Trump Proposes $1,000 Investment for U.S. Children Born 2025-2029

In a recent announcement, former President Donald Trump introduced a new federal program aimed at giving American children born during his potential second term a financial head start. The initiative promises a one-time deposit of $1,000 into a tax-deferred investment account for every child born between January 1, 2025 and December 31, 2028.

How the "Trump Accounts" Work

Dubbed “Trump accounts,” this program would set up individual investment accounts that track the overall U.S. stock market, providing an early opportunity to begin wealth accumulation. Parents and guardians will be allowed to contribute an additional up to $5,000 per year into these accounts, encouraging further savings and investment for their children.

Trump described this as a “pro-family initiative” meant to empower families to leverage the strength of the economy for the benefit of the next generation.

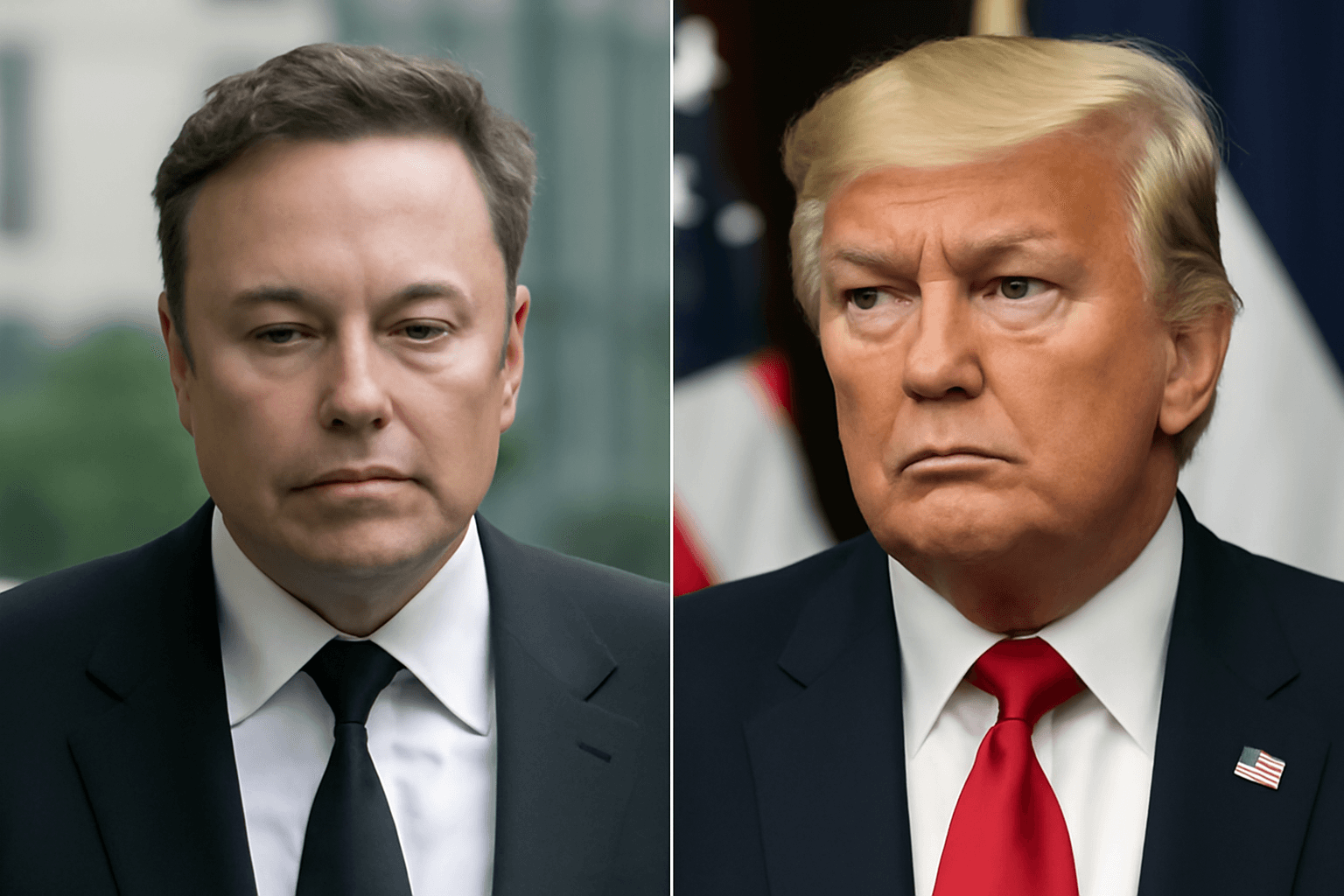

Backing From Business Leaders and Lawmakers

The announcement came during a White House roundtable attended by influential industry figures such as Michael Dell of Dell Technologies, Dara Khosrowshahi of Uber, David Solomon of Goldman Sachs, and Vladimir Tenev of Robinhood. These leaders expressed their support and pledged billions in private funding to support employees’ families alongside the federal effort.

House Speaker Mike Johnson also endorsed the plan, calling it “a bold, transformative policy” that provides every eligible child a financial advantage right from birth.

Legislative Challenges and Fiscal Concerns

The Trump accounts are part of a larger budget bill which narrowly cleared the House by a single vote, without any Democratic support. This bill now moves to the Senate, where it faces significant scrutiny and opposition, including from Republicans wary about its long-term fiscal impact.

Trump insists the program is “fully funded through targeted reforms,” which include changes to welfare programs and a proposed remittance tax. However, the Congressional Budget Office forecasts the bill will add $2.4 trillion to the national debt over the decade and project that nearly 11 million Americans could lose healthcare coverage due to cuts in Medicaid and food assistance.

Comparisons and Critiques

The concept is reminiscent of other government-led initiatives like the UK’s Child Trust Fund and Singapore’s ongoing Baby Bonus Scheme, both aimed at encouraging early savings for children.

Despite the optimism behind the proposal, some financial experts have expressed skepticism. The relatively low contribution limits and the structure of accounts raise doubts about their long-term growth potential.

Looking Ahead

Trump remains hopeful, stating that beneficiaries of these accounts will have a significant advantage as they grow, “especially if the economy performs well.” Speaker Johnson added urgency to the bill’s passage, warning that failure could trigger “the largest tax increase in American history” and urged lawmakers to swiftly approve legislation he described as “pro-growth” and beneficial to every American.