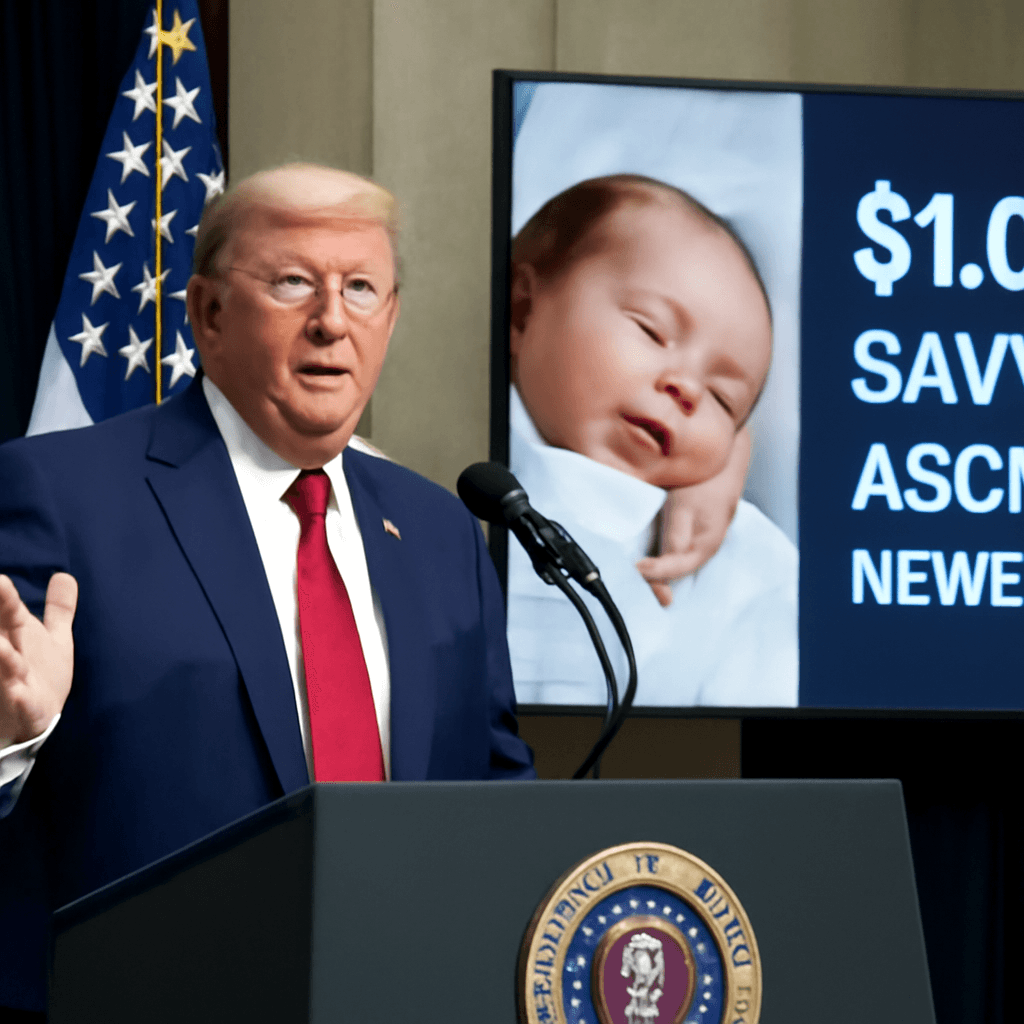

Introducing the 'Trump Savings Account': A $1,000 Gift for American Babies

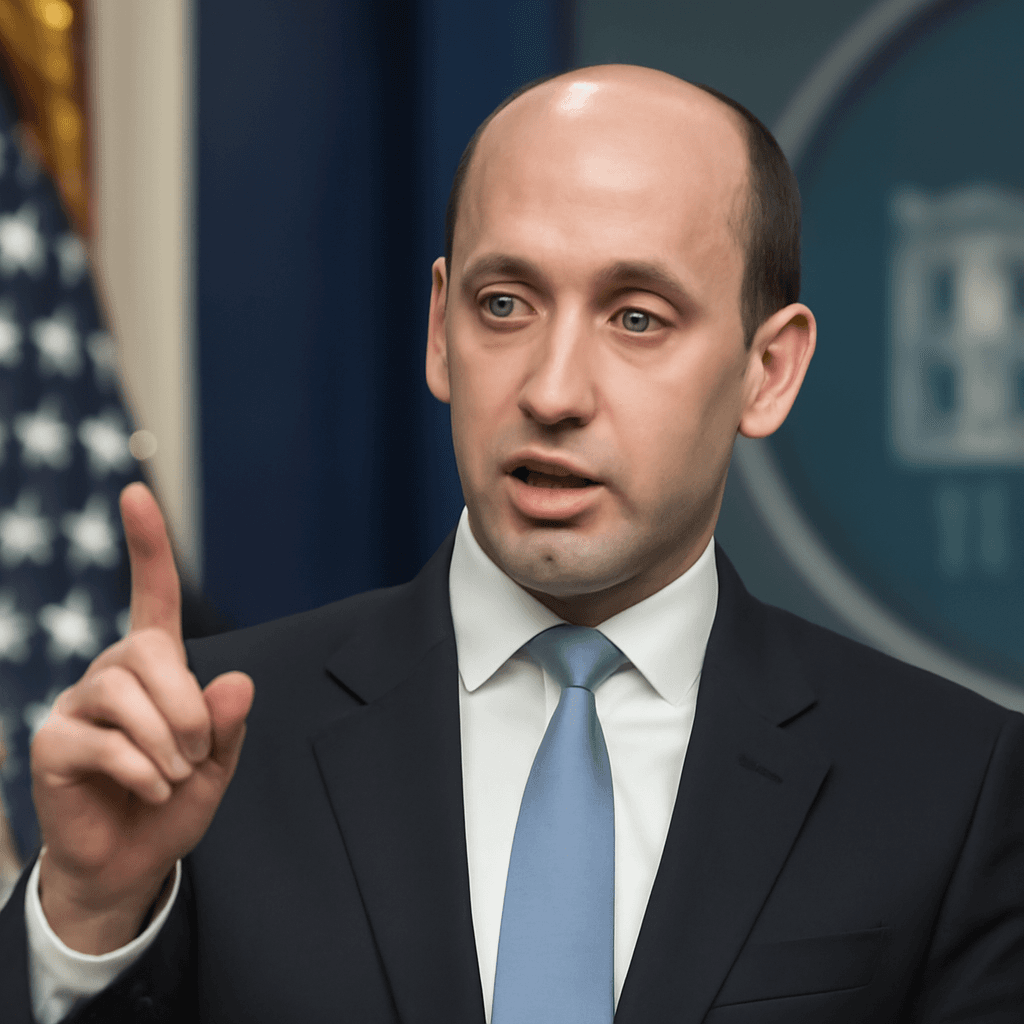

In a significant policy announcement, the US government has launched a new initiative dubbed the "Trump savings account", promising a $1,000 investment for every American child born between 2025 and 2029. This plan, revealed by the President during a White House roundtable with top business leaders, aims to create tax-deferred investment accounts that track stock market performance, offering newborns a financial head start.

How the Program Works: Automatic Enrollment and Investment Details

Under this proposal, the Treasury Department will automatically enroll newborns and contribute a one-time $1,000 into a dedicated tax-deferred investment account. Parents or guardians will manage these accounts, with the option to add up to an additional $5,000 through private contributions. The investment’s value will be tied to overall stock market performance, representing a long-term savings avenue for American families.

A Vision for Economic Empowerment

Described by the President as "a pro-family initiative that will help millions of Americans harness the strength of our economy to lift up the next generation," the savings accounts are a key feature of the broader legislative agenda known as the "Big, Beautiful Bill." Passed recently in the House of Representatives, the bill faces challenges ahead in the Senate, and the savings account program cannot be enacted independently; it must pass as part of the full legislation.

