Major CEOs Pledge Billions to Newborn Investment Accounts at White House

In a high-profile White House roundtable, several top executives announced plans to invest billions into a new government-backed savings initiative designed for the children of their employees. This program, often referred to as the "Trump accounts," aims to provide a jumpstart on financial security for America's youngest generation.

Who’s on Board?

Among the leaders confirming their involvement are Michael Dell (Dell Technologies), Dara Khosrowshahi (Uber), David Solomon (Goldman Sachs), and Vladimir Tenev (Robinhood). Additional business figures, including CEOs and founders from diverse sectors like technology and finance, are expected to join this ambitious investment endeavor.

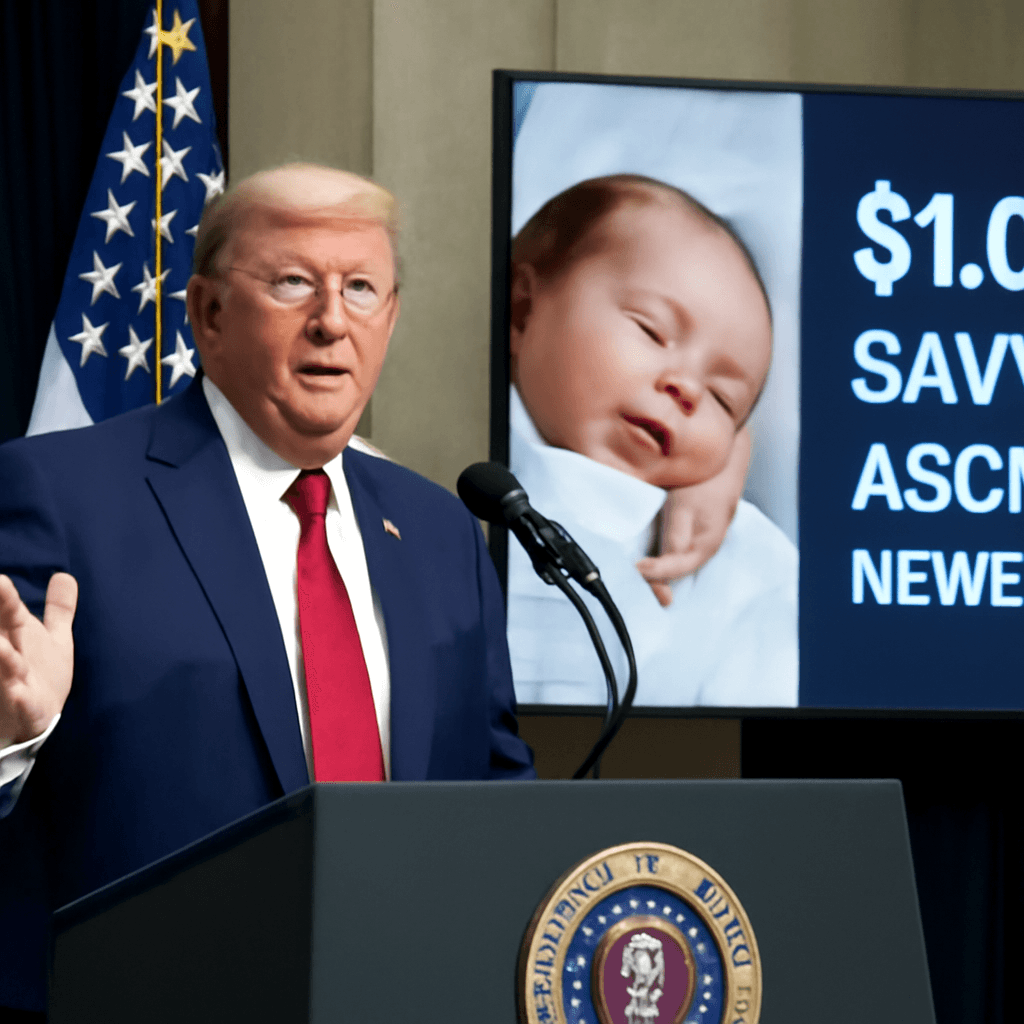

What Are 'Trump Accounts'?

The initiative proposes depositing $1,000 into government-seeded investment accounts for every U.S. citizen born between January 1, 2025, and December 31, 2028. These tax-deferred accounts will track the broader U.S. stock market via index funds and allow additional contributions up to $5,000 annually.

Controlled by the child’s guardian, these funds can be accessed once the beneficiary turns 18 — aiming to offer families a meaningful financial foundation from birth.

Legislative Progress and Challenges

The provision for these accounts was passed by the House last month as part of a sweeping budget bill. However, the legislation now awaits Senate approval, where it faces resistance from certain fiscally conservative members seeking significant amendments.

How Do These Accounts Compare?

This pilot program draws parallels with established options like 529 college savings plans, though some experts caution that the "Trump accounts" might not provide the most favorable investment incentives.

Official Response

White House Press Secretary Karoline Leavitt emphasized the program's transformative potential, describing it as "a life-changing initiative for working and middle-class families across America, delivering substantial tax cuts, expanding child tax credits, and establishing a new path toward financial stability for young Americans."

Looking Ahead

As this program unfolds, it represents a novel approach to empowering families financially from the moment a child is born. With prominent corporate leaders backing the effort, these accounts may reshape the landscape of early financial investment for many Americans.

Stay tuned for further updates as the story develops.