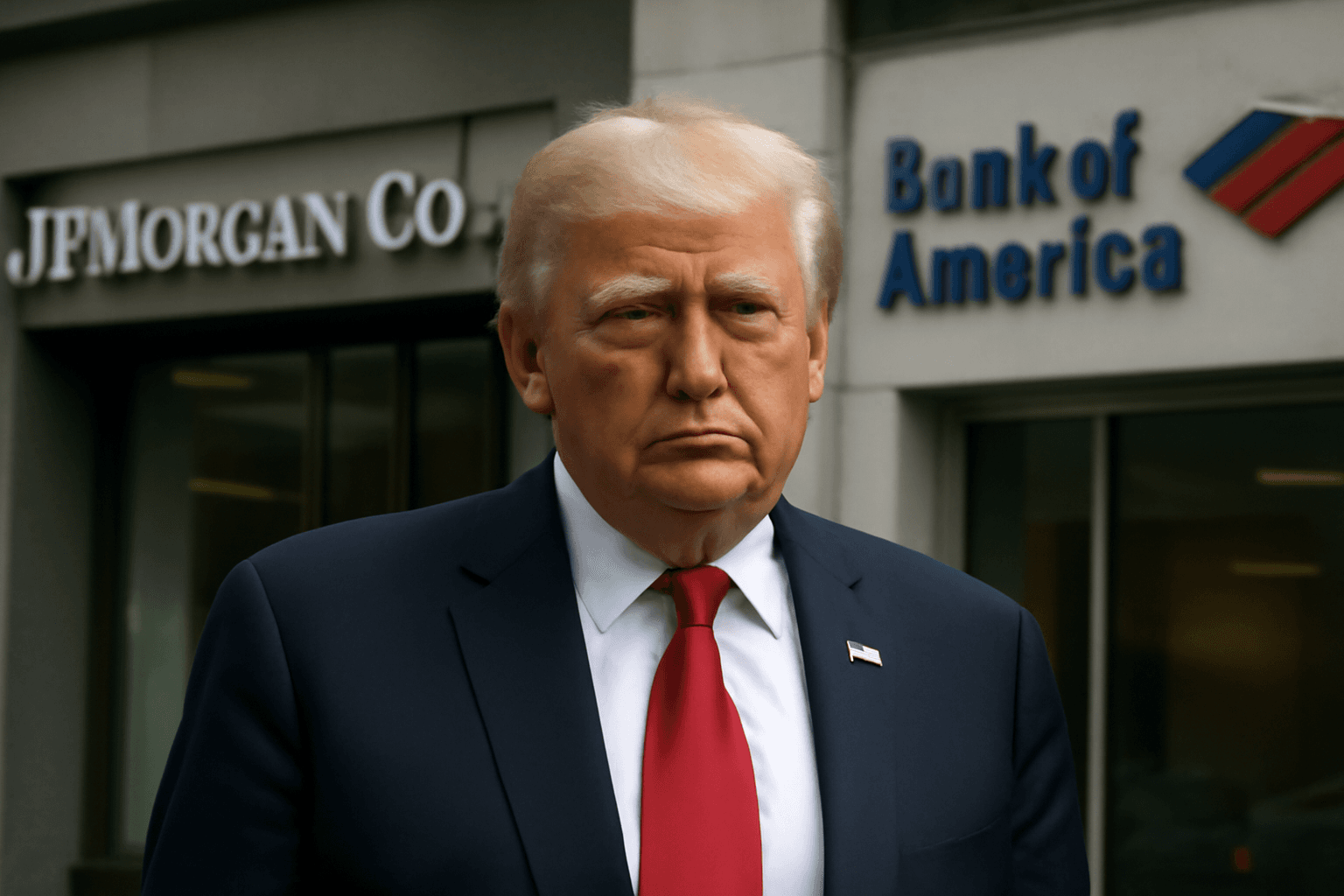

Trump Alleges Political Bias in Banking as White House Prepares Executive Action

In a recent interview with CNBC, former President Donald Trump charged that major banks, including Bank of America and JPMorgan Chase, have discriminated against him personally and his political supporters. Trump claims these financial institutions effectively barred him from maintaining deposits, suggesting a broader pattern of bias against conservatives.

Claims of 'Debanking' and Political Discrimination

Speaking candidly, Trump said, "They totally discriminate against, I think, me maybe even more, but they discriminate against many conservatives. I think the word might be Trump supporters more than conservatives." He recounted how JPMorgan Chase reportedly told him to withdraw his funds within 20 days during his post-presidential years, despite his large cash holdings.

Trump also stated that his attempts to deposit funds at Bank of America met with similar resistance, forcing him to split his deposits among smaller banks. While he did not present concrete evidence, he suggested that these banking decisions may have been influenced by pressure from administrations opposing him.

Banks' Responses and Industry Perspective

JPMorgan Chase, while not directly addressing Trump’s accusations, denied any politically motivated closures. A spokesperson emphasized, "We don’t close accounts for political reasons, and we agree with President Trump that regulatory change is desperately needed." Bank of America also refrained from commenting on the specific claims but expressed support for ongoing regulatory clarity.

Financial analysts and banking observers note that the notion of "reputational risk" has long influenced banks' decisions on client relationships—particularly when individuals are involved in heightened legal or political scrutiny. One source involved in the matter commented that under President Joe Biden’s administration, regulators may have pressured banks to assess Trump-affiliated accounts more critically.

Regulatory Landscape and Upcoming Executive Order

A draft executive order reportedly under consideration by the White House instructs federal regulators to investigate whether banks have engaged in "politicized or unlawful debanking" practices. This includes violations of the Equal Credit Opportunity Act, antitrust laws, or consumer protection statutes.

- The order could empower regulators to impose fines or mandates on banks found discriminating based on political affiliation.

- The Federal Reserve previously halted enforcement of reputational risk as a supervisory criterion, aiming to reduce ambiguity.

- Bank policy groups warn that the root issue lies in regulatory overreach, which pressures banks to limit services to avoid potential consequences amid unclear standards.

Broader Implications for Banking and Politics

This unfolding controversy spotlights a tension at the intersection of finance, politics, and regulatory policy. As banks navigate complex compliance environments, accusations of political bias raise critical questions about fair access to financial services and the role of government oversight.

While some experts dismiss the allegations as "rhetoric likely to fade," others see genuine regulatory ambiguity that could hinder banking operations. The debate also touches on American values of non-discrimination and equal opportunity, now being reexamined in the context of political divides.

Looking Ahead: What Comes Next?

The White House has yet to officially comment on the timing of the executive order. However, the banking industry’s cautious response signals anticipation of possible shifts in supervisory frameworks. Stakeholders across politics, finance, and civil rights continue to watch closely, recognizing that the outcome may set important precedents for how financial institutions engage with politically connected clients.

Editor's Note

This episode underscores the complex interplay between financial regulation and political expression in today's polarized climate. It raises vital questions: How do banks balance legal compliance with fairness to customers? Can regulatory reforms ensure both accountability and neutrality? And importantly, how do these actions affect trust in our financial systems and democratic institutions?

As the situation evolves, readers should consider both the legal frameworks governing banking practices and the broader societal implications of 'debanking' allegations—an issue that reflects deep currents in contemporary American life.