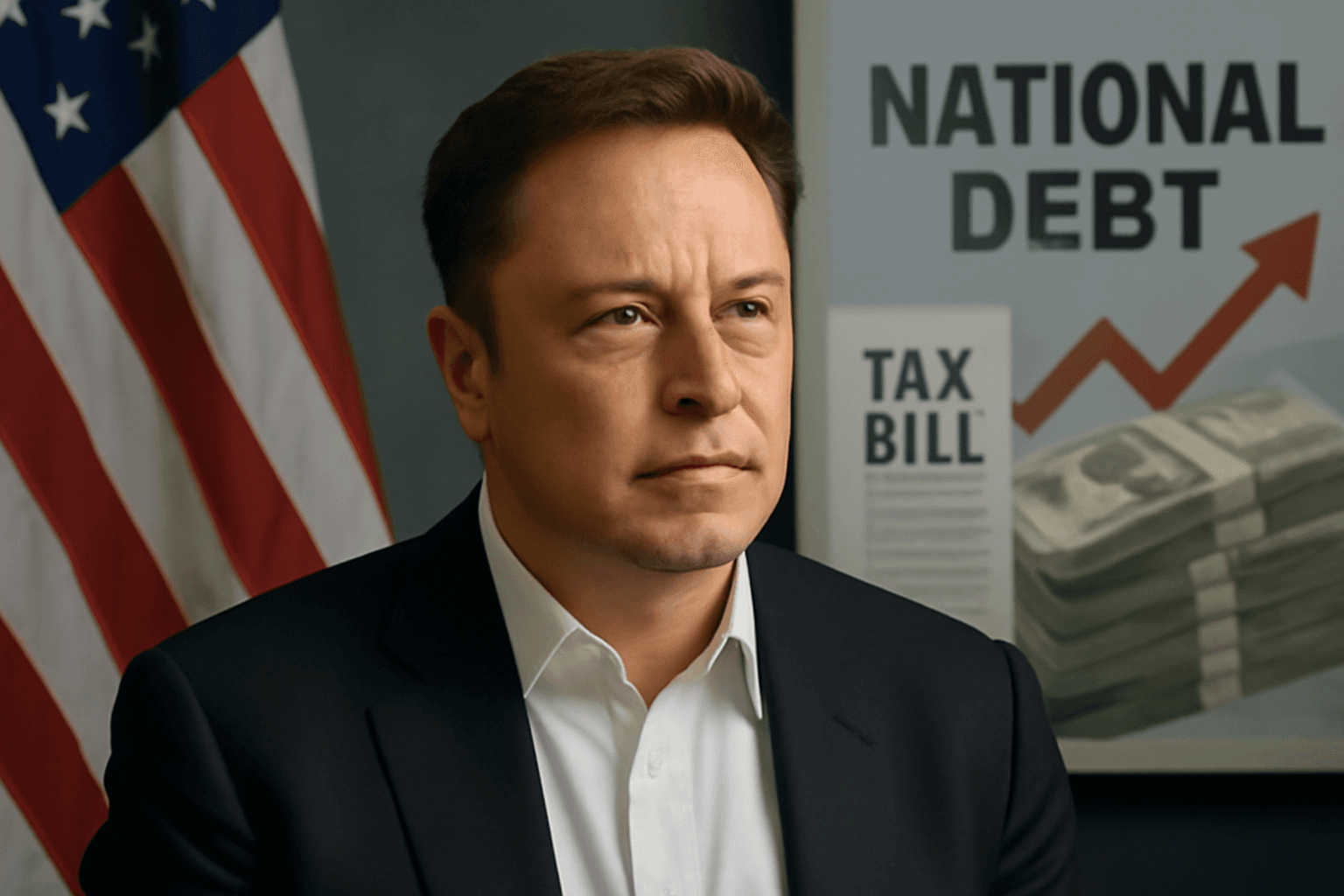

Overview of Trump’s Tax Plan and National Debt Concerns

President Donald Trump’s expansive tax cut proposal is straining both economic principles and Republican Party cohesion amid growing worries about its impact on the national debt. The administration asserts that accelerated economic growth combined with increased tariff revenues will offset any resulting budget deficits. However, many economists and factions within the GOP remain doubtful, citing unrealistic assumptions and insufficient fiscal discipline in the plan.

Political and Market Reactions

As the administration pushes for a multitrillion-dollar tax cut bill, skepticism mounts among Republican senators, investors, voters, and other influential figures. Financial markets have responded cautiously, reflecting doubts about the administration's capacity to fulfill prior deficit reduction commitments. Critics highlight the lack of concrete spending cuts and warn that the new tax bill could lock in higher deficits for years to come.

The administration’s rhetoric about trimming trillions in spending has largely failed to materialize, and the tax plan enshrines this trend according to fiscal analysts.

Administration’s Defense and Economic Growth Projections

The White House firmly rejects allegations that the proposal will exacerbate deficits, attributing such assertions to flawed forecasts from established budget authorities. President Trump acknowledged the political difficulty of enforcing spending cuts, emphasizing the need to maintain legislative support.

To reconcile fiscal challenges and maintain political unity, the administration places considerable emphasis on an anticipated surge in economic growth. The White House Council of Economic Advisers leads this optimism, projecting a 3.2% annual GDP growth over the next four years, significantly surpassing other estimates. They argue this vigorous growth, coupled with tariff-generated revenues, will generate sufficient funds to reduce the deficit without triggering inflationary pressures.

Skepticism from Economists and Politicians

Despite the administration's assurances, many experts remain unconvinced. The analysis suggests that reliance on growth alone to close budget gaps is misplaced. Critics warn that ongoing deficits may sustain elevated interest rates, dampen overall economic expansion, and increase borrowing costs for households and businesses.

Skepticism around the economic projections spans the political spectrum, with some Senate Republicans voicing concerns about the plan’s long-term fiscal sustainability. There are growing calls within the GOP to delay legislation until more rigorous deficit reduction measures are proposed.

Challenges Surrounding Tariff Revenue Assumptions

The administration’s expectation that tariff revenues could offset some deficits faces significant legal and practical barriers. Recent court decisions have limited the administration’s authority to impose sweeping trade restrictions under claims of economic emergencies.

Long-Term Fiscal Impact and Deficit Projections

Independent research highlights that while economic growth may alleviate some deficit pressures, it is unlikely to fully address the fiscal gap. Analysts estimate that stabilizing the national debt would require approximately $10 trillion in deficit reductions over the next decade—a scale far exceeding current policy provisions.

Furthermore, much of the proposed tax relief effectively perpetuates existing breaks rather than catalyzing substantial new economic activity, suggesting limited stimulus benefit and a potential continuation of fiscal imbalance.

Conclusion: Weighing Growth Against Debt Expansion Risks

President Trump continues to express confidence that the tax plan will drive prosperity and materially reduce the national debt. However, the combination of rising debt levels exceeding $36 trillion, increased borrowing costs, and uncertain economic responses present formidable challenges.

The debate underscores a critical tension between ambitions for rapid economic expansion and the necessity of responsible fiscal management. Without comprehensive deficit reduction strategies, reliance on growth alone may be insufficient to ensure long-term economic stability and political consensus.