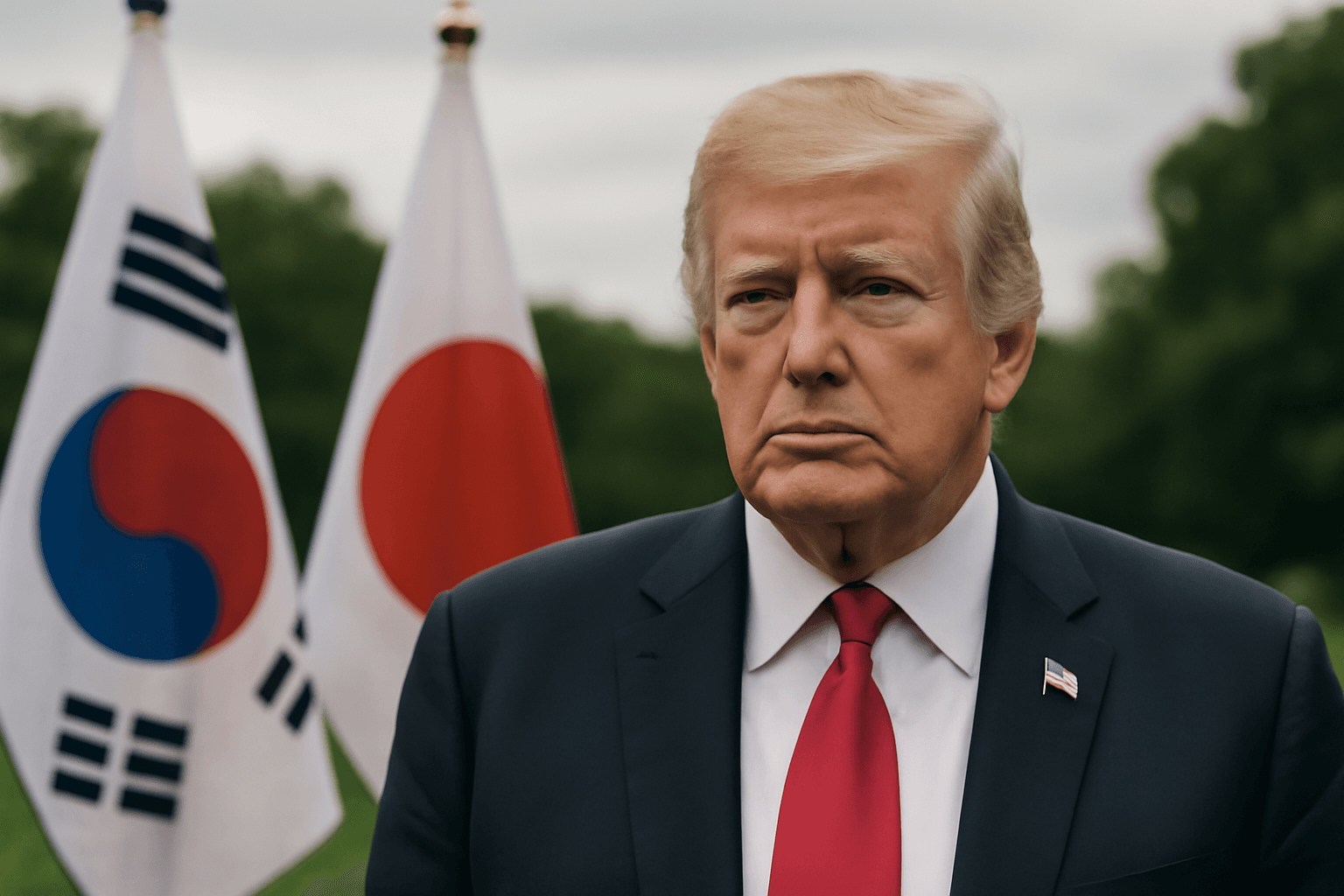

Trump’s August Tariff Deadline Approaches: A Global Trade Crossroads

With the August 1 deadline fast approaching, the global trade landscape is more uncertain than ever. U.S. President Donald Trump’s tariff plans, initially announced in April 2025 and delayed twice to allow for negotiation attempts, now stand at a critical juncture. Countries around the world face mounting pressure to reach final agreements or endure steep tariffs on exports to the United States.

Trump has reiterated the firmness of the August 1 deadline via his Truth Social platform, dismissing further extensions despite earlier ambiguity. This hard line means nations must quickly navigate complex trade talks or risk economic consequences on both sides of the Pacific and Atlantic.

Breaking Down the U.S. Trade Deals: Where Key Partners Stand

South Korea: Tariffs in Exchange for Massive Energy Investments

On July 30, a deal was struck between the U.S. and South Korea that imposes a 15% tariff on South Korean exports to the U.S. In reciprocation, South Korea has committed to purchasing $100 billion worth of U.S. energy products while pledging a monumental $350 billion investment in American-controlled projects. President Trump emphasized that these projects are “owned and controlled by the United States,” underscoring a nationalist economic vision.

However, not all stakeholders in South Korea welcomed the deal enthusiastically. Farmers, for example, protested vocally, fearing the tariffs could harm agricultural exports and domestic industries. This reveals a common tension in trade talks: balancing national economic interests with global diplomatic commitments.

European Union: Partial Tariff Reductions and Strategic Cooperation

In talks with the EU, the U.S. lowered a threatened 30% tariff on European exports to 15% on approximately 70% of goods, including critical sectors like pharmaceuticals, semiconductors, and automobiles. The remaining 30% remain under negotiation, reflecting persistent disagreements.

European Commission President Ursula von der Leyen emphasized a mutual commitment to zero tariffs on certain strategic goods, highlighting a pragmatic approach amid global supply chain concerns. Trump highlighted EU energy investments reaching $750 billion over three years, with a nonbinding $600 billion pledge further illustrating the scale of economic interdependence despite political volatility.

Japan: Significant Investment Amid Moderated Tariffs

Japan negotiated a reduced tariff rate of 15% on its exports, down from an initially proposed 25%. In return, Japan promised to invest $550 billion in U.S. markets and open its automotive and rice sectors to American goods.

This compromise was welcomed by major Japanese automakers, including Toyota and Honda, after months of costly 25% tariffs on vehicles and parts. Yet, some trading partners express concern this preferential deal could skew competition in the region.

Other Asian Nations: Mixed Outcomes and Ongoing Negotiations

- Philippines: Following talks between Donald Trump and President Ferdinand Marcos Jr., tariffs were marginally reduced to 19%, while the Philippines exempts U.S. goods from tariffs. Full terms remain nebulous, leaving room for uncertainty.

- Indonesia: Tariffs cut to 19% with American exports facing minimal duties. Indonesian leadership signals ongoing dialogue to further address trade equities.

- Vietnam: U.S. gains duty-free access, while Vietnam faces a capped 20% tariff, markedly lower than the originally proposed 46%. The U.S. additionally enforces a 40% transshipping tax targeting Chinese goods routed through Vietnam, reflecting strategic measures against unfair trade practices.

United Kingdom: Partial Relief with Delayed Implementation

A May agreement with the UK eased tariffs on British automobiles, steel, and aluminum, among other goods. However, implementation was delayed until June, coinciding with U.S. tariff hikes on steel and aluminum to 50%. The UK enjoys an exemption from the full tariff hike but still contends with a significant 25% levy, the highest among Western allies, illustrating lingering trade frictions post-Brexit.

China: A Tentative Truce amid Strategic Mineral Access Negotiations

Amid escalating tensions, the U.S. and China reached a 90-day truce in May, reducing tariffs on Chinese imports from historic highs above 140% to 30%, and U.S. goods entering China to 10%. Treasury Secretary Scott Bessent highlighted China’s promise to ease restrictions on rare earth minerals—critical for U.S. manufacturing sectors including technology and defense.

Despite efforts to prolong this truce beyond August 12, discussions in Stockholm have yielded no firm agreement, underscoring uncertain prospects for sustained trade peace.

Expert Analysis: The Broader Implications of Trump’s Tariff Strategy

This flurry of trade negotiations demonstrates Washington's attempt to leverage tariffs as bargaining chips for national economic gains. However, the uneven tariff treatment risks sparking distortions in global markets, encouraging countries to seek alternative alliances or supply chains. Moreover, the timing—amid an already fragile global economic recovery—raises concerns about price volatility impacting both producers and consumers.

From a US policy perspective, these deals reflect a deep strategic interest in reviving domestic manufacturing and securing access to critical resources, especially in the technology and energy sectors. Yet, the rigidity around deadlines and tariff rates may limit flexibility and stymie long-term multilateral cooperation.

Looking Ahead: What’s at Stake Post-August 1?

As the August deadline looms, several critical questions remain:

- Will the remaining nations acquiesce to U.S. demands or face punitive tariffs that may hamper their economies?

- How will these tariff policies influence global supply chains, especially amid growing calls for diversification away from China?

- What role will emerging sectors—energy, technology, and rare earth minerals—play in shaping future trade agreements?

For American consumers and businesses, the pressure to strike these deals reflects an attempt to balance international cooperation with domestic political priorities. The outcomes in the coming weeks will likely set the tone for global trade dynamics well into the next decade.