Financial Implications and Legislative Challenges Ahead

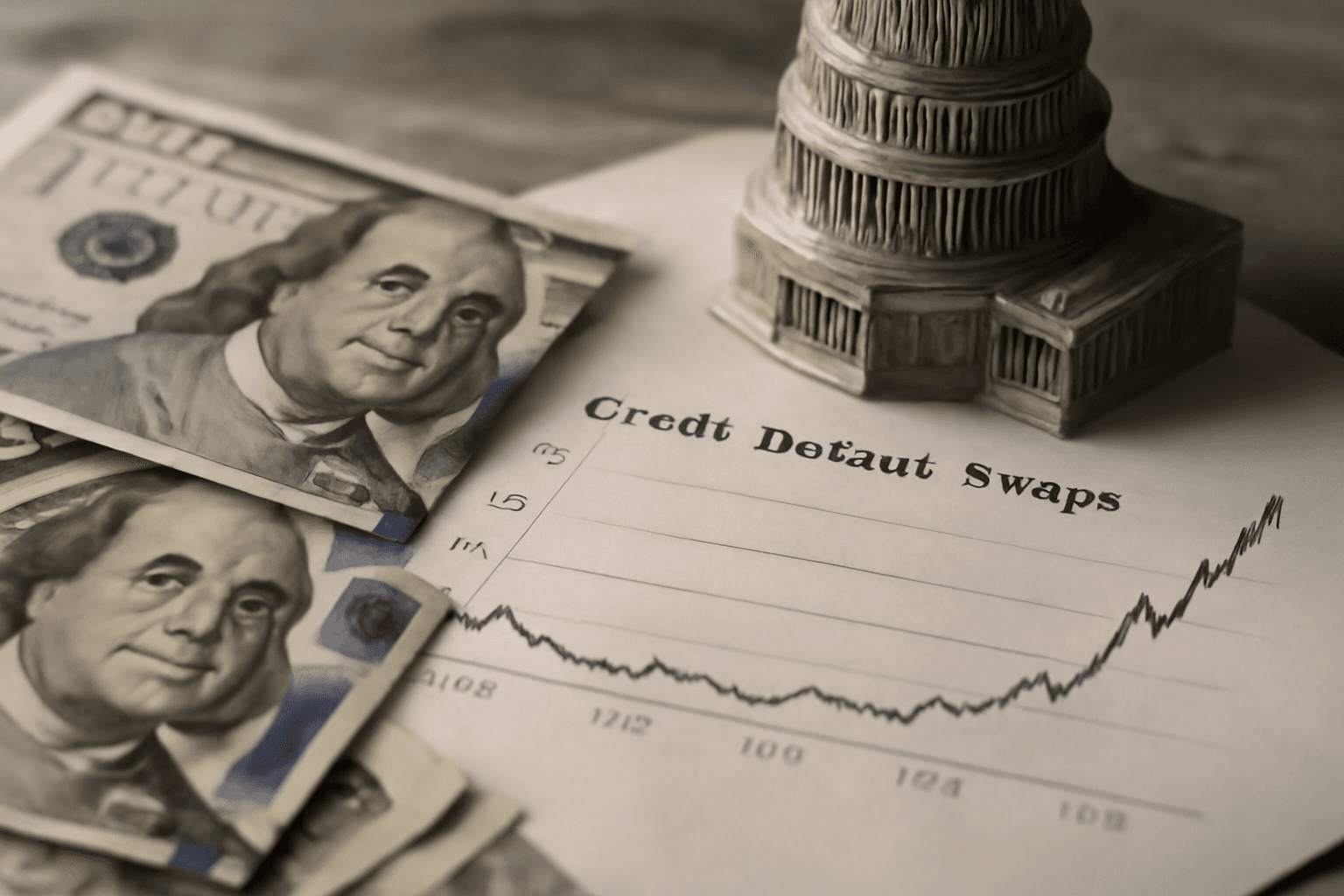

Critics voice concerns about the bill’s fiscal impact, noting that it could add $2.4 trillion to the national debt over the next decade. To offset costs, the government may need to reduce funding for programs such as Medicaid and food assistance. Nonetheless, advocates argue that the savings accounts represent a forward-thinking investment in the nation’s youth, encouraging financial literacy and early wealth building.

Looking Ahead

The "Trump savings account" initiative promises to change the way Americans prepare financially from birth. Whether it will secure broad political support remains to be seen, but it undoubtedly sparks vital conversations about economic opportunity and family financial security in the years to come.