Introducing 'Trump Accounts': A Financial Boost for Newborn Americans

President Donald Trump unveiled a new federal initiative dubbed 'Trump accounts,' aimed at providing $1,000 government-funded investment accounts for every American child born between 2025 and 2029. This plan, announced during a White House roundtable with prominent business leaders and Republican lawmakers, is designed to offer children a financial jumpstart through tax-deferred accounts tracking the stock market.

How the Plan Works

The initiative guarantees a one-time contribution of $1,000 by the federal government into each eligible child's account. Guardians will have the option to add up to $5,000 annually to these accounts, encouraging long-term savings and investment. President Trump described the program as "a pro-family initiative that will help millions of Americans harness the strength of our economy to lift up the next generation."

Strong Endorsements from Business Leaders and Lawmakers

Several influential business figures, including Michael Dell of Dell Technologies, Dara Khosrowshahi from Uber, David Solomon of Goldman Sachs, and Vladimir Tenev of Robinhood, publicly supported the initiative, pledging billions in private contributions for employee families. Trump praised these leaders as "the greatest business minds we have today" committed to backing the program.

House Speaker Mike Johnson voiced strong approval, calling the policy "bold" and "transformative," emphasizing that it provides "every eligible American child a financial head start from day one." He also highlighted that the initiative aligns with Republican values by supporting life, families, prosperity, and opportunity.

Legislative Outlook and Financial Implications

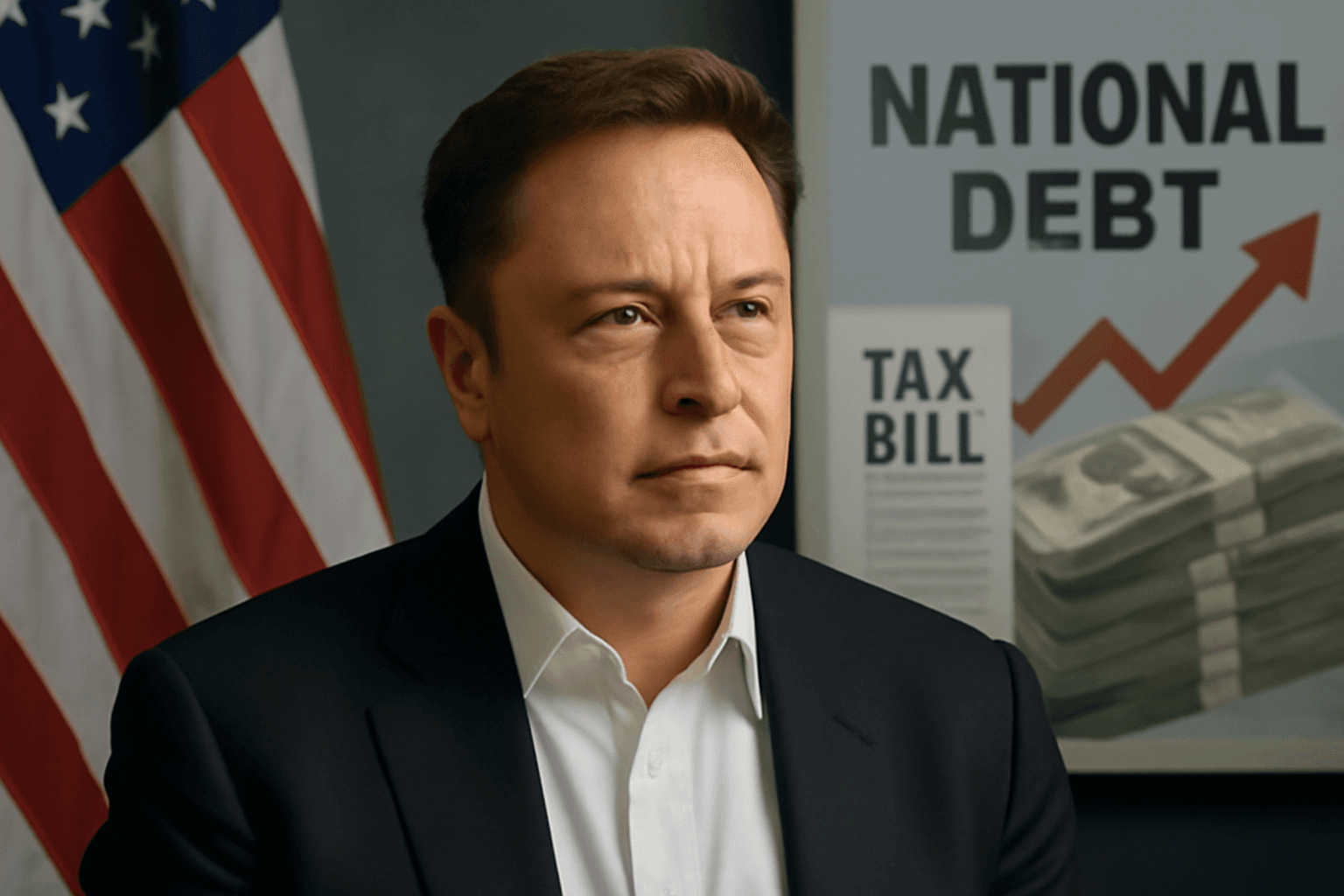

The 'Trump accounts' are a component of a broad budget bill that recently passed the House by a narrow margin, with no Democratic votes. However, the bill faces a more challenging journey in the Senate, where concerns persist among some Republicans regarding its overall fiscal effects.

Despite assertions from President Trump that the bill is fully funded through targeted reforms—including welfare adjustments and a remittance tax—the Congressional Budget Office (CBO) projects that it would add $2.4 trillion to the national debt over the next decade. Additionally, the CBO anticipates that by 2034, approximately 10.9 million more Americans would lose healthcare coverage due to cuts in Medicaid and food assistance programs.

Comparisons and Expert Perspectives

The structure of 'Trump accounts' resembles 529 college savings plans, though with lower contribution limits. This similarity has prompted some financial advisors to question the long-term investment value of the program.

Looking internationally, similar child savings programs have existed—such as the United Kingdom's Child Trust Fund, which operated from 2002 to 2011, and Singapore’s ongoing Baby Bonus Scheme that offers matched savings incentives.

Looking Ahead: Potential Benefits and Congressional Stakes

President Trump expressed optimism about the initiative’s long-term impact, suggesting beneficiaries would be "getting a big jump on life," especially if economic conditions align favorably. Speaker Johnson warned that failure to pass the legislation could trigger "the largest tax increase in American history," urging Congress to act swiftly on what he termed "pro-growth legislation" to benefit all Americans.

Stay informed on the latest developments as this proposal advances through Congress and its potential to reshape financial opportunities for future generations.