The recently passed U.S. House of Representatives’ legislation, informally known as the "One Big Beautiful Bill Act," introduces the most significant changes in decades to the tax treatment of foreign capital within the United States. Central to this legislation is Section 899, a provision targeting entities from so-called "discriminatory foreign countries" which impose levies disproportionately affecting U.S. companies.

Under Section 899, the U.S. government intends to increase taxes on U.S.-source income by 5 percentage points annually for investors from these countries, potentially elevating tax rates up to 20%. This measure directly responds to digital services taxes (DSTs) enacted by countries like France and Germany, which tax revenues of U.S.-based technology firms such as Apple, Amazon, Facebook, and Google.

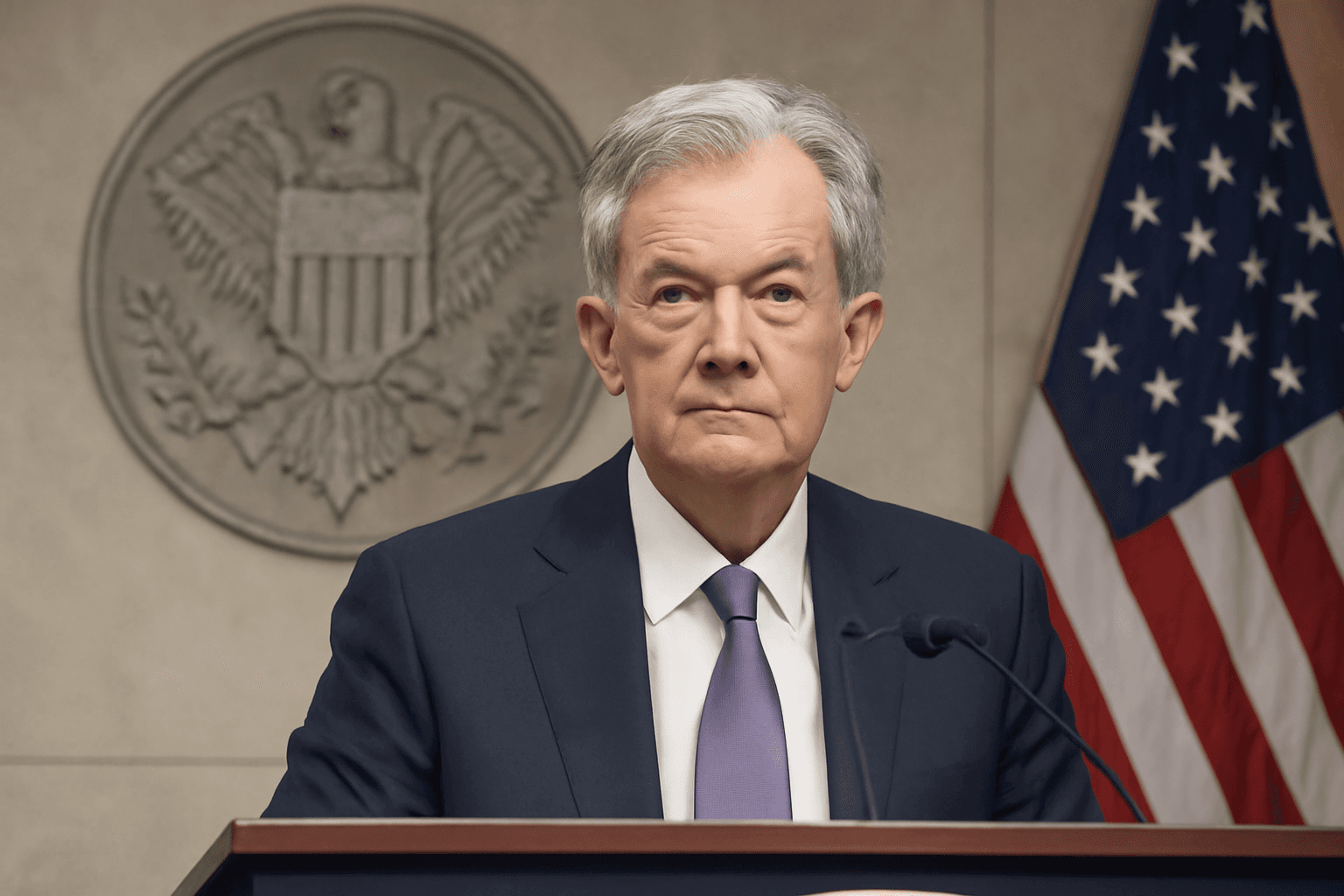

Deutsche Bank’s Global Head of FX Research, George Saravelos, has warned this provision could escalate a trade dispute into a "capital war," as it uses taxation on foreign holdings of U.S. assets as economic leverage. He emphasized that this shift challenges the traditionally open nature of U.S. capital markets.

Experts also caution that beyond European companies, governments and central banks holding significant U.S. Treasury securities may be adversely impacted. For example, France and Germany together held approximately $200 billion in U.S. government bonds as of March 2025. Deutsche Bank forecasts that the effective yield on U.S. Treasuries for these investors could decline by nearly 100 basis points, potentially affecting demand for U.S. debt and complicating efforts to fund the U.S. budget deficit.

Emmanuel Cau, Head of European Equity Strategy at Barclays, highlighted that companies with substantial U.S. revenue streams, such as London-listed Sodexo and Accor, which own myriad U.S. assets, are vulnerable under this framework. He warned that capital outflows could ensue if the bill passes the Senate in its present form due to the sharply negative U.S. net international investment position.

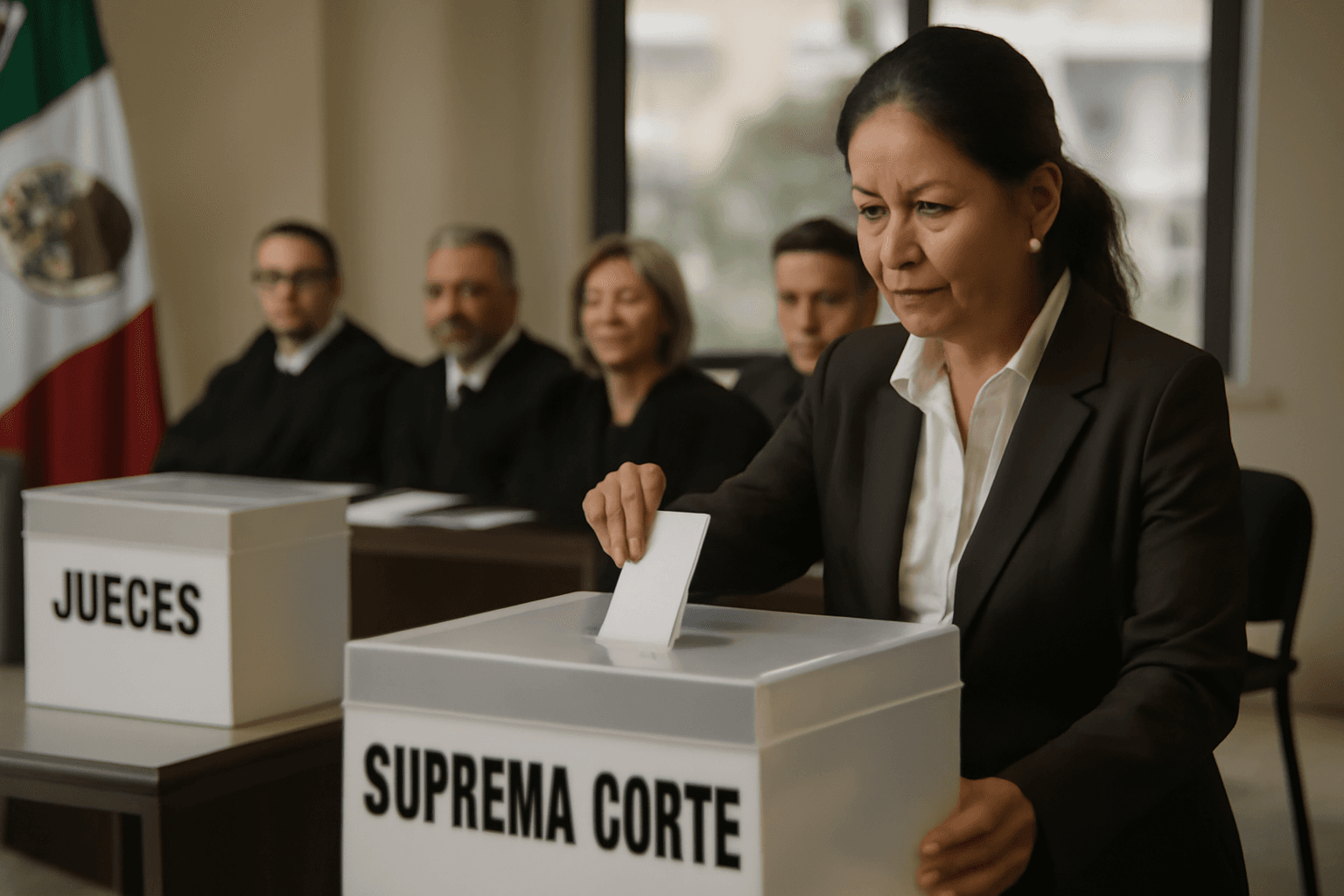

Legal analysts from Mayer Brown note that as the bill advances toward the Senate for approval, significant amendments remain possible, particularly regarding provisions that could override existing tax treaties. These changes may influence the final shape of the law before it is enacted.

Market commentators consider this legislation a pivotal development consistent with the current administration's assertive economic posture. Swiss-based Porta Advisors’ chairman Beat Wittmann described it as a substantial component of the U.S. government's broader strategy, with tangible effects already visible in bond market movements favoring perceived safe havens like the Japanese yen.

In conclusion, while the "One Big Beautiful Bill Act" aims to counteract foreign taxes targeting U.S. firms, it carries significant risks, including potential capital flight and reduced attractiveness of U.S. assets for key global investors, with wide-ranging implications for international financial markets.