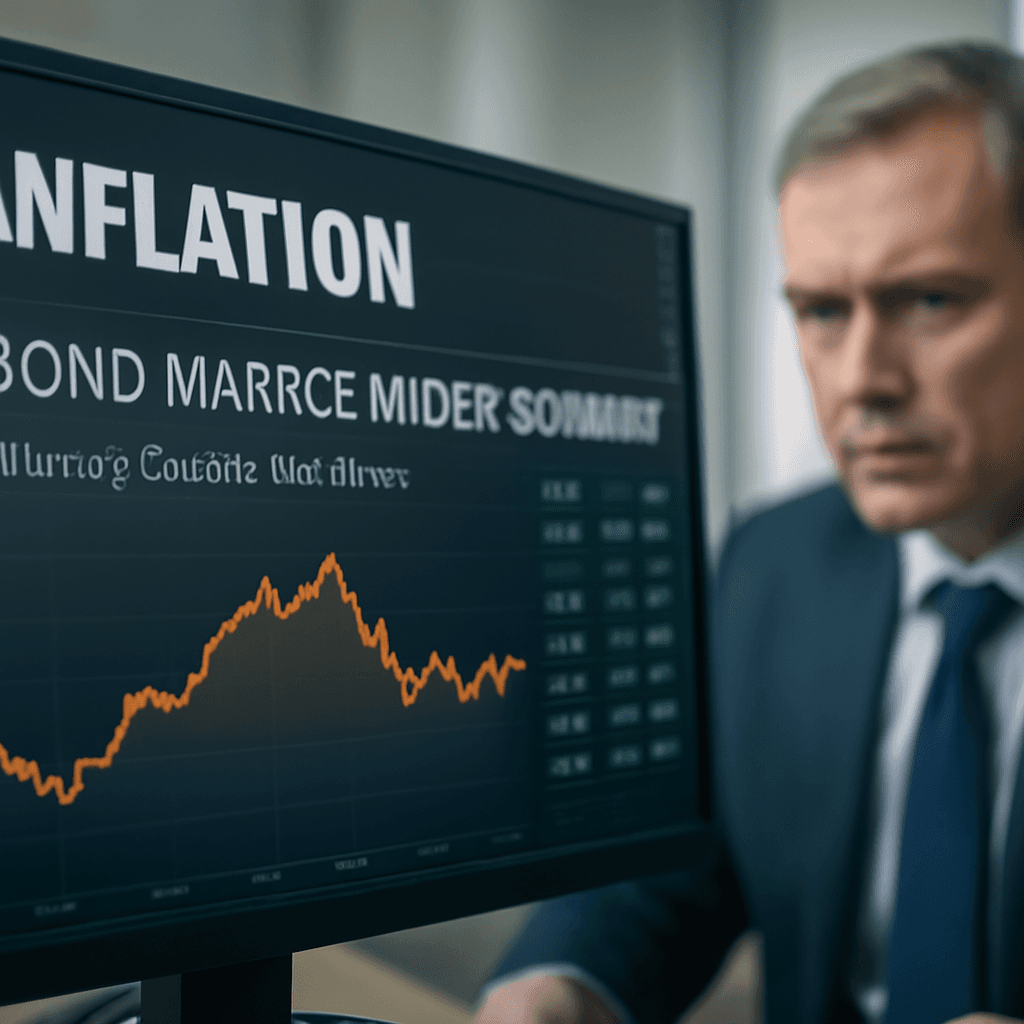

U.S. Treasury Yields Stabilize After Notable Decline

U.S. Treasury yields showed signs of stabilization on Thursday after experiencing significant drops on Wednesday due to disappointing U.S. economic indicators. At 3:26 a.m. EST, the 10-year Treasury yield increased marginally by less than 1 basis point, reaching 3.885%, while the 30-year yield also rose slightly to 4.371%. The 2-year Treasury yield held steady at 4.89%. It is important to note that in the bond market, yields and prices move inversely, and a basis point corresponds to 0.01%.

Weak Economic Data Triggers Investor Caution

Wednesday’s sharp declines in Treasury yields were triggered by a series of underwhelming economic reports. Investors are now closely monitoring April trade data and the latest initial jobless claims, which are due Thursday, to gauge the economic outlook further.

Recent economic indicators include:

- The manufacturing Purchasing Managers' Index (PMI) for May declined to 49.9%, dipping just below the contraction threshold of 50% and missing the forecasted 52.1%.

- Private sector payroll additions significantly undershot expectations, with a figure much lower than the estimated 110,000 new jobs.

These disappointing figures have fueled concerns about a weakening labor market and broader economic slowdown.

Recession Fears Remain Muted Despite Data Misses

Despite these setbacks, analysts suggest that the latest data are not alarming enough to reignite fears of an imminent recession. A research note from a leading financial institution emphasized that while the misses are notable, they do not currently point toward a significant economic downturn.

Upcoming Economic Reports to Watch

Market participants are anticipating the release of key employment figures later this week, including the May non-farm payrolls report and the unemployment rate data, both scheduled for Friday. These reports will be crucial in assessing the strength and trajectory of the U.S. labor market and overall economic health